Regulations Amending the Output-Based Pricing System Regulations and the Environmental Violations Administrative Monetary Penalties Regulations: SOR/2023-240

Canada Gazette, Part II, Volume 157, Number 24

Registration

SOR/2023-240 November 9, 2023

GREENHOUSE GAS POLLUTION PRICING ACT

ENVIRONMENTAL VIOLATIONS ADMINISTRATIVE MONETARY PENALTIES ACT

P.C. 2023-1133 November 9, 2023

Whereas subsection 194(1) of the Greenhouse Gas Pollution Pricing Act footnote a stipulates that a regulation made under section 192 or 193 of that Act may have effect earlier than the day on which it is made if it so provides and it gives effect to measures referred to in a notice published by the Minister of the Environment;

And whereas the Minister of the Environment published a Notice of intent to amend the Output-Based Pricing System Regulations on October 28, 2022, to announce the intent to make a Regulation under sections 192 and 193 of that Act to ensure continued greenhouse gas emissions reductions, reduce administrative burden and improve implementation;

Therefore, Her Excellency the Governor General in Council, on the recommendation of the Minister of the Environment, makes the annexed Regulations Amending the Output-Based Pricing System Regulations and the Environmental Violations Administrative Monetary Penalties Regulations under

- (a) sections 192, 193 and 198 of the Greenhouse Gas Pollution Pricing Actfootnote a; and

- (b) section 5footnote b of the Environmental Violations Administrative Monetary Penalties Act footnote c.

Regulations Amending the Output-Based Pricing System Regulations and the Environmental Violations Administrative Monetary Penalties Regulations

Output-Based Pricing System Regulations

1 (1) The portion of subsection 1(1) of the Output-Based Pricing System Regulations footnote 1 before paragraph (b) is replaced by the following:

Definition of facility

1 (1) Subject to subsection (6), for the purposes of the Act and these Regulations, facility means

- (a) all of the following elements that are operated in an integrated way to carry out a specified industrial activity:

- (i) a site, or multiple sites, at which the specified industrial activity is carried out and the buildings, equipment and other structures and stationary items located on the site or sites, and

- (ii) any other sites used in conjunction with the specified industrial activity, including a quarry, tailings pond, wastewater lagoon or pond and landfill; or

(2) Subsection 1(5) of the Regulations is replaced by the following:

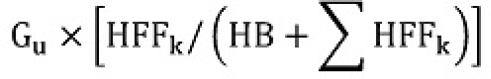

Interpretation

(5) Subject to subsection (6), with respect to a facility

- (a) any part of a public road or of a railway track that is bordered on both sides by the facility and used to carry out the facility’s specified industrial activities is deemed to be part of the facility;

- (b) for greater certainty, any part of a railway track that is used exclusively to carry out the facility’s specified industrial activities is part of the facility;

- (c) for greater certainty, buildings that are used for legal, administrative or management purposes and that are not located where a specified industrial activity is carried out are not included for the purposes of the definition facility in subsection (1); and

- (d) if two or more facilities referred to in paragraph (b) of the definition facility in subsection (1), within the same province, have the same person responsible or a person responsible in common and are not operated in an integrated way, they each constitute a separate facility.

Special case

(6) In the case of a facility that is not a covered facility, the specified industrial activities referred to in subsections (1) and (5) are those that would be specified industrial activities if the facility was a covered facility.

2 (1) The definitions Directive 017, Directive PNG017, GHGRP, IPCC Guidelines, 2020 GHGRP and WCI Method in subsection 2(1) of the Regulations are repealed.

(2) The definitions electricity generation facility and specified industrial activity in subsection 2(1) of the Regulations are replaced by the following:

- electricity generation facility

- means a covered facility, other than one whose primary activity is something other than an industrial activity, that generates electricity as its primary industrial activity, used to generate electricity from fossil fuels and composed of one unit or a group of units. (installation de production d’électricité)

- specified industrial activity

- means, with respect to a covered facility, an industrial activity referred to in subsection 5(2). (activité industrielle visée)

(3) Subsection 2(1) of the Regulations is amended by adding the following in alphabetical order:

- additional industrial activity

- means an industrial activity that is not set out in column 1 of Schedule 1, that is recognized by the Minister, including for the purposes of a facility’s designation as a covered facility under subsection 172(1) of the Act, and that is engaged in in a sector that is recognized by the Minister as being at significant risk of competitiveness impacts resulting from carbon pricing and of carbon leakage resulting from carbon pricing. (activité industrielle additionnelle)

(4) Subsection 2(1) of the Regulations is amended by adding the following in alphabetical order:

- Quantification Methods

- means the document entitled Quantification Methods for the Output-Based Pricing System Regulations, published by the Department of the Environment in 2022. (méthodes de quantification)

(5) Subsection 2(1) of the Regulations is amended by adding the following in alphabetical order:

- distribution system

- has the same meaning as section 3 of the Act. (réseau de distribution)

(6) Subsection 2(2) of the Regulations is replaced by the following:

Incorporation by reference

(2) Unless otherwise indicated, a reference to any document incorporated by reference into these Regulations, except the GHGRP and the 2020 GHGRP, is incorporated as amended from time to time.

(7) Subsection 2(2) of the Regulations is replaced by the following:

Incorporation by reference

(2) Unless otherwise indicated, a reference to any document incorporated by reference into these Regulations is a reference to the document as amended from time to time.

(8) Section 2 of the Regulations is amended by adding the following after subsection (2):

Accreditation

(3) Despite subsection (2), if ISO Standard 14065 is amended, the previous version of the document may be complied with for a period of four years beginning on the day on which the amended version is published.

(9) Section 2 of the Regulations is amended by adding the following after subsection (3):

Quantification Methods

(4) Despite subsection (2), the version of Quantification Methods to be complied with for a compliance period is the version that was most recently published prior to the day on which that compliance period begins.

3 Subsection 5(2) of the Regulations is replaced by the following:

Specified industrial activities

(2) Output-based standards are established under these Regulations for the industrial activities set out in column 1 of Schedule 1 and for additional industrial activities engaged in at the covered facility.

4 The Regulations are amended by adding the following after section 6:

Cancellation following request

6.1 If the Minister receives a request to cancel a designation of a covered facility during a calendar year and the Minister decides, under subsection 172(3) of the Act, to cancel the designation, that cancellation is effective as of December 31 of the calendar year in which the decision is made.

5 Paragraph 8(b) of the Regulations is replaced by the following:

- (b) the primary activity engaged in at the facility is any of the industrial activities set out in column 1 of Schedule 1.

6 The Regulations are amended by adding the following after section 8:

Remote community

8.1 Unless designated by the Minister as a covered facility under subsection 172(1) of the Act, an electricity generation facility is not included in the definition covered facility in section 169 of the Act if the industrial activity set out in paragraph 38(b) or (c), column 1, of Schedule 1 is engaged in at that facility and that facility

- (a) generates electricity for general distribution to the public in a geographic area that is neither serviced by an electrical network that distributes electricity and is subject to the standards of the North American Electric Reliability Corporation nor by a distribution system,

- (b) is not connected to an electrical network, for the distribution of electricity, that is subject to the standards of the North American Electric Reliability Corporation, and

- (c) is not connected to a distribution system.

7 Subsection 9(2) of the Regulations is replaced by the following:

First compliance period

(2) If a facility becomes a covered facility under the Act after January 1 of a given calendar year, its specified period, for the purposes of the definition compliance period in section 169 of the Act, begins on January 1 of the calendar year following

- (a) the calendar year during which the facility is registered under subsection 171(2) of the Act, if the facility meets the criteria set out in section 8, or

- (b) the calendar year during which the facility was designated as a covered facility under subsection 172(1) of the Act.

8 Paragraph 10.1(1)(i) of the Regulations is replaced by the following:

- (i) the requirement to notify the Minister if there is a change in the person responsible, in accordance with section 48.

9 Section 11 of the Regulations is amended by adding the following after subsection (2):

New additional industrial activity

(3) For the purposes of subparagraph (1)(a)(ii), an additional industrial activity that was recognized by the Minister during a calendar year is not taken into account for the annual report for the compliance period that corresponds to that calendar year.

10 Subsection 13(2) of the Regulations is replaced by the following:

Correction of errors or omissions

(2) The person responsible for a covered facility must correct the errors or omissions, identified by a verification body during the verification of the annual report, prior to submitting the annual report to the Minister, if possible.

11 (1) Section 16 of the Regulations is amended by adding the following after subsection (6):

Additional production of evaporated salt

(6.1) If evaporated salt is produced through solution mining at a covered facility where a specified industrial activity set out in item 24, column 1, of Schedule 1 is engaged in, the following rules apply:

- (a) for the purposes of section 17, the person responsible for the covered facility must quantify the GHGs from the production of evaporated salt in accordance with the method applicable to the industrial activity set out in item 24, column 1, of Schedule 1; and

- (b) for the purposes of sections 31, 36 and 36.2, the industrial activity set out in item 24.1, column 1, of Schedule 1 is deemed not to be engaged in at the covered facility.

(2) The portion of subsection 16(9) of the Regulations before paragraph (a) is replaced by the following:

Additional production of petrochemicals

(9) Subject to subsection (9.1), if a petrochemical product referred to in item 17, column 1, of Schedule 1 is produced at a covered facility where a specified industrial activity set out in item 3 or 4, column 1, of that Schedule is engaged in, the following rules apply:

(3) Section 16 of the Regulations is amended by adding the following after subsection (9):

Parallel production

(9.1) If a covered facility has at least one refinery that is engaged in a specified industrial activity set out in item 3, column 1, of Schedule 1, and one petrochemical plant, that is engaged in a specified industrial activity referred to in item 17, column 1, of Schedule 1, subsection (9) only applies to the refinery.

(4) Paragraph 16(10)(b) of the French version of the Regulations is replaced by the following:

- b) pour l’application des articles 31, 36 et 36.2, l’activité industrielle prévue à l’alinéa 26c) de l’annexe 1 est réputée ne pas être exercée à l’installation assujettie.

12 (1) The descriptions of Ej and GWPj in subsection 17(1) of the Regulations are replaced by the following:

- Ej

- is the quantity of each GHG type “j” from the covered facility during a compliance period, for each specified emission type, determined in accordance with subsections (2) to (4);

- GWPj

- is the global warming potential of the GHG type “j” applicable to the compliance period and, if it is used to determine the quantities referred to in the descriptions of A, C and F in subsection 37(1), for the reference year “i”, the global warming potential applicable to the compliance period in respect of which the output-based standard is being calculated;

(2) Subsections 17(2) to (4.1) of the Regulations are replaced by the following:

Quantity of each GHG

(2) The quantity of a GHG type “j” from a covered facility during a compliance period for a specified emission type “i” is the sum of the following quantities, determined in accordance with the applicable requirements set out in Quantification Methods:

- (a) the quantities of that GHG from industrial activities set out in column 1 of Schedule 1 and set out in column 2 of the table to the Part of Schedule 3 that is applicable to those industrial activities, for a specified emission type set out in column 1 of that table;

- (b) the quantities of that GHG from those industrial activities, but not set out in column 2 of the table to the Part of Schedule 3 that applies to those activities or for a specified emission type not set out in column 1 of that table; and

- (c) any quantity of that GHG that is not referred to in paragraph (a) or (b).

Sampling, analysis and measurement requirements

(3) If the quantity of a GHG is determined in accordance with subsection (2), the sampling, analysis and measurement requirements that apply are those set out in Quantification Methods.

Missing data

(4) For the purposes of subsection (2), if, for any reason beyond the control of the person responsible for a covered facility, the data required to quantify the GHGs from a covered facility are missing for a given period of a compliance period, replacement data for the given period must be calculated in accordance with Quantification Methods.

13 Sections 18 and 19 of the Regulations are replaced by the following:

Additional generation of electricity

18 For the purposes of section 17, the quantities of the GHGs for specified emission types from the generation of electricity using fossil fuels by a covered facility — other than a covered facility referred to in paragraph 11(1)(c) — are determined in accordance with the methods that are applicable to any of the industrial activities engaged in at the covered facility.

14 (1) The description of GWPj in subsection 20(1) of the Regulations is replaced by the following:

- GWPj

- is the global warming potential of the GHG type “j” applicable to the compliance period;

(2) Subsection 20(2) of the Regulations is replaced by the following:

Quantity of each GHG

(2) The quantity of a GHG type “j” generated by a unit during a compliance period for a specified emission type “i” is the sum of the following quantities, determined in accordance with the applicable requirements set out in Quantification Methods:

- (a) the quantities of the GHG that is set out in column 2 of the table to Part 38 of Schedule 3 for a specified emission type set out in column 1; and

- (b) any quantity of the GHG that is not referred to in paragraph (a).

(3) Subsections 20(4) and (5) of the Regulations are replaced by the following:

Sampling, analysis and measurement requirements

(4) If the quantity of a GHG is determined in accordance with subsection (2), the sampling, analysis and measurement requirements that apply are those set out in Quantification Methods.

Missing data

(5) For the purposes of subsection (2), if, for any reason beyond the control of the person responsible for a covered facility, the data required to quantify GHGs generated by a unit are missing for a given period of a compliance period, replacement data for the given period must be calculated in accordance with Quantification Methods.

15 The Regulations are amended by adding the following after section 22:

Measuring device

22.1 Unless otherwise provided for in a method set out in Quantification Methods, any measuring device that is used to determine a quantity for the purposes of these Regulations must

- (a) be installed, operated, maintained and calibrated in accordance with the manufacturer’s specifications, or, if those specifications are not available, with any applicable generally recognized national or international industry standard; and

- (b) maintain accuracy within plus or minus 5%.

16 Section 25 of the Regulations is replaced by the following:

Continuous Emissions Monitoring System

25 If a continuous emissions monitoring system is used to quantify GHGs under these Regulations, the person responsible for the covered facility must ensure that the system complies with the requirements set out in Quantification Methods.

17 Section 26 of the Regulations is replaced by the following:

Alternative method

26 Despite sections 17 and 20, the person responsible for a covered facility may use a method other than a method set out in Quantification Methods if they have a permit issued in accordance with section 28.

18 The portion of subsection 28(1) of the Regulations before paragraph (d) is replaced by the following:

Conditions of issuance

28 (1) The Minister must issue the permit to use a method of quantification other than the method set out in Quantification Methods if

- (a) the person responsible for the covered facility establishes that, at the time of the application, it is not technically or economically feasible to use the method set out in Quantification Methods;

- (b) the person responsible for the covered facility demonstrates that the method being proposed is at least as rigorous as the requirements set out in Quantification Methods and provides equivalent results to those that would have been obtained from those requirements;

- (c) the person responsible for the covered facility provides a plan describing measures that will be taken to enable the use of the method set out in Quantification Methods and the implementation period for that plan, up to a maximum of two years; and

19 (1) Paragraph 31(1)(a) of the Regulations is replaced by the following:

- (a) in the case of production from a specified industrial activity set out in items 1 to 37 and 39 to 44, column 1, of Schedule 1, in the units of measurement set out in column 2 of Schedule 1 for that industrial activity, and in accordance with any requirements set out in the applicable part of Schedule 3;

(2) Subparagraph 31(1)(b)(i) of the Regulations is replaced by the following:

- (i) quantified in whole for the compliance period in accordance with the requirements set out in sections 3 and 4 of Part 38 of Schedule 3, or

(3) Paragraph 31(1)(c) of the Regulations is replaced by the following:

- (c) in the case of production from an additional industrial activity, in the units of measurement specified by the Minister for that activity.

(4) The portion of subsection 31(2) of the English version of the Regulations before paragraph (a) is replaced by the following:

Measuring device

(2) Any measuring device that is used to determine a quantity for the purposes of these Regulations must

(5) Paragraphs 31(2)(a) and (b) of the Regulations are replaced by the following:

- (a) be installed, operated, maintained and calibrated in accordance with the manufacturer’s specifications or, if those specifications are not available, any applicable generally recognized national or international industry standard; and

- (b) maintain accuracy within plus or minus 5%.

20 Paragraphs 32(1)(a) and (b) of the Regulations are replaced by the following:

- (a) if a unit uses only one fossil fuel to generate electricity, in accordance with subsection 1(1) and section 2 of Part 38 of Schedule 3; and

- (b) if a unit uses a mixture of fossil fuels or a mixture of biomass and fossil fuels to generate electricity, in accordance with subsections 1(2) and (3) and section 2 of Part 38 of Schedule 3.

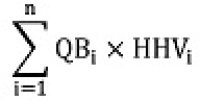

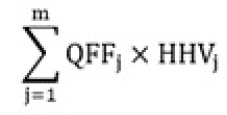

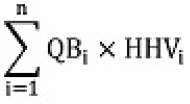

21 Paragraphs 34(1)(b) and (c) of the Regulations are replaced by the following:

- (b) for a covered facility not referred to in paragraph (c), determined by the following formula if the thermal energy is produced from the combustion of both fossil fuels and biomass:

- HF ÷ (HF + B)

- where

- HF

- is determined by the formula

- where

- QFi

- is the quantity of fossil fuel of type “i” combusted in the facility for the generation of thermal energy during the compliance period, determined in accordance with subsection 4(2) of Part 38 of Schedule 3,

- HHVi

- is the higher heating value of the fossil fuel of type “i” combusted in the facility for the generation of thermal energy during the compliance period, determined in accordance with Quantification Methods, and

- i

- is the ith fossil fuel type combusted in the facility during the compliance period, where “i” goes from 1 to n and where n is the number of types of fossil fuels combusted, and

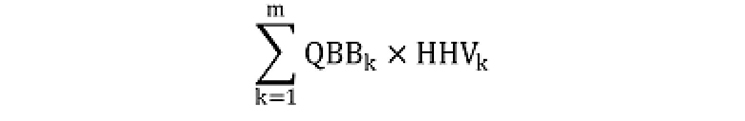

- B

- is determined by the formula

-

- where

- QBBk

- is the quantity of biomass fuel type “k” combusted in the facility for the generation of thermal energy during the compliance period, determined in accordance with subsection 4(2) of Part 38 of Schedule 3 and Quantification Methods,

- HHVk

- is the higher heating value for biomass fuel type “k” combusted in the facility for the generation of thermal energy during the compliance period, determined in accordance with Quantification Methods, and

- k

- is the kth biomass fuel type combusted in the facility during the compliance period, where “k” goes from 1 to m and where m is the number of types of biomass fuels combusted; and

- (c) for an electricity generation facility, determined by the following formula when the thermal energy is produced from the combustion of both fossil fuels and biomass:

- HF ÷ (HF + B)

- where

- HF

- is determined by the formula

- where

- QFi

- is the quantity of fossil fuel of type “i” combusted in the facility for the generation of thermal energy during the compliance period, determined in accordance with subsection 1(3) of Part 38 of Schedule 3,

- HHVi

- is the higher heating value of the fossil fuel of type “i” combusted in the facility for the generation of thermal energy during the compliance period, determined in accordance with Quantification Methods, and

- i

- is the ith fossil fuel type combusted in the facility during the compliance period, where “i” goes from 1 to n and where n is the number of types of fossil fuel combusted, and

- B

- is determined by the formula

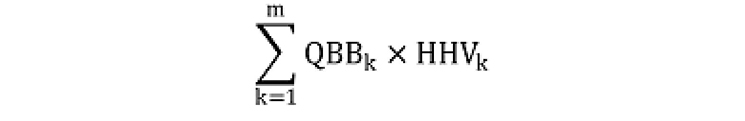

- where

- QBBk

- is the quantity of biomass fuel type “k” combusted in the facility for the generation of thermal energy during the compliance period, determined in accordance with subsection 1(3) of Part 38 of Schedule 3,

- HHVk

- is the higher heating value for biomass fuel type “k” combusted in the facility for the generation of thermal energy, during the compliance period determined in accordance with Quantification Methods, and

- k

- is the kth biomass fuel type combusted in the facility during the compliance period, where “k” goes from 1 to m and where m is the number of types of biomass fuels combusted.

22 The description of B in subsection 35(1) of the Regulations is replaced by the following:

B is the quantity of CO2 captured at the covered facility that is stored during the compliance period in a storage project, determined using Quantification Methods, expressed in CO2e tonnes.

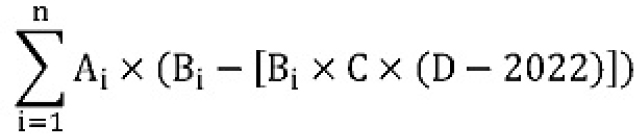

23 (1) Subsection 36(1) of the Regulations is replaced by the following:

General rule

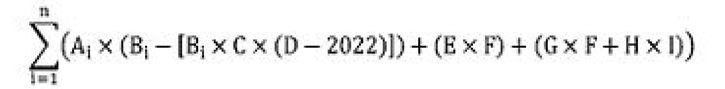

36 (1) Subject to subsection (2) and sections 16, 36.1, 36.2 and 42, the person responsible for a covered facility, other than an electricity generation facility, must determine the GHG emissions limit that applies to that covered facility for each compliance period, expressed in CO2e tonnes, in accordance with the formula

- where

- Ai

- is the covered facility’s production from each specified industrial activity “i” during the compliance period, quantified in accordance with section 31;

- Bi

- is the following output-based standard applicable to the specified industrial activity “i”, as the case may be:

- (a) for a specified industrial activity set out in column 1 of Schedule 1 and for which an output-based standard is set out in column 3 of that Schedule, that standard,

- (b) for a specified industrial activity set out in column 1 of Schedule 1 and for which column 3 of that Schedule sets out that an output-based standard must be calculated in accordance with section 37, the output-based standard calculated in accordance with that section, and

- (c) for an additional industrial activity, the output-based standard calculated in accordance with section 37;

- C

- is the following tightening rate applicable to the specified industrial activity “i”, as the case may be:

- (a) 0% for the specified industrial activity set out in item 38, column 1, of Schedule 1,

- (b) 1% for the specified industrial activities set out in paragraph 3(c) and items 7, 8, 13, 17, 19, 20, and 34, column 1, of Schedule 1, and

- (c) 2% for all other specified industrial activities;

- D

- is the calendar year that corresponds to the compliance period; and

- i

- is the ith specified industrial activity where “i” goes from 1 to n and where n is the total number of specified industrial activities engaged in at the covered facility.

(2) Subsection 36(1) of the Regulations is replaced by the following:

General rule

36 (1) Subject to subsection (2) and sections 16, 36.1, 36.2 and 42, the person responsible for a covered facility, other than an electricity generation facility, must determine the GHG emissions limit that applies to that covered facility for each compliance period, expressed in CO2e tonnes, in accordance with the formula

- where

- Ai

- is the covered facility’s production from each specified industrial activity “i” during the compliance period, quantified in accordance with section 31;

- Bi

- is the following output-based standard applicable to the specified industrial activity “i”, as the case may be:

- (a) for a specified industrial activity set out in column 1 of Schedule 1 and for which an output-based standard is set out in column 3 of that Schedule, that standard,

- (b) for a specified industrial activity set out in column 1 of Schedule 1 and for which column 3 of that Schedule sets out that an output-based standard must be calculated in accordance with section 37, the output-based standard calculated in accordance with that section, and

- (c) for an additional industrial activity, the output-based standard calculated in accordance with section 37;

- C

- is the following tightening rate applicable to the specified industrial activity “i”, as the case may be:

- (a) 0% for the specified industrial activity set out in item 38, column 1, of Schedule 1,

- (b) 1% for the specified industrial activities set out in paragraph 3(c) and items 7, 8, 13, 17, 19, 20, 34, 40, 41 and 43, column 1, of Schedule 1, and

- (c) 2% for all other specified industrial activities;

- D

- is the calendar year that corresponds to the compliance period; and

- i

- is the ith specified industrial activity where “i” goes from 1 to n and where n is the total number of specified industrial activities engaged in at the covered facility.

(3) Subsection 36(4) of the Regulations is replaced by the following:

Clarification — fertilizer

(4) For greater certainty, if the industrial activity set out in paragraph 29(b), column 1, of Schedule 1 and also any of the industrial activities set out in paragraph 29(c), (d) or (e), column 1, of Schedule 1 are engaged in at the covered facility, the output-based standard applicable to the industrial activity set out in that paragraph 29(b) applies and the output-based standard applicable to the industrial activity set out in that paragraph 29(c), (d) or (e) applies, as the case may be.

(4) Section 36 of the Regulations is amended by adding the following after subsection (4):

New additional industrial activity

(4.1) For the purposes of subsection (1), an additional industrial activity that was recognized by the Minister during a calendar year is not included in the determination of the GHG emissions limit for the compliance period that corresponds to that calendar year.

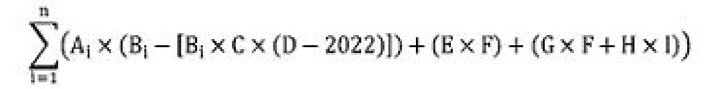

24 (1) Subsections 36.2(2) and (3) of the Regulations are replaced by the following:

Different output-based standard

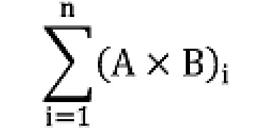

(2) The GHG emissions limit that applies to the covered facility for a compliance period, expressed in CO2e tonnes, is determined in accordance with the formula

- where

- Ai

- is the covered facility’s production during the compliance period, quantified in accordance with section 31,

- (a) from each specified industrial activity “i”, except the industrial activity set out in paragraph 38(c), column 1, of Schedule 1, and

- (b) from the specified industrial activity set out in paragraph 38(c), column 1, of Schedule 1, other than from equipment referred to in the descriptions of E, G and H;

- Bi

- is the following output-based standard applicable to the specified industrial activity “i”, as the case may be:

- (a) for a specified industrial activity set out in column 1 of Schedule 1 and for which an output-based standard is set out in column 3 of that Schedule, that standard,

- (b) for a specified industrial activity set out in column 1 of Schedule 1 and for which column 3 of that Schedule sets out that an output-based standard must be calculated in accordance with section 37, the output-based standard calculated in accordance with that section, and

- (c) for an additional industrial activity, the output based standard calculated in accordance with section 37;

- C

- is the following tightening rate applicable to the specified industrial activity “i”, as the case may be:

- (a) 0% for the specified industrial activity set out in item 38, column 1, of Schedule 1,

- (b) 1% for the specified industrial activities set out in paragraph 3(c) and items 7, 8, 13, 17, 19, 20 and 34, column 1, of Schedule 1, and

- (c) 2% for all other specified industrial activities;

- D

- is the calendar year that corresponds to the compliance period;

- E

- is the gross amount of electricity generated during the compliance period by the equipment that started generating electricity from gaseous fuels on or after January 1, 2021, and is designed to operate at a thermal energy to electricity ratio of less than 0.9, from the specified industrial activity set out in paragraph 38(c), column 1, of Schedule 1, quantified in accordance with section 31;

- F

- is the output-based standard set out in subsection 36.1(2) that is applicable for the compliance period;

- G

- is, for equipment with increased electricity generation capacity and a thermal energy to electricity ratio of less than 0.9, other than equipment referred to in the description of E, the gross amount of electricity generated during the compliance period attributed to the capacity added to the equipment, from the specified industrial activity set out in paragraph 38(c), column 1, of Schedule 1, quantified in accordance with section 31 and subsection (3);

- H

- is, for equipment with increased electricity generation capacity and a thermal energy to electricity ratio of less than 0.9, other than equipment referred to in the description of E, the gross amount of electricity generated during the compliance period attributed to the capacity of the equipment before the additional capacity was added, from the specified industrial activity set out in paragraph 38(c), column 1, of Schedule 1, quantified in accordance with section 31 and subsection (3);

- I

- is the output-based standard set out in item 38, column 3, of Schedule 1 that is applicable to the specified industrial activity set out in paragraph 38(c), column 1 of that Schedule; and

- i

- is the ith specified industrial activity where “i” goes from 1 to n and where n is the total number of specified industrial activities engaged in at the covered facility.

Apportionment of electricity generation

(3) For the purposes of the descriptions of G and H in subsection (2), the gross amount of electricity generated by the equipment referred to in those descriptions is apportioned, using engineering estimates, to the equipment’s capacity added to the equipment and to the capacity of the equipment before the additional capacity was added, based on the ratio of the amount of its increased capacity to its total capacity, taking into account the increased capacity.

(2) Subsection 36.2(2) of the Regulations is replaced by the following:

Different output-based standard

(2) The GHG emissions limit that applies to the covered facility for a compliance period, expressed in CO2e tonnes, is determined in accordance with the formula

- where

- Ai

- is the covered facility’s production during the compliance period, quantified in accordance with section 31,

- (a) from each specified industrial activity “i”, except the industrial activity set out in paragraph 38(c), column 1, of Schedule 1, and

- (b) from the specified industrial activity set out in paragraph 38(c), column 1, of Schedule 1, other than from equipment referred to in the descriptions of E, G and H;

- Bi

- is the following output-based standard applicable to the specified industrial activity “i”, as the case may be:

- (a) for a specified industrial activity set out in column 1 of Schedule 1 and for which an output-based standard is set out in column 3 of that Schedule, that standard,

- (b) for a specified industrial activity set out in column 1 of Schedule 1 and for which column 3 of that Schedule sets out that an output-based standard must be calculated in accordance with section 37, the output-based standard calculated in accordance with that section, and

- (c) for an additional industrial activity, the output based standard calculated in accordance with section 37;

- C

- is the following tightening rate applicable to the specified industrial activity “i”, as the case may be:

- (a) 0% for the specified industrial activity set out in item 38, column 1, of Schedule 1,

- (b) 1% for the specified industrial activities set out in paragraph 3(c) and items 7, 8, 13, 17, 19, 20, 34, 40, 41 and 43, column 1, of Schedule 1, and

- (c) 2% for all other specified industrial activities;

- D

- is the calendar year that corresponds to the compliance period;

- E

- is the gross amount of electricity generated during the compliance period by the equipment that started generating electricity from gaseous fuels on or after January 1, 2021, and is designed to operate at a thermal energy to electricity ratio of less than 0.9, from the specified industrial activity set out in paragraph 38(c), column 1, of Schedule 1, quantified in accordance with section 31;

- F

- is the output-based standard set out in subsection 36.1(2) that is applicable for the compliance period;

- G

- is, for equipment with increased electricity generation capacity and a thermal energy to electricity ratio of less than 0.9, other than equipment referred to in the description of E, the gross amount of electricity generated during the compliance period attributed to the capacity added to the equipment, from the specified industrial activity set out in paragraph 38(c), column 1, of Schedule 1, quantified in accordance with section 31 and subsection (3);

- H

- is, for equipment with increased electricity generation capacity and a thermal energy to electricity ratio of less than 0.9, other than equipment referred to in the description of E, the gross amount of electricity generated during the compliance period attributed to the capacity of the equipment before the additional capacity was added, from the specified industrial activity set out in paragraph 38(c), column 1, of Schedule 1, quantified in accordance with section 31 and subsection (3);

- I

- is the output-based standard set out in item 38, column 3, of Schedule 1 that is applicable to the specified industrial activity set out in paragraph 38(c), column 1 of that Schedule; and

- i

- is the ith specified industrial activity where “i” goes from 1 to n and where n is the total number specified industrial activities engaged in at the covered facility.

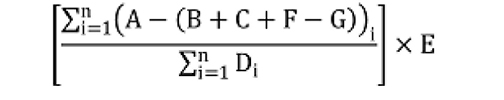

25 (1) Subsection 37(1) of the Regulations is replaced by the following:

Calculated output-based standard

37 (1) Subject to subsection (3) and sections 38 and 39, the output-based standard that is applicable to a specified industrial activity of a covered facility, for which an output-based standard must be calculated in accordance with this section, is calculated in accordance with the formula

- where

- A

- is the quantity of GHGs that are emitted from the covered facility for reference year “i”, determined in accordance with section 35, expressed in CO2e tonnes;

- B

- is the allocation for net thermal energy for reference year “i” and is

- (a) determined by the formula

- 0.062 CO2e tonnes/gigajoules × (M − N) × O

- where

- M

- is the quantity of thermal energy produced by the covered facility that was sold to another covered facility in reference year “i”, as indicated by the quantity of thermal energy on sales receipts or determined by another objective method, expressed in gigajoules,

- N

- is the quantity of thermal energy that was bought from other covered facilities and not subsequently sold in reference year “i”, as indicated by the quantity of thermal energy on sales receipts or by another objective method, expressed in gigajoules, and

- O

- is the ratio of heat from the combustion of fossil fuels to produce thermal energy and is,

- (i) if M is greater than N, the ratio of heat determined under section 34 for reference year “i” for the covered facility, or

- (ii) if M is less than N, the ratio of heat determined under section 34 for reference year “i” for the covered facility from which the thermal energy was purchased, and

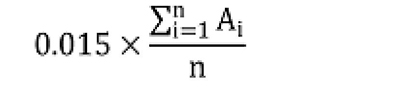

- (b) 0 for all reference years if the absolute value of the quotient obtained by dividing the sum of the results determined under paragraph (a) for each reference year “i” by the number of reference years is less than the quotient determined by the formula

- (a) determined by the formula

- C

- is the total quantity of GHGs from all specified industrial activities engaged in at the facility for reference year “i” other than the industrial activity for which the output-based standard is being calculated, determined in accordance with sections 17 and 18;

- D

- is the production from a covered facility from the specified industrial activity for which the output-based standard is being calculated for reference year “i” quantified in accordance with section 31;

- E

- is the GHG emissions reduction factor applicable to the specified industrial activity for which the output-based standard is being calculated and is

- (a) 95% for a specified industrial activity set out in paragraph 7(c), 8(b) or (c) or 20(d), column 1, of Schedule 1,

- (b) 90% for a specified industrial activity set out in item 22 or paragraph 23(a) or 29(d), column 1, of Schedule 1, and

- (c) 80% for all other specified industrial activities;

- F

- is the total quantity of GHGs from an activity engaged in at the facility, for reference year “i”, that is not a specified industrial activity, determined in accordance with sections 17 and 18, if

- (a) with respect to a covered facility whose primary activity is an industrial activity,

- (i) that quantity accounts for 20% or more of the total quantity of GHGs from a covered facility for that reference year, determined in accordance with sections 17 and 18, or

- (ii) the revenue, in dollars, attributable to the sale of the product produced by the facility from that industrial activity accounts for 20% or more of the revenue, in dollars, attributable to the sale of all products produced by the facility from all of the facility’s industrial activities for that reference year, or

- (b) with respect to a covered facility whose primary activity is not an industrial activity,

- (i) the activity is not an industrial activity, or

- (ii) the quantity of GHGs from an industrial activity accounts for 20% or more of the total quantity of GHGs from a covered facility, for that reference year, determined in accordance with sections 17 and 18; and

- (a) with respect to a covered facility whose primary activity is an industrial activity,

- G

- is the quantity of CO2 determined for the purposes of the description B in section 35, from all activities engaged in at the facility for reference year “i” other than the industrial activity for which the output-based standard is being calculated; and

- i

- is the ith reference year, where “i” goes from 1 to n and where n is the number of reference years, determined in accordance with subsection (2).

(2) The portion of subsection 37(2) of the Regulations before paragraph (b) is replaced by the following:

Reference years

(2) Subject to paragraph (2.1)(a), the reference years applicable to the specified industrial activities that are engaged in at a covered facility for which an emissions limit is calculated for a compliance period are

- (a) except for a covered facility referred to in paragraph (b),

- (i) the 2017, 2018 and 2019 calendar years, if the data are available for those years,

- (ii) the three calendar years preceding the compliance period, if the data are not available for the 2017, 2018, and 2019 calendar years, or

- (iii) the compliance period, if the data are not available for the years specified in subparagraphs (i) and (ii); and

(3) Section 37 of the Regulations is amended by adding the following after subsection (2):

New activity

(2.1) For the purposes of subsection (1), if the calculation of the emissions limit for a compliance period takes into account a specified industrial activity that began to be engaged in at the covered facility during that compliance period and for which an output-based standard has not previously been calculated under this section

- (a) the applicable reference years with respect to that specified industrial activity are that compliance period and the two calendar years following it; and

- (b) the determination of the output-based standard for that specified industrial activity is to be made based on projections, made using engineering estimates, for the applicable reference years.

Attributing of emissions

(2.2) For the purposes of the descriptions of C, F and G in subsection (1), the method used to attribute the quantity of GHGs to an activity must be rigourous, objective and based on sound engineering principles. The same method must be used for each reference year and no quantity of GHGs may be attributed to more than one activity.

26 Section 39 of the Regulations are replaced by the following:

Recalculation of output-based standard

39 If an output-based standard applicable to a specified industrial activity was calculated in accordance with subsection 37(2.1) for a compliance period, it must be recalculated in accordance with subsection 37(1) for the third compliance period following the compliance period for which the original calculation was done. The reference years that must be used for the recalculation are the three calendar years that precede that third compliance period.

27 Section 40 of the Regulations is repealed.

28 (1) Subsection 45(2) of the Regulations is replaced by the following:

Continuous Emissions Monitoring System

(2) For each compliance period during which a person responsible for the covered facility uses a continuous emissions monitoring system, they must comply with the record keeping requirements set out in Quantification Methods.

(2) Section 45 of the Regulations is amended by adding the following after subsection (3):

Provision of records

(4) A person who is required to keep a record of information under subsection (1), must, on the Minister’s request, provide a copy of that record to the Minister without delay.

29 (1) The portion of paragraph 49(1)(b) of the Regulations before subparagraph (i) is replaced by the following:

- (b) conduct the verification in accordance with the version of ISO Standard 14064-3 published by the International Organization for Standardization in 2006 and entitled Greenhouse gases — Part 3: Specification with guidance for the validation and verification of greenhouse gas assertions, the version of that Standard, published in 2019 and entitled Greenhouse gases — Part 3: Specification with guidance for the verification and validation of greenhouse gas statements, or the subsequent published version, set out in their accreditation, by applying methods that allow it to make a determination to a reasonable level of assurance, as defined in that standard, on whether

(2) Subsection 49(2) of the Regulations is replaced by the following:

Material discrepancy

(2) For the purpose of the verification of a covered facility’s annual report or corrected report, a material discrepancy exists when

- (a) with respect to GHGs from covered facilities that have emitted a quantity of GHGs of less than 500 kt of CO2e during the compliance period,

- (i) in the case of an error or omission respecting GHGs that is identified during the verification and that may be quantified, the result, expressed as a percent, determined by the formula, is equal to or greater than 5%:

- A ÷ B × 100

- where

- A

- is the absolute value of the overstatement or understatement resulting from the error or omission, expressed in CO2e tonnes, and

- B

- is the total quantity of GHGs reported in the annual report or corrected report, expressed in CO2e tonnes, and

- (ii) in the case of the aggregate of all errors and omissions respecting GHGs that are identified during the verification and that may be quantified, the result, expressed as a percent, determined by the formula, is equal to or greater than 5%:

- A ÷ B × 100

- where

- A

- is the absolute value of the net result of all overstatements and understatements resulting from all errors and omissions, expressed in CO2e tonnes, and

- B

- is the total quantity of GHGs reported in the annual report or corrected report, expressed in CO2e tonnes;

- (i) in the case of an error or omission respecting GHGs that is identified during the verification and that may be quantified, the result, expressed as a percent, determined by the formula, is equal to or greater than 5%:

- (b) with respect to GHGs from covered facilities that emitted a quantity of GHGs that is equal to or greater than 500 kt of CO2e during the compliance period,

- (i) in the case of an error or omission respecting GHGs that is identified during the verification and that may be quantified, the result, expressed as a percent, determined by the formula, is equal to or greater than 2%:

- A ÷ B × 100

- where

- A

- is the absolute value of the overstatement or understatement resulting from an error or omission, expressed in CO2e tonnes, and

- B

- is the total quantity of GHGs reported in the annual report or corrected report, expressed in CO2e tonnes, and

- (ii) in the case of the aggregate of all errors and omissions respecting GHGs that are identified during the verification and that may be quantified, the result, expressed as a percent, determined by the formula, is equal to or greater than 2%:

- A ÷ B × 100

- where

- A

- is the absolute value of the net result of all overstatements and understatements resulting from all errors and omissions, expressed in CO2e tonnes, and

- B

- is the total quantity of GHGs reported in the annual report or corrected report, expressed in CO2e tonnes; and

- (c) with respect to the production from a specified industrial activity that is used in the calculation of the emissions limit, in the case of an error or omission respecting the quantification of the production that is identified during the verification and may be quantified, the result, expressed as a percent, determined by the formula, is equal to or greater than 5%:

- A ÷ B × 100

- where

- A

- is the absolute value of the overstatement or understatement resulting from an error or omission expressed in the applicable unit of measure, and

- B

- is the production from the specified industrial activity in question that is reported in the annual report or corrected report, expressed in the applicable unit of measure.

- (i) in the case of an error or omission respecting GHGs that is identified during the verification and that may be quantified, the result, expressed as a percent, determined by the formula, is equal to or greater than 2%:

30 Paragraph 51(1)(b) of the Regulations is replaced by the following:

- (b) two calendar years have passed since a verification body has visited the covered facility for the purposes of verifying an annual report or corrected report;

31 Subsection 53(1) of the Regulations is replaced by the following:

Determination

53 (1) The Minister may establish the emissions limit or determine the quantity of GHGs emitted from the covered facility for the compliance period if

- (a) there is a material discrepancy with respect to the total quantity of GHGs from the covered facility or the production from one or more specified industrial activities used in the calculation of the emissions limit reported in the annual report or the corrected report for the compliance period;

- (b) the verification opinion referred to in paragraph 3(n) of Schedule 5 that is included in the verification report that accompanies an annual report or corrected report for the compliance period indicates that it is impossible to determine that a material discrepancy does not exist or that the annual report or corrected report was prepared in accordance with these Regulations;

- (c) the emissions limit for the covered facility that is indicated in the annual report or corrected report for the compliance period was not calculated in accordance with these Regulations and any resulting error was equal to or greater than 2%; or

- (d) the annual report for the compliance period was not submitted to the Minister.

32 Subparagraphs 58(g)(ii) to (iv) of the Regulations are replaced by the following:

- (ii) the province or program authority referred to in subsection 78(1) that issued the units or credits,

- (iii) the date of their retirement or the date they are designated for use exclusively as a compliance unit for the purposes of remittance to the Minister under section 174, paragraph 178(1)(a) or subsection 181(2) of the Act, as the case may be,

- (iv) the serial numbers assigned to them by the province or program authority referred to in subsection 78(1),

33 Section 59 of the Regulations is replaced by the following:

Surplus credits

59 (1) For the purposes of section 175 of the Act and subject to subsection (2), the number of surplus credits, equivalent to the difference between the emissions limit and the quantity of GHGs emitted from the covered facility, that the Minister issues is based on what is reported in the annual report submitted for the compliance period if the emissions limit that was set out in the report was calculated in accordance with these Regulations, unless a material discrepancy within the meaning of subsection 49(2) exists with respect to the total quantity of GHGs or the production from one of the specified industrial activities that is used in the calculation of the emissions limit for the compliance period.

Exception

(2) The Minister will not issue surplus credits if the Minister has established the emissions limit or determined the quantity of GHGs emitted from the covered facility for the compliance period under section 53.

34 Section 62 of the Regulations is replaced by the following:

Corrected report

62 (1) If the notice indicated that the error or omission, or the aggregate of all errors and omissions, would have constituted a material discrepancy under subsection 49(2), a corrected report, along with a verification report prepared in accordance with section 52, must be submitted to the Minister by the person responsible within 120 days after the day on which the notice is submitted.

Content

(2) The corrected report must include the information referred to in sections 11 and 12 and, under a heading, the following information:

- (a) the information provided in the annual report that required correction and a description of the corrections made;

- (b) a description of the circumstances that led to the errors or omissions and an indication of the reasons why the error or omission was not previously detected; and

- (c) a description of the measures that have been and will be implemented to avoid future errors or omissions of the same type.

35 Paragraph 63(1)(b) of the Regulations is replaced by the following:

- (b) in the case of a verified corrected report, 120 days after the day on which the Minister required it.

36 Sections 64 and 65 of the Regulations are replaced by the following:

Change in obligations

64 (1) For the purposes of section 178 of the Act, the revised compensation to be paid or remitted or the number of surplus credits to be issued, as the case may be, is equal to the difference between the result of the assessment made in accordance with section 44, and reported in the annual report, and the result that is reported in the corrected report.

Revised compensation

(2) For the purposes of paragraph 178(1)(a) of the Act, any revised compensation is to be provided by means of an excess emissions charge payment or a remittance of compliance units. Revised compensation is to be provided if the difference referred to in subsection (1) is greater than or equal to 500 CO2e tonnes.

Issuance of surplus credits

(3) For the purposes of paragraph 178(1)(b) of the Act and subject to subsection (4), the Minister may issue a number of surplus credits that is equivalent to the difference between, as the case may be,

- (a) the number of surplus credits that corresponds to the result obtained under section 44 based on the corrected report and the number of surplus credits issued under section 175 of the Act based on the annual report; or

- (b) the applicable emissions limit and the quantity of GHGs emitted from the covered facility that are reported in the corrected report, if the emissions limit that was set out in the corrected report was calculated in accordance with these Regulations.

Exception

(4) The Minister will not issue surplus credits if

- (a) a material discrepancy within the meaning of subsection 49(2) exists with respect to the total quantity of GHGs reported in the corrected report or the production from one of the specified industrial activities that is used in the calculation of the emissions limit reported in the corrected report for the compliance period; or

- (b) the emissions limit or quantity of GHGs emitted from the covered facility is determined by the Minister for the compliance period under section 53.

37 Section 67 of the Regulations is replaced by the following:

Charge

67 An excess emissions charge payment made for the purposes of subsection 64(2) must be made in the manner set out in section 55.

38 (1) Subsection 69(1) of the Regulations is replaced by the following:

Regular-rate compensation deadline

69 (1) With respect to revised compensation, the regular rate referred to in subsection 174(3) of the Act applies for a period of 45 days after the day on which the corrected report must be submitted.

(2) Subsection 69(2) of the French version of the Regulations is replaced by the following:

Délai de compensation — taux élevé

(2) Si la compensation n’est pas versée en entier dans le délai fixé au paragraphe (1), le délai de compensation à taux élevé visé au paragraphe 174(4) de la Loi court pendant soixante jours à compter de la fin du délai prévu au paragraphe (1).

39 (1) Subsection 78(1) of the Regulations is replaced by the following:

Compliance unit

78 (1) A unit or credit is to be recognized as a compliance unit if

- (a) it is issued by a province or by a program authority on behalf of a province;

- (b) it is issued under an offset protocol and offset program that is set out on the list published on the Department of the Environment’s website;

- (c) it is eligible for use as a method of compensation or compliance with respect to a pricing mechanism for GHG emissions in the province in which it was issued; and

- (d) it corresponds to a GHG reduction or removal of one CO2e tonne.

(2) Paragraph 78(2)(f) of the English version of the Regulations is replaced by the following:

- (f) measures to ensure that, for a GHG reduction or removal of one CO2e tonne, one credit or unit is issued and the unit or credit is not used more than once;

(3) Subparagraph 78(4)(d)(ii) of the Regulations is replaced by the following:

- (ii) is not suspended by the accreditation organization that issued its accreditation nor suspended at the time the verification relative to the issuance of the unit or credit occurred or at the time the verification report related to the issuance of the unit or credit was signed; and

(4) Subsection 78(4) of the Regulations are amended by striking out “and” at the end of paragraph (c) and by adding the following after paragraph (d):

- (e) be designated for use exclusively as a compliance unit for the purposes of remittance to the Minister under section 174, paragraph 178(1)(a) or subsection 181(2) of the Act.

40 Schedule 1 to the Regulations is amended by replacing the references after the heading “SCHEDULE 1” with the following:

(Subsections 2(1) and 5(2), paragraph 8(b), section 8.1, subparagraphs 11(1)(b)(iii) and (iv), clauses 11(1)(c)(iii)(A) and (B), subsections 12(2) and (3), section 16, paragraph 17(2)(a), subsections 22(2), 31(1), 32(1) and 36(1) to (4), section 36.1, subsections 36.2(2) and 37(1), sections 38 and 41, subsections 41.1(2) and 41.2(2), sections 41.3 and 42, subsection 1(1.1) of Part 3 of Schedule 3, subparagraphs 1(2)(b)(i) and (ii) and (c)(i) of Part 3 of Schedule 3, section 1 of Part 4 of Schedule 3, sections 1 and 2 of Part 7 of Schedule 3, section 1 of Part 37 of Schedule 3 and subparagraphs 3(g)(ii) and 3(h)(iii) of Schedule 5)

| Item | Column 1 Industrial Activity |

Column 2 Units of Measurement |

Column 3 Output-based standard (CO2e tonnes/unit of measurement) |

Column 4 Applicable Part of Schedule 3 |

|---|---|---|---|---|

| 3.1 | Surface mining of oil sands and extraction of bitumen | barrels of bitumen | 0.0266 | Part 3.1 |

| Item | Column 1 Industrial Activity |

|---|---|

| 17 | Production of the following petrochemical products from petroleum and liquefied natural gas or from feedstocks derived from petroleum: |

| Item | Column 1 Industrial Activity |

Column 2 Units of Measurement |

Column 3 Output-based standard (CO2e tonnes/unit of measurement) |

Column 4 Applicable Part of Schedule 3 |

|---|---|---|---|---|

| 17 | (g) ethylene glycol with six or fewer monomer units | tonnes of ethylene glycol with six or fewer monomer units | 0.326 | Part 17 |

| Item | Column 1 Industrial Activity |

Column 2 Units of Measurement |

Column 3 Output-based standard (CO2e tonnes/unit of measurement) |

Column 4 Applicable Part of Schedule 3 |

|---|---|---|---|---|

| 24.1 | Production of evaporated salt through solution mining | tonnes of evaporated salt at a concentration of at least 99% of NaCl | 0.153 | Part 24.1 |

| Item | Column 1 Industrial Activity |

|---|---|

| 26 | Production of metal or diamonds from the mining and milling of ore or kimberlite |

| Item | Column 3 Output-based standard (CO2e tonnes/unit of measurement) |

|---|---|

| 29(a) | 0.310 |

| Item | Column 3 Output-based standard (CO2e tonnes/unit of measurement) |

|---|---|

| 29(c) | 0.132 |

| Item | Column 1 Industrial Activity |

Column 2 Units of Measurement |

Column 3 Output-based standard (CO2e tonnes/unit of measurement) |

Column 4 Applicable Part of Schedule 3 |

|---|---|---|---|---|

| 29 | (e) granular urea in addition to producing anhydrous ammonia or aqueous ammonia by the steam reforming of hydrocarbons | Tonnes of granular urea | 0.159 | Part 29 |

| Item | Column 3 Output-based standard (CO2e tonnes/unit of measurement) |

|---|---|

| 30 | 0.102 |

| Item | Column 1 Industrial Activity |

Column 2 Units of Measurement |

Column 3 Output-based standard (CO2e tonnes/unit of measurement) |

Column 4 Applicable Part of Schedule 3 |

|---|---|---|---|---|

| 35.1 | Production of malt | Tonnes of malt | 0.117 | Part 35.1 |

| Item | Column 1 Industrial Activity |

|---|---|

| 36 | (b) pulp from wood, other plant material or paper or any product derived directly from pulp or a pulping process — excluding specialty products and products referred to in subitem 39(3) — at a facility not equipped with a recovery boiler, lime kiln or pulping digester |

| Item | Column 1 Industrial Activity |

|---|---|

| 37 | Main assembly of four-wheeled self-propelled vehicles that are designed for use on highways and that have a gross vehicle weight rating of less than 4 536 kg (10,000 pounds), except vehicles capable of operating with no tailpipe emissions and equipped with a battery with a capacity of at least 15 kWh |

| Item | Column 1 Industrial Activity |

Column 2 Units of Measurement |

Column 3 Output-based standard (CO2e tonnes/unit of measurement) |

Column 4 Applicable Part of Schedule 3 |

|---|---|---|---|---|

| Wood Products | ||||

| 39 | (1) Production of wood veneer or plywood | Cubic metres of wood veneer and plywood | 0.0701 | Part 39 |

| (2) Production of lumber | Cubic metres of lumber | 0.0229 | Part 39 | |

(3) Production of the following products:

|

Cubic metres of particle board and of panels composed primarily of cellulosic fibers and a bonding system cured under heat and pressure, including hardboard | 0.0889 | Part 39 | |

| Aluminium | ||||

| 40 | Aluminium production from alumina | Tonnes of liquid aluminium | 1.58 | Part 40 |

| 41 | Production of baked anodes for use in aluminium production from alumina | Tonnes of baked anodes | 0.328 | Part 41 |

| 42 | Production of calcined petroleum coke for use in aluminium production from alumina | Tonnes of calcined petroleum coke | 0.486 | Part 42 |

| 43 | Production of alumina from bauxite | Tonnes of alumina (Al2O3 ) equivalent | Calculated in accordance with section 37 of these Regulations | Part 43 |

| Rubber Products | ||||

| 44 | Production of pneumatic tires, not including retreading and other forms of reconditioning | Tonnes of pneumatic tires | 0.225 | Part 44 |

51 Schedule 2 of the Regulations is amended by adding the following after section 3:

3.1 The global warming potential applicable for each GHG for the compliance period.

52 Section 8 of Schedule 2 of the Regulations is replaced by the following:

8 The output-based standard for each of the specified industrial activities engaged in at the covered facility.

8.1 If an output-based standard must be calculated for a specified industrial activity engaged in at the covered facility or recalculated under to section 39 of these Regulations, the following information in the annual report for the compliance period for which the standard is calculated,

- (a) the quantification, sampling, analysis and measurement methods and the data used to calculate that standard;

- (b) if a determination is made under subsection 37(2.1) of these Regulations, the methods for the projections and the projections bearing the stamp and signature of an engineer; and

- (c) the method used to attribute the quantity of GHGs to each specified industrial activity or to activities that are not specified industrial activities.

53 Schedule 3 to the Regulations is replaced by the Schedule 3 set out in the schedule to these Regulations.

54 The portion of paragraph 3(n) of Schedule 5 of the Regulations before subparagraph (i) is replaced by the following:

- (n) a verification opinion by the verification body containing

Environmental Violations Administrative Monetary Penalties Regulations

| Item | Column 1 Provision |

Column 2 Violation Type |

|---|---|---|

| 9.1 | 16(6.1)(a) | E |

| Item | Column 1 Provision |

Column 2 Violation Type |

|---|---|---|

| 13.2 | 22.1 | D |

| Item | Column 1 Provision |

Column 2 Violation Type |

|---|---|---|

| 14.1 | 31(2) | D |

| Item | Column 1 Provision |

Column 2 Violation Type |

|---|---|---|

| 16 | 36(1) | E |

| 16.1 | 36(2) | E |

| 16.2 | 36(3) | E |

| 16.3 | 36(4) | E |

| 16.4 | 36(5) | E |

| Item | Column 1 Provision |

Column 2 Violation Type |

|---|---|---|

| 26.11 | 45(4) | D |

Coming into Force

60 (1) Subject to subsections (2) and (3), these Regulations come into force on the day on which they are registered.

(2) Sections 5 and 6, subsections 2(5), 12(1), 14(1), 23(1) and 24(1), sections 25 and 26, subsection 45(1) and section 46 are deemed to have come into force on January 1, 2023 and apply from that date with respect to the 2023 compliance period and subsequent compliance periods.

(3) Section 1, subsections 2(1), (4), (7) and (9), section 11, subsection 12(2), section 13, subsections 14(2) and (3), sections 15 to 18, subsections 19(1), (2), (4) and (5), sections 20 to 22, subsections 23(2) and (3), 24(2), 28(1) and 29(2), sections 41 to 44, subsections 45(2) and (3), and sections 47 to 50, 53, 55 and 56 come into force on January 1, 2024 and apply with respect to the 2024 compliance period and subsequent compliance periods.

SCHEDULE

(Section 53)

SCHEDULE 3

(Paragraphs 17(2)(a) and (b), 20(2)(a), and 31(1)(a), subparagraph 31(1)(b)(i), subsection 32(1), paragraphs 34(1)(b) and (c) and Schedule 1)

Quantification Requirements

PART 1

Bitumen and Other Crude Oil Production

| Item | Column 1 Specified Emission Types |

Column 2 GHGs |

|---|---|---|

| 1 | Stationary fuel combustion emissions | CO2, CH4 and N2O |

| 2 | Flaring emissions | CO2, CH4 and N2O |

| 3 | Wastewater emissions from | |

| (a) anaerobic and aerobic wastewater treatment | CO2, CH4 and N2O | |

| (b) oil-water separators | CH4 | |

| 4 | On-site transportation emissions | CO2, CH4 and N2O |

PART 2

Bitumen and Heavy Oil Upgrading

| Item |

Column 1 Specified Emission Types |

Column 2 GHGs |

|---|---|---|

1 |

Stationary fuel combustion emissions |

CO2, CH4 and N2O |

2 |

Industrial process emissions from |

|

(a) hydrogen production |

CO2 |

|

(b) sulphur recovery |

CO2 |

|

(c) catalyst regeneration |

CO2, CH4 and N2O |

|

3 |

Flaring emissions |

CO2, CH4 and N2O |

4 |

Venting emissions from |

|

(a) process vents |

CO2 and N2O |

|

(b) uncontrolled blowdown |

CO2 and N2O |

|

5 |

Wastewater emissions from |

|

(a) anaerobic and aerobic wastewater treatment |

CO2, CH4 and N2O |

|

(b) oil-water separators |

CH4 |

|

6 |

On-site transportation emissions |

CO2, CH4 and N2O |

PART 3

Petroleum Refining

DIVISION 1

Quantification of Emissions

| Item | Column 1 Specified Emission Types |

Column 2 GHGs |

|---|---|---|

| 1 | Stationary fuel combustion emissions | CO2, CH4 and N2O |

| 2 | Venting emissions from | |

| (a) process vent | CO2, CH4 and N2O | |

| (b) asphalt production | CO2, and CH4 | |

| (c) delayed coking unit | CH4 | |

| 3 | Industrial process emissions from | |

| (a) hydrogen production | CO2 | |

| (b) catalyst regeneration | CO2, CH4 and N2O | |

| (c) sulphur recovery | CO2 | |

| (d) coke calcining | CO2, CH4 and N2O | |

| 4 | Flaring emissions | CO2, CH4 and N2O |

| 5 | Leakage emissions | CH4 |

| 6 | Wastewater emissions from | |

| (a) anaerobic and aerobic wastewater treatment | CO2, CH4 and N2O | |

| (b) oil-water separators | CH4 | |

| 7 | On-site transportation emissions | CO2, CH4 and N2O |

DIVISION 2

Quantification of Production

1 (1) Direct-only complexity weighted barrels (direct-only CWB) is quantified in accordance with the method outlined in section 2.5 of the directive entitled CAN-CWB Methodology for Regulatory Support: Public Report, published by Solomon Associates in January 2014.

(1.1) When quantifying the direct-only complexity weighted barrels, the emissions and energy use accounted for are those that are associated with the industrial activity set out in paragraph 3(a), column 1 of Schedule 1.

(2) In the method referred to in subsection (1),

- (a) the value of “Sales and Exports of Steam and Electricity” is equal to zero;

- (b) the value of “EC Reported CO2e Site Emissions” excludes

- (i) the emissions associated with electricity generated at the covered facility and used for the purpose of the industrial activity set out in paragraph 3(a), column 1 of Schedule 1, prorated based on the energy used for the refinery operation, and

- (ii) the emissions associated with steam generated at the covered facility but not used for the purpose of the industrial activity set out in paragraph 3(a), column 1 of Schedule 1;

- (c) the value of “Deemed Indirect CO2e Emissions from imported electricity”

- (i) includes emissions associated with electricity that is generated and used at the covered facility and used for the purpose of the industrial activity set out in paragraph 3(a), column 1 of Schedule 1, prorated based on the energy used for the refinery operation, and

- (ii) for purchased electricity, is calculated using 0.420 tonnes of CO2e per megawatt hours of electricity bought;

- (d) the value of “Deemed Indirect CO2e Emissions from imported steam” is equal to zero; and

- (e) the value of the “CWB factor” used to calculate hydrogen generation, in all cases, is 5.7.

PART 3.1

Surface mining of oil sands and extraction of bitumen

| Item | Column 1 Specified Emission Types |

Column 2 GHGs |

|---|---|---|

| 1 | Stationary fuel combustion emissions | CO2, CH4 and N2O |

| 2 | Flaring emissions | CO2, CH4 and N2O |

| 3 | Leakage emissions | CO2 and CH4 |

| 3 | Wastewater emissions from | |

| (a) anaerobic and aerobic wastewater treatment | CO2, CH4 and N2O | |

| (b) oil-water separators | CH4 | |

| 5 | On-site transportation emissions | CO2, CH4 and N2O |

PART 4

Natural Gas Processing

DIVISION 1

Quantification of Emissions

| Item | Column 1 Specified Emission Types |

Column 2 GHGs |

|---|---|---|

| 1 | Stationary fuel combustion emissions | CO2, CH4 and N2O |

| 2 | Industrial process emissions from acid gas removal | CO2 |

| 3 | Flaring emissions | CO2, CH4 and N2O |

| 4 | On-site transportation emissions | CO2, CH4 and N2O |

DIVISION 2

Quantification of Production

1 The combined quantity, in cubic metres, of propane and butane set out in paragraph 4(b), column 2, of the table to Schedule 1 is the sum of the quantity of propane, in cubic metres, at a temperature of 15°C and at an equilibrium pressure and the quantity of butane at a temperature of 15°C and at an equilibrium pressure, in cubic metres.

PART 5

Natural Gas Transmission

DIVISION 1

Quantification of Emissions

| Item | Column 1 Specified Emission Types |

Column 2 GHGs |

|---|---|---|

| 1 | Stationary fuel combustion emissions | CO2, CH4 and N2O |

| 2 | Flaring emissions | CO2, CH4 and N2O |

DIVISION 2

Quantification of Production

1 (1) Production by the covered facility, expressed in megawatt hours, is the sum of the amounts determined by the following formula for each of the drivers operated by the covered facility:

- Px × Lx× Hx

- where

- Px

- is the rated brake power of driver “x”, expressed in megawatts;

- Lx

- is the actual annual average percent load of driver “x”, or, if the actual annual average percent load is unavailable, the percentage determined by the formula:

- rpmavg /rpmmax

- where

- rpmavg

- is the actual annual average speed during operation of driver “x”, expressed in revolutions per minute, and

- rpmmax

- is the maximum rated speed of driver “x”, expressed in revolutions per minute;

- Hx

- is the number of hours during the compliance period that driver “x” was operated; and

(2) The following definitions apply in this section.

- driver

- means an electric motor, reciprocating engine or turbine used to drive a compressor. (conducteur)

- rated brake power

- means the maximum brake power of a driver as specified by its manufacturer either on its nameplate or otherwise. (puissance au frein nominale)

PART 6

Hydrogen Gas Production

| Item | Column 1 Specified Emission Types |

Column 2 GHGs |

|---|---|---|

| 1 | Stationary fuel combustion emissions | CO2, CH4 and N2O |

| 2 | Industrial process emissions | CO2 |

| 3 | Flaring emissions | CO2, CH4 and N2O |

| 4 | Leakage emissions | CH4 |

| 5 | On-site transportation emissions | CO2, CH4 and N2O |

PART 7

Cement and Clinker Production

DIVISION 1

Quantification of Emissions

| Item | Column 1 Specified Emission Types |

Column 2 GHGs |

|---|---|---|

| 1 | Stationary fuel combustion emissions | CO2, CH4 and N2O |

| 2 | Industrial process emissions | CO2 |

| 3 | On-site transportation emissions | CO2, CH4 and N2O |

DIVISION 2

Quantification of Production

1 The quantity of clinker set out in paragraph 7(a), column 2, of Schedule 1 refers only to clinker that is transported out of the facility.

2 The quantity of grey cement and white cement set out in paragraphs 7(b) and (c), column 2, of Schedule 1 refers only to cement produced from clinker that was produced at that facility and that has not been transported out of the facility.

PART 8

Lime Manufacturing

DIVISION 1

Quantification of Emissions

| Item | Column 1 Specified Emission Types |

Column 2 GHGs |

|---|---|---|

| 1 | Stationary fuel combustion emissions | CO2, CH4 and N2O |

| 2 | Industrial process emissions | CO2 |

| 3 | On-site transportation emissions | CO2, CH4 and N2O |

DIVISION 2

Quantification of Production

1 The quantity of dolomitic lime does not include the dolomitic lime used in the production of speciality lime.

PART 9

Glass Manufacturing

| Item | Column 1 Specified Emission Types |

Column 2 GHGs |

|---|---|---|

| 1 | Stationary fuel combustion emissions | CO2, CH4 and N2O |

| 2 | Industrial process emissions | CO2 |

| 3 | On-site transportation emissions | CO2, CH4 and N2O |

PART 10

Gypsum Product Manufacturing

| Item | Column 1 Specified Emission Types |

Column 2 GHGs |

|---|---|---|

| 1 | Stationary fuel combustion emissions | CO2, CH4 and N2O |

| 2 | On-site transportation emissions | CO2, CH4 and N2O |

PART 11

Mineral Wool Insulation Manufacturing

| Item | Column 1 Specified Emission Types |

Column 2 GHGs |

|---|---|---|

| 1 | Stationary fuel combustion emissions | CO2, CH4 and N2O |

| 2 | Industrial process emissions | CO2 |

| 3 | On-site transportation emissions | CO2, CH4 and N2O |

PART 12

Brick Production

| Item | Column 1 Specified Emission Types |

Column 2 GHGs |

|---|---|---|

| 1 | Stationary fuel combustion emissions | CO2, CH4 and N2O |

| 2 | Industrial process emissions | CO2 |

| 3 | On-site transportation emissions | CO2, CH4 and N2O |

PART 13

Ethanol Production

| Item | Column 1 Specified Emission Types |

Column 2 GHGs |

|---|---|---|

| 1 | Stationary fuel combustion emissions | CO2, CH4 and N2O |

| 2 | On-site transportation emissions | CO2, CH4 and N2O |

PART 14

Furnace Black Production