Volatile Organic Compound Concentration Limits for Certain Products Regulations: SOR/2021-268

Canada Gazette, Part II, Volume 156, Number 1

Registration

SOR/2021-268 December 21, 2021

CANADIAN ENVIRONMENTAL PROTECTION ACT, 1999

P.C. 2021-1026 December 17, 2021

Whereas, pursuant to subsection 332(1)footnote a of the Canadian Environmental Protection Act, 1999footnote b, the Minister of the Environment published in the Canada Gazette, Part I, on July 6, 2019, a copy of the proposed Volatile Organic Compound Concentration Limits for Certain Products Regulations, substantially in the annexed form, and persons were given an opportunity to file comments with respect to the proposed Regulations or to file a notice of objection requesting that a board of review be established and stating the reasons for the objection;

Whereas, pursuant to subsection 93(3) of that Act, the National Advisory Committee has been given an opportunity to provide its advice under section 6footnote c of that Act;

And whereas, in the opinion of the Governor in Council, pursuant to subsection 93(4) of that Act, the proposed Regulations do not regulate an aspect of a substance that is regulated by or under any other Act of Parliament in a manner that provides, in the opinion of the Governor in Council, sufficient protection to the environment and human health;

Therefore, Her Excellency the Governor General in Council, on the recommendation of the Minister of the Environment and the Minister of Health, pursuant to subsection 93(1) and sections 286.1footnote d and 326 of the Canadian Environmental Protection Act, 1999 footnote b, makes the annexed Volatile Organic Compound Concentration Limits for Certain Products Regulations.

Volatile Organic Compound Concentration Limits for Certain Products Regulations

Interpretation

Definitions

1 (1) The following definitions apply in these Regulations.

- adhesive

- does not include a product for use on humans or animals or any product with an adhesive incorporated onto or in an inert substrate. (adhésif)

- fragrance

- means a substance or mixture of chemicals, natural essential oils or other components, that has a combined vapour pressure that is less than or equal to 0.267 kPa when measured at 20°C, the sole purpose of which is to impart a scent or to mask an unpleasant odour. (parfum)

- high vapour pressure VOC,

- in respect of an antiperspirant or deodorant for the human axilla, means a VOC that has a vapour pressure of greater than 10.67 kPa when measured at 20°C. (COV à pression de vapeur élevée)

- low vapour pressure VOC,

- in respect of a product other than an antiperspirant or deodorant for the human axilla, means a VOC that

- (a) has a vapour pressure of less than 0.013 kPa when measured at 20°C;

- (b) has a boiling point that is greater than 216°C; or

- (c) contains more than 12 carbon atoms per molecule. (COV à faible pression de vapeur)

- medium vapour pressure VOC,

- in respect of an antiperspirant or deodorant for the human axilla, means a VOC that has a vapour pressure of greater than 0.267 kPa but less than or equal to 10.67 kPa when measured at 20°C. (COV à pression de vapeur moyenne)

- reformulated product

- means a product that belongs to a product category set out in column 1 of the table to Schedule 1 and that has been reformulated to reduce its VOC concentration to a level that is less than the maximum VOC concentration set out in column 3 for that product category or, if applicable, the subcategory set out in column 2 to which it belongs. (produit à composition modifiée)

- VOC

- means a volatile organic compound that participates in atmospheric photochemical reactions and that is not excluded under item 65 of Schedule 1 to the Canadian Environmental Protection Act, 1999. (COV)

VOC concentration

(2) For the purpose of these Regulations, the VOC concentration of a product is measured and expressed as a percentage of the product’s net weight (% w/w).

Net quantity

(3) For the purposes of these Regulations, the quantity of a product or the quantity of VOCs in a product is the net quantity.

Product category or subcategory

(4) For the purposes of these Regulations, a product belongs to a product category set out in column 1 of the table to Schedule 1 or column 1 of Schedule 2 or, if applicable, a subcategory set out in column 2 of the table to Schedule 1 if, according to information on its container or included in any documentation relating to the product that is supplied by the product’s manufacturer or importer or their authorized representative, the product may be used as a product that belongs to that product category or, if applicable, subcategory.

Design

(5) For the purposes of these Regulations, any reference to a product that is designed for a particular purpose includes a product that, according to information on its container or included in any documentation relating to the product that is supplied by the product’s manufacturer or importer or their authorized representative, may be used for that purpose.

Application

Products

2 (1) These Regulations apply in respect of any product that contains VOCs and belongs to a product category set out in column 1 of the table to Schedule 1 or column 1 of Schedule 2.

Non-application — certain products

(2) These Regulations do not apply in respect of products that are

- (a) designed to be used solely in a manufacturing or processing activity;

- (b) to be used solely in a laboratory for analysis, in scientific research or as a laboratory analytical standard;

- (c) regulated under the Pest Control Products Act;

- (d) manufactured or imported for export only;

- (e) adhesives that are to be sold in containers of 30 ml or less;

- (f) regulated under the Volatile Organic Compound (VOC) Concentration Limits for Architectural Coatings Regulations or the Volatile Organic Compound (VOC) Concentration Limits for Automotive Refinishing Products Regulations;

- (g) used in or on a new car at the time of its manufacture; or

- (h) in transit through Canada, from a place outside Canada to another place outside Canada.

Maximum VOC Concentrations and Maximum VOC Emission Potentials

Prohibition

3 (1) Subject to subsection (4), a person must not manufacture or import a product that belongs to a product category set out in column 1 of the table to Schedule 1 and, if applicable, a subcategory set out in column 2 that has a VOC concentration that is greater than the applicable maximum VOC concentration set out in column 3, unless

- (a) the product is, according to the instructions set out in both official languages on the product’s container or in any accompanying documentation, to be diluted before use to a level at which the VOC concentration is less than or equal to the applicable maximum VOC concentration set out in column 3; or

- (b) a permit has been issued under section 9, 16 or 19 in respect of the product.

Product categories set out in Schedule 2

(2) Subject to subsection (4), a person must not manufacture or import a product that belongs to a product category set out in column 1 of Schedule 2 and has a VOC emission potential that is greater than the applicable maximum VOC emission potential set out in column 2, unless a permit has been issued under section 19 in respect of the product.

Non-application of paragraph (1)(a)

(3) The exception set out in paragraph (1)(a) does not apply to a multi-purpose solvent or paint thinner referred to in items 48 and 52, respectively, of the table to Schedule 1.

Start date for prohibitions

(4) The prohibitions set out in subsections (1) and (2) apply beginning on

- (a) in the case of a disinfectant referred to in item 31 of the table to Schedule 1, January 1 of the year following the calendar year of the third anniversary of the day on which these Regulations are registered; or

- (b) in any other case, January 1 of the year following the calendar year of the second anniversary of the day on which these Regulations are registered.

Product belonging to more than one product category

4 (1) Subject to subsection (2), if a product belongs to more than one product category set out in column 1 of the table to Schedule 1, the applicable maximum VOC concentration is the lowest of the maximum VOC concentrations set out in column 3 for the product categories to which the product belongs.

Exception for certain categories

(2) The maximum VOC concentration for a product that belongs to one of the following product categories is the maximum VOC concentration set out in column 3 of the table to Schedule 1 for the applicable product category set out in column 1 or, if applicable, subcategory set out in column 2, regardless of whether the product also belongs to a product category with a lower maximum VOC concentration:

- (a) antiperspirant for the human axilla referred to in item 2 of the table to Schedule 1;

- (b) deodorant for the human axilla referred to in item 3 of that table;

- (c) hair products referred to in item 6 of that table; or

- (d) general-purpose cleaner referred to in item 42 of that table.

Determination of VOC concentration

5 (1) For the purposes of these Regulations and subject to subsections (2) and (3), the VOC concentration of a product that belongs to a product category set out in column 1 of the table to Schedule 1 is determined by the formula

- [(WS − WEX) ÷ WP] × 100

- where

- WS

- is the weight in grams of all of the substances contained in the product that volatize when the product is tested to determine its VOC concentration for the purposes of these Regulations;

- WEX

- is the weight in grams of all of the substances to be excluded when determining the VOC concentration, namely, any of the following substances contained in the product that volatize when the product is tested to determine its VOC concentration for the purposes of these Regulations:

- (a) water, ammonia and any other inorganic substances;

- (b) compounds that are excluded under item 65 of Schedule 1 to the Canadian Environmental Protection Act, 1999;

- (c) in the case of an antiperspirant or deodorant for the human axilla referred to in items 2 and 3, respectively, of the table to Schedule 1,

- (i) VOCs that have a vapour pressure of less than or equal to 0.267 kPa when measured at 20°C or, if the vapour pressure is unknown, that contain more than 10 carbon atoms per molecule,

- (ii) colourants and fragrances that, combined, constitute 2% or less of the product’s net weight, and

- (iii) ethanol;

- (d) in the case of a personal fragrance product referred to in item 11 of that table,

- (i) low vapour pressure VOCs, and

- (ii) fragrances;

- (e) in the case of a pressurized gas duster referred to in item 53 of that table, low vapour pressure VOCs; and

- (f) in the case of a product other than a product referred to in paragraph (c), (d) or (e),

- (i) low vapour pressure VOCs, and

- (ii) fragrances that, combined, constitute 2% or less of the product’s net weight; and

- WP

- is the net weight of the product, expressed in grams.

Aerosol products

(2) For the purposes of the descriptions WS and WEX, if the product in question belongs to a subcategory set out in column 2 of the table to Schedule 1 that includes aerosol products, the propellant and non-propellant fractions are determined separately then added together to give the total value for each of those elements.

Antiperspirants and deodorants

(3) If the product in question is an antiperspirant or deodorant for the human axilla referred to in items 2 and 3, respectively, of the table to Schedule 1, the VOC concentration is determined separately for medium vapour pressure VOCs and high vapour pressure VOCs.

Determination of VOC emission potential

6 When determining the VOC emission potential for the purposes of these Regulations, the following substances are excluded:

- (a) low vapour pressure VOCs; and

- (b) in the case of charcoal lighter products referred to in item 1 of Schedule 2, fragrances that, combined, constitute 2% or less of the product’s net weight.

VOC Compliance Unit Trading System

Participation

Purpose of compliance unit trading system

7 A person that manufactures or imports a product that belongs to a product category set out in column 1 of the table to Schedule 1 may elect to participate in a compliance unit trading system that allows participants to do one or more of the following:

- (a) generate compliance units in accordance with section 11 in respect of all of the reformulated products for which they have elected to participate in the compliance unit trading system;

- (b) transfer unused compliance units to another person in accordance with section 12; or

- (c) use compliance units that are generated by them or transferred to them to compensate for the excess quantity of VOCs determined in accordance with paragraph 13(d) in respect of a product.

Permit — participants in compliance unit trading system

8 (1) A person that elects to participate in the compliance unit trading system may apply for a permit authorizing them to manufacture or import a product that belongs to a product category set out in column 1 of the table to Schedule 1 and, if applicable, a subcategory set out in column 2 that has a VOC concentration greater than the applicable maximum VOC concentration set out in column 3.

Required information

(2) The application must be submitted to the Minister and must contain the following information:

- (a) the applicant’s name, civic and postal addresses, telephone number and, if any, fax number and email address;

- (b) the name, title, civic and postal addresses, telephone number and, if any, fax number and email address of their authorized representative, if applicable;

- (c) for each product in respect of which a permit is sought,

- (i) its common or generic name and its trade name, if any,

- (ii) the product category set out in column 1 of the table to Schedule 1 and, if applicable, the subcategory set out in column 2 to which it belongs, as well as the information used to categorize it,

- (iii) the VOC concentrations at which the applicant expects to manufacture or import the product,

- (iv) for each VOC concentration referred to in subparagraph (iii), the quantity of the product, expressed in kilograms, that the applicant expects to manufacture or import per calendar year, excluding any quantity that is manufactured or imported for export only, and

- (v) for each VOC concentration referred to in subparagraph (iii), the quantity of VOCs in the product that are in excess of the applicable maximum VOC concentration, determined by the formula

- (A − B) × W

- where

- A

- is the VOC concentration of the product,

- B

- is the maximum VOC concentration set out in column 3 of the table to Schedule 1 for the product category set out in column 1 or, if applicable, the subcategory set out in column 2 to which the product belongs, and

- W

- is the quantity of the product, expressed in kilograms, that the applicant expects to manufacture or import per calendar year, excluding the quantity that is to be manufactured or imported for export only; and

- (d) a plan indicating how the applicant intends to compensate for the excess quantity of VOCs determined in accordance with subparagraph (c)(v) for all of the products in respect of which a permit is sought by using compliance units generated by them or transferred to them in accordance with sections 11 and 12.

Clarifications

(3) The Minister may, on receiving the application, require any clarifications that are necessary for the application to be processed.

Notice of change to information

(4) The applicant must notify the Minister in writing of any change to the information provided under this section — other than that provided under subparagraph (2)(c)(iv) — within 30 days after the day on which the change occurs.

Issuance

9 (1) Subject to subsection (2), the Minister must issue the permit referred to in subsection 8(1) if the applicant has demonstrated how they will compensate for the excess quantity of VOCs determined in accordance with subparagraph 8(2)(c)(v).

Refusal

(2) The Minister must refuse to issue the permit if

- (a) the Minister has reasonable grounds to believe that the applicant has provided false or misleading information in support of their application; or

- (b) the information required under subsections 8(2) to (4) and the certification required under section 26 have not been provided or are insufficient to enable the Minister to process the application.

Revocation — grounds

10 (1) The Minister must revoke a permit issued under subsection 9(1) if

- (a) the permit holder has not submitted the annual report referred to in section 13 within the prescribed time limit;

- (b) the Minister has reasonable grounds to believe that the permit holder has not compensated for the excess quantity of VOCs determined in accordance with paragraph 13(d); or

- (c) the Minister has reasonable grounds to believe that the permit holder has provided false or misleading information.

Notice of revocation

(2) Before revoking a permit, the Minister must provide the permit holder with written reasons and an opportunity to make written representations concerning the revocation.

Generation, Use and Transfer of Compliance Units

Notice of participation

11 (1) A person that intends to generate compliance units in respect of a reformulated product that they manufacture or import must, no later than October 1 of the first year in which they elect to participate in the compliance unit trading system in respect of that product, submit a notice to the Minister that contains the following information:

- (a) the person’s name, civic and postal addresses, telephone number and, if any, fax number and email address;

- (b) the name, title, civic and postal addresses, telephone number and, if any, fax number and email address of their authorized representative, if applicable; and

- (c) respecting the product,

- (i) its common or generic name and its trade name, if any,

- (ii) the product category set out in column 1 of the table to Schedule 1 and, if applicable, the subcategory set out in column 2 to which it belongs, as well as the information used to categorize it,

- (iii) its lowest VOC concentration prior to reformulation, the date of reformulation and its VOC concentration after reformulation, and

- (iv) the quantity of the product, expressed in kilograms, that the person expects to manufacture or import during the period beginning on the day on which the notice is submitted and ending on December 31 of the same year, excluding the quantity that is to be manufactured or imported for export only.

Generation of compliance units

(2) A person that has submitted a notice under subsection (1) may generate compliance units, at a rate of one compliance unit per kilogram, for all of the reformulated products that they manufacture or import during a given calendar year. The number of kilograms is determined by the formula

- ∑ [(Bi − Ci) × Wi]

- where

- Bi

- is, for each reformulated product, the maximum VOC concentration set out in column 3 of the table to Schedule 1 for the product category set out in column 1 or, if applicable, the subcategory set out in column 2 to which the product belongs;

- Ci

- is, for each reformulated product, the product’s VOC concentration after reformulation; and

- Wi

- is, for each reformulated product, the quantity, expressed in kilograms, that was manufactured or imported during the year in question, excluding the quantity that was manufactured or imported for export only.

First year of participation

(3) For the first calendar year in which the person participates in the compliance unit trading system, the value of the element Wi in the formula set out in subsection (2) is the quantity of the reformulated product that was manufactured or imported during the period beginning on the day on which the notice referred to in subsection (1) was submitted or the day on which the product was reformulated, whichever is later, and ending on December 31 of that year.

Availability confirmed by Minister

(4) The Minister must provide the person with written confirmation of the number of compliance units that are available to them within 60 days after the day on which the person submits a report in accordance with section 14.

Valid for two years

(5) Compliance units whose availability is confirmed by the Minster are valid for two years beginning on January 1 of the year following the calendar year in which they are generated.

Transfer of compliance units

12 (1) A person that participates in the compliance unit trading system may transfer unused compliance units to another person if the compliance units are still valid and the Minister approves the transfer.

Application for approval of transfer

(2) The transferee and transferor must, at least 90 days before the day on which the compliance units expire, submit to the Minister a joint application for approval of the transfer, using the form provided by the Minister, that contains the following information:

- (a) the names of the transferee and transferor and their civic and postal addresses, telephone numbers and, if any, fax numbers and email addresses;

- (b) the number of compliance units to be transferred;

- (c) the year during which the compliance units were generated; and

- (d) the effective date of the transfer.

Approval by Minister

(3) The Minister must approve the transfer and inform the transferee and transferor of the approval in writing if the transferor has at least the number of unused compliance units as are proposed to be transferred to the transferee.

Use by transferee

(4) The transferee may use the compliance units during the calendar year in which they are transferred and, if there are any compliance units remaining and those compliance units are still valid in accordance with subsection 11(5), during the following calendar year.

Invalid transfer

(5) For greater certainty, if the transferor does not have at least the number of unused compliance units as are proposed to be transferred to the transferee, the transfer is invalid.

Annual Reports

Permit issued under subsection 9(1)

13 A person that holds a permit issued under subsection 9(1) must, no later than March 1 of each year, submit a report to the Minister that contains the following information in respect of the preceding calendar year:

- (a) the person’s name, civic and postal addresses, telephone number and, if any, fax number and email address;

- (b) the name, title, civic and postal addresses, telephone number and, if any, fax number and email address of their authorized representative, if applicable;

- (c) for each product that the person manufactured or imported under a permit issued under subsection 9(1) during the year in question,

- (i) its common or generic name and its trade name, if any,

- (ii) the permit number,

- (iii) the VOC concentrations at which the product was manufactured or imported, and

- (iv) for each VOC concentration referred to in subparagraph (iii), the quantity of the product, expressed in kilograms, that was manufactured or imported during the year in question, excluding the quantity that was manufactured or imported for export only;

- (d) for all of the products that the person manufactured or imported under a permit issued under subsection 9(1) during the year in question, the quantity of VOCs in the products that is in excess of the applicable maximum VOC concentration for those products, determined by the formula

- ∑ [(Ai − Bi) × Wi]

- where

- Ai

- is, for each product in respect of which a permit was issued that was manufactured or imported at a given VOC concentration, the product’s VOC concentration,

- Bi

- is, for each product in respect of which a permit was issued that was manufactured or imported at a given VOC concentration, the maximum VOC concentration set out in column 3 of the table to Schedule 1 for the product category set out in column 1 or, if applicable, the subcategory set out in column 2 to which the product belongs, and

- Wi

- is, for each product in respect of which a permit was issued that was manufactured or imported at a given VOC concentration, the quantity, expressed in kilograms, that was manufactured or imported during the year, excluding the quantity that is manufactured or imported for export only;

- (e) the values and data used in the calculation made in accordance with paragraph (d);

- (f) the number of compliance units that are being used to compensate for the excess quantity of VOCs determined in accordance with paragraph (d) and

- (i) a statement as to whether those compliance units were generated by the person or were transferred to them, and

- (ii) if the compliance units were transferred, the date of the transfer and the name of the transferor; and

- (g) confirmation of whether the person intends to continue manufacturing or importing products under a permit issued under subsection 9(1) during the calendar year following the year in question and, if so, the quantity of each product, expressed in kilograms, that they expect to manufacture or import during that calendar year, excluding any quantity to be manufactured or imported for export only, and the expected VOC concentration for each product.

Person that generates compliance units

14 A person that generates compliance units during a calendar year must, no later than March 1 of the following year, submit a report to the Minister that contains the following information:

- (a) the person’s name, civic and postal addresses, telephone number and, if any, fax number and email address;

- (b) the name, title, civic and postal addresses, telephone number and, if any, fax number and email address of their authorized representative, if applicable;

- (c) for each reformulated product for which they have elected to participate in the compliance unit trading system for the calendar year in question,

- (i) its common or generic name and its trade name, if any,

- (ii) the product category set out in column 1 of the table to Schedule 1 and, if applicable, the subcategory set out in column 2 to which it belongs, as well as the information used to categorize it,

- (iii) its VOC concentration after reformulation and the date of the reformulation, and

- (iv) the quantity of the product, expressed in kilograms, that the person manufactured or imported during the year in question, excluding the quantity that was manufactured or imported for export only;

- (d) the values and data used in the calculation made in accordance with subsection 11(2) for the calendar year in question and the result of that calculation; and

- (e) confirmation of whether the person intends to continue participating in the compliance unit trading system during the calendar year following the year in question and, if so, the quantity of each product, expressed in kilograms, that they expect to manufacture or import during that calendar year, excluding any quantity to be manufactured or imported for export only, and the expected VOC concentration for each product.

Permit — Products Whose Use Results in Lower VOC Emissions

Application

15 (1) A person may apply for a permit or a renewal of their permit, as the case may be, authorizing them to manufacture or import a product that belongs to a product category set out in column 1 of the table to Schedule 1 and, if applicable, a subcategory set out in column 2 that has a VOC concentration that is greater than the applicable maximum VOC concentration set out in column 3, but that, when used in accordance with the manufacturer’s written instructions, results in lower VOC emissions than those that would result from the use of another product that belongs to the same category and, if applicable, the same subcategory that has a VOC concentration that is less than or equal to that maximum VOC concentration.

Required information

(2) The application must be submitted to the Minister and must contain the following information:

- (a) the applicant’s name, civic and postal addresses, telephone number and, if any, fax number and email address;

- (b) the name, title, civic and postal addresses, telephone number and, if any, fax number and email address of their authorized representative, if applicable;

- (c) the product’s common or generic name and trade name, if any;

- (d) the product category set out in column 1 of the table to Schedule 1 and, if applicable, the subcategory set out in column 2 to which the product belongs, as well as the information used to categorize it;

- (e) the product’s VOC concentration;

- (f) the quantity of the product, expressed in kilograms, that the applicant expects to manufacture or import per calendar year, excluding any quantity that is manufactured or imported for export only;

- (g) in the case of an application for the renewal of a permit in respect of the product, the number of the existing permit; and

- (h) evidence that demonstrates that the use of the product in accordance with the manufacturer’s written instructions results in lower VOC emissions than those that would result from the use of another product that belongs to the same category and, if applicable, the same subcategory that has a VOC concentration that is less than or equal to the applicable maximum VOC concentration set out in column 3 of the table to Schedule 1.

Clarifications

(3) The Minister may, on receiving the application, require any clarifications that are necessary for the application to be processed.

Notice of change to information

(4) The applicant must notify the Minister in writing of any change to the information provided under this section — other than that provided under paragraph (2)(f) — within 30 days after the day on which the change occurs.

Issuance or renewal

16 (1) Subject to subsection (2), the Minister must issue or renew, as the case may be, a permit referred to in subsection 15(1) if the applicant has demonstrated that, even though the product’s VOC concentration is greater than the applicable maximum VOC concentration set out in column 3 of the table to Schedule 1, the use of the product, in accordance with the manufacturer’s written instructions, results in lower VOC emissions than those that would result from the use of another product that belongs to the same category and, if applicable, the same subcategory that has a VOC concentration that is less than or equal to that maximum VOC concentration.

Refusal

(2) The Minister must refuse to issue or renew the permit if

- (a) the Minister has reasonable grounds to believe that the applicant has provided false or misleading information in support of their application; or

- (b) the information required under subsections 15(2) to (4) and the certification required under section 26 have not been provided or are insufficient to enable the Minister to process the application.

Expiry

(3) The permit expires on the fourth anniversary of the day on which it is issued or renewed unless the permit holder submits an application for renewal at least 90 days before the day on which the permit expires and the application is approved by the Minister.

Revocation — grounds

17 (1) The Minister must revoke a permit issued or renewed under subsection 16(1) in respect of a product if

- (a) the Minister has reasonable grounds to believe that the use of the product, in accordance with the manufacturer’s written instructions, no longer results in lower VOC emissions than those that would result from the use of another product that belongs to the same category and, if applicable, the same subcategory that has a VOC concentration that is less than or equal to the applicable maximum VOC concentration set out in column 3 of the table to Schedule 1;

- (b) the Minister has reasonable grounds to believe that the permit holder has provided false or misleading information; or

- (c) the product does not bear a label, or is not accompanied by documentation, that sets out the instructions referred to in section 23.

Notice of revocation

(2) Before revoking a permit, the Minister must provide the permit holder with written reasons and an opportunity to make written representations concerning the revocation.

Permit — Technical or Economic Non-feasibility

Application

18 (1) A person that intends to, on or after the applicable date referred to in subsection 3(4) or the day on which their permit expires, as the case may be, manufacture or import a product that belongs to a product category set out in column 1 of the table to Schedule 1 or column 1 of Schedule 2 that has a VOC concentration or VOC emission potential that is greater than the applicable maximum VOC concentration set out in column 3 of the table to Schedule 1 or the applicable maximum VOC emission potential set out in column 2 of Schedule 2, as the case may be, may apply for a permit, or for a renewal of their permit, authorizing them to manufacture or import that product on or after the applicable date if it is not technically or economically feasible for them to, by that date, reduce the product’s VOC concentration or VOC emission potential, as the case may be, to a level that is less than or equal to that maximum VOC concentration or maximum VOC emission potential.

Required information

(2) The application must be submitted to the Minister before the applicable date referred to in subsection 3(4) or the day on which the permit expires, as the case may be, and must contain the following information:

- (a) the applicant’s name, civic and postal addresses, telephone number and, if any, fax number and email address;

- (b) the name, title, civic and postal addresses, telephone number and, if any, fax number and email address of their authorized representative, if applicable;

- (c) the product’s common or generic name and trade name, if any;

- (d) the product category set out in column 1 of the table to Schedule 1 or column 1 of Schedule 2 and, if applicable, the subcategory set out in column 2 of the table to Schedule 1 to which the product belongs, as well as the information used to determine its classification;

- (e) the product’s VOC concentration or, in the case of a product that belongs to a product category set out in column 1 of Schedule 2, its VOC emission potential;

- (f) the quantity of the product that the applicant expects to manufacture or import per calendar year, excluding any quantity that is manufactured or imported for export only;

- (g) in the case of an application for the renewal of a permit in respect of the product, the number of the existing permit;

- (h) the requested validity period for the permit, up to a maximum of two years;

- (i) evidence that demonstrates that it will not be technically or economically feasible for the applicant to, by the applicable date referred to in subsection 3(4) or the day on which their permit is to expire, as the case may be, reduce the product’s VOC concentration or VOC emission potential, as the case may be, to a level that is less than or equal to the applicable maximum VOC concentration set out in column 3 of the table to Schedule 1 or the applicable maximum VOC emission potential set out in column 2 of Schedule 2, as the case may be;

- (j) a plan describing the measures that will be taken to reduce the product’s VOC concentration or VOC emission potential, as the case may be, to a level that is less than or equal to the applicable maximum VOC concentration set out in column 3 of the table to Schedule 1 or the applicable maximum VOC emission potential set out in column 2 of Schedule 2, as the case may be; and

- (k) a statement of the period within which the plan is to be implemented, up to a maximum of two years.

Clarifications

(3) The Minister may, on receiving the application, require any clarifications that are necessary for the application to be processed.

Notice of change to information

(4) The applicant must notify the Minister in writing of any change to the information provided under this section — other than that provided under paragraph (2)(f) — within 30 days after the day on which the change occurs.

Issuance or renewal

19 (1) Subject to subsection (2), the Minister must issue or renew a permit referred to in subsection 18(1) if the applicant has demonstrated that it will not be technically or economically feasible for them to, by the applicable date referred to in subsection 3(4) or the day on which their permit is to expire, as the case may be, reduce the product’s VOC concentration or VOC emission potential, as the case may be, to a level that is less than or equal to the applicable maximum VOC concentration set out in column 3 of the table to Schedule 1 or the applicable maximum VOC emission potential set out in column 2 of Schedule 2, as the case may be.

Refusal

(2) The Minister must refuse to issue or renew a permit if

- (a) the Minister has reasonable grounds to believe that the applicant has provided false or misleading information in support of their application; or

- (b) the information required under subsections 18(2) to (4) and the certification required under section 26 have not been provided or are insufficient to enable the Minister to process the application.

Expiry

(3) The permit expires on the second anniversary of the day on which the permit becomes effective or on an earlier date specified in the permit unless the permit holder submits an application for renewal at least 90 days before the day on which the permit expires and the application is approved by the Minister. The renewed permit expires on the second anniversary of the day on which the renewal becomes effective or on an earlier date specified in the renewed permit.

Application for renewal

(4) An application for renewal may be made only once.

Explanation of reasons

(5) An application for renewal must include an explanation of the reasons why the plan that was submitted in the initial permit application was not implemented within the period identified in that initial application.

Revocation — grounds

20 (1) The Minister must revoke a permit issued or renewed under subsection 19(1) if the Minister has reasonable grounds to believe that the permit holder has provided false or misleading information.

Notice of revocation

(2) Before revoking a permit, the Minister must provide the permit holder with written reasons and an opportunity to make written representations concerning the revocation.

Accredited Laboratory

Accredited laboratory

21 (1) Any analysis performed to determine the VOC concentration or VOC emission potential of a product for the purposes of these Regulations must be performed by a laboratory that meets the following conditions at the time of the analysis:

- (a) it is accredited

- (i) under the International Organization for Standardization standard ISO/IEC 17025, entitled General requirements for the competence of testing and calibration laboratories, by an accrediting body that is a signatory to the International Laboratory Accreditation Cooperation Mutual Recognition Arrangement, or

- (ii) under the Environment Quality Act, CQLR, c. Q-2; and

- (b) subject to subsection (2), the scope of its accreditation includes the analysis performed to determine the VOC concentration or VOC emission potential of a product.

Standards of good practice

(2) If no method has been recognized by a standards development organization in respect of the analysis performed to determine the VOC concentration or VOC emission potential of a product and the scope of the laboratory’s accreditation does not therefore include that analysis, the analysis must be performed in accordance with standards of good scientific practice that are generally accepted at the time that it is performed.

Labelling

Date of manufacture

22 (1) Beginning on the applicable date referred to in subsection 3(4), any person that manufactures or imports a product that belongs to a product category set out in column 1 of the table to Schedule 1 or in column 1 of Schedule 2 must indicate, on the container in which the product is offered for sale or sold, the date on which the product was manufactured or a code representing that date. If a code is used, the person must provide the Minister, on request, with an explanation of the code.

Exemptions

(2) Subsection (1) does not apply to

- (a) a personal fragrance product referred to in item 11 of the table to Schedule 1 that is in a container of 2 ml or less; or

- (b) any product that belongs to a product category set out in column 1 of that table and has a VOC concentration less than or equal to 0.10% w/w.

Instructions for use

23 Beginning on the applicable date referred to in subsection 3(4), if a product is authorized to be manufactured or imported by a permit issued under subsection 16(1), the manufacturer or importer must ensure that, before the product is offered for sale or sold, it bears a label, or is accompanied by documentation, that sets out instructions in both official languages for the use of the product in a manner that results in lower VOC emissions than those that would result from the use of another product that belongs to the same category and, if applicable, the same subcategory that has a VOC concentration that is less than or equal to the applicable maximum VOC concentration set out in column 3 of the table to Schedule 1.

Record-Keeping

Records to be maintained

24 (1) Beginning on the applicable date referred to in subsection 3(4), any person that manufactures or imports a product that contains VOCs and belongs to a product category set out in column 1 of the table to Schedule 1 or column 1 of Schedule 2 must maintain records containing the following information and any supporting documents:

- (a) in the case of a manufacturer,

- (i) the product’s common or generic name and trademark and trade name, if any, and

- (ii) the quantity of the product that is manufactured at each manufacturing plant and the date of its manufacture; and

- (b) in the case of an importer,

- (i) the product’s common or generic name and trademark and trade name, if any,

- (ii) the quantity of the product that is imported and the date of its importation,

- (iii) the name, civic and postal addresses, telephone number and, if any, fax number and email address of the principal place of business of the product’s sender,

- (iv) the Harmonized Commodity Description and Coding System number for the product, as set out in the Customs Tariff, and

- (v) the business number assigned to the importer by the Minister of National Revenue.

Records — information submitted to Minister

(2) Any person that submits information to the Minister under these Regulations must maintain records containing that information and a copy of any supporting documents.

Five years

(3) The records must be kept for a period of at least five years after

- (a) the day on which they are made, in the case of the records referred to in subsection (1); and

- (b) the day on which the information referred to in subsection (2) is submitted to the Minister, in the case of the records referred to in that subsection.

Location of records

25 (1) The records referred to in section 24 must be kept at the person’s principal place of business in Canada or at any other place in Canada where they can be inspected. If the records are not kept at the person’s principal place of business, the person must provide the Minister with the civic address of the place where they are kept.

Change of address

(2) If the civic address referred to in subsection (1) changes, the person must notify the Minister in writing within 30 days after the day on which the change occurs.

Submission Requirements

Certification

26 Any information that is submitted under these Regulations must be accompanied by a certification, dated and signed by the person submitting the information or by their authorized representative, stating that the information is accurate and complete.

Electronic or paper format

27 (1) Any document that is submitted under these Regulations may be submitted in paper format or in an electronic format that is compatible with the format that is used by the Minister.

Electronic signature

(2) If the document is submitted in electronic format, the document may be signed electronically.

Related Amendment to the Regulations Designating Regulatory Provisions for Purposes of Enforcement (Canadian Environmental Protection Act, 1999)

| Item | Column 1 Regulations |

Column 2 Provisions |

|---|---|---|

| 34 | Volatile Organic Compound Concentration Limits for Certain Products Regulations | (a) subsections 3(1) and (2) |

Coming into Force

January 1 following first anniversary of registration

29 These Regulations come into force on January 1 of the year following the calendar year of the first anniversary of the day on which they are registered.

SCHEDULE 1

(Subsections 1(1) and (4), 2(1) and 3(1) and (3), paragraph 3(4)(a), sections 4, 5 and 7, subsection 8(1), subparagraphs 8(2)(c)(ii) and (v) and 11(1)(c)(ii), subsection 11(2), paragraph 13(d), subparagraph 14(c)(ii), subsection 15(1), paragraphs 15(2)(d) and (h), subsection 16(1), paragraph 17(1)(a), subsection 18(1), paragraphs 18(2)(d), (i) and (j), subsection 19(1), sections 22 and 23 and subsection 24(1))

Product Categories and VOC Concentration Limits

Definitions

1 The following definitions apply in this Schedule.

- cleaner or duster for energized equipment

- means a product that is designed to clean or dust equipment while there is an electrical current in the equipment or while there is a residual electrical potential from a component such as a capacitor. (nettoyant ou dépoussiéreur d’équipements sous tension)

- contact adhesive

- means non-aerosol adhesive – other than rubber cement that is designed for use on paper substrates and vulcanizing fluid that is designed solely for tire repair — that

- (a) is designed for application to surfaces to be bonded together;

- (b) is to dry before the surfaces are placed in contact with each other;

- (c) forms an immediate bond that makes it difficult or impossible to reposition the adhesive-coated surfaces after they are placed in contact with each other; and

- (d) does not require sustained pressure or the clamping of surfaces to establish an adherence between the surfaces after the adhesive-coated surfaces have been brought together using momentary pressure. (adhésif de contact)

Aerosol

2 For greater certainty, in this Schedule, a reference to “aerosol” does not include pump sprays.

Overview

3 The table to this Schedule sets out VOC concentration limits for each product category or, if applicable, subcategory.

| Item | Column 1 Product Category |

Column 2 Subcategory |

Column 3 Maximum VOC Concentration (% w/w) |

|---|---|---|---|

| Personal Care Products | |||

| 1 | Astringent, toner or clarifier, including astringent, toner or clarifier products that are impregnated in a substrate but excluding any product that is regulated as a drug under the Food and Drugs Act | 35 | |

| 2 | Antiperspirant for the human axilla | (i) aerosol, |

|

| (ii) non-aerosol | 0 | ||

| 3 | Deodorant for the human axilla | (i) aerosol, |

|

| (ii) non-aerosol | 0 | ||

| 4 | Heavy-duty hand cleaner or soap, excluding any product that is

|

(i) non-aerosol, | 1 |

| (ii) all other forms | 8 | ||

| 5 | Hairstyling mousse designed to facilitate styling or provide limited holding power | 6 | |

| 6 | Hair products that are designed for the primary purpose of creating a shine when applied to the hair, excluding any product whose primary purpose is to condition or hold the hair | 55 | |

| 7 | Hairspray that is designed to hold or finish styled hair, excluding any product that aids in styling without holding the hair | 55 | |

| 8 | Temporary hair-colour products that are designed to add colour, glitter or UV-active pigment to hair, wigs or fur or to cover thinning or balding areas | aerosol | 55 |

| 9 | Any hairstyling product other than those referred to in items 5 to 8 | (i) aerosol or pump spray, | 6 |

| (ii) all other forms | 2 | ||

| 10 | Nail polish remover | 1 | |

| 11 | Personal fragrance products, excluding any product that is

|

(i) product containing fragrance less than or equal to 20% based on net weight, | 75 |

| (ii) product containing fragrance greater than or equal to 20% based on net weight | 65 | ||

| 12 | Shaving cream or foam | aerosol | 5 |

| 13 | Shaving gel | aerosol | 4 |

| Maintenance Products | |||

| 14 | Automotive brake cleaner | 10 | |

| 15 | Automotive rubbing or polishing compound that is designed to remove oxides, old paint, scratches, swirl marks or other defects from the painted surfaces of motor vehicles without leaving a protective barrier | 17 | |

| 16 | Automotive wax, polish, sealant or glaze that is designed to enhance the painted surfaces of motor vehicles, seal out moisture from those surfaces or increase their gloss, excluding any product that is

|

(i) hard paste wax that does not contain water, | 45 |

| (ii) instant detailer that is in pump-spray format and is to be wiped off before the product dries, | 3 | ||

| (iii) all other forms | 15 | ||

| 17 | Cleaners for carburetors, chokes, associated linkages or fuel-injection air intakes, including throttle bodies, excluding any product that is

|

10 | |

| 18 | Automotive wash, excluding any product that is designed exclusively for use on locomotives or aircraft | non-aerosol | 0.2 |

| 19 | Products designed to remove the following from the painted surfaces of motor vehicles:

|

40 | |

| 20 | Undercoating products that provide a protective, non-paint layer to the undercarriage, trunk interior or firewall of motor vehicles to prevent the formation of rust or deaden sound, including rubberized, mastic and asphaltic products | aerosol | 40 |

| 21 | Windshield water repellent | 75 | |

| 22 | Tire or wheel cleaner, excluding any product that is designed solely for use on locomotives or aircraft | (i) aerosol, | 8 |

| (ii) non-aerosol | 2 | ||

| 23 | Pressurized tire sealant and inflator | 20 | |

| 24 | Rubber or vinyl protectant, excluding any product that is

|

(i) aerosol, | 10 |

| (ii) non-aerosol | 3 | ||

| 25 | Engine degreaser that is designed to remove grease, oil or other contaminants from the external surfaces of engines or other mechanical parts | (i) aerosol, | 10 |

| (ii) non-aerosol | 5 | ||

| 26 | Lubricants, excluding any product that is

|

(i) multi-purpose lubricants that are not solid or semi-solid, | 25 |

| (ii) silicone-based multi-purpose lubricants that are not solid or semi-solid, | 60 | ||

| (iii) penetrating lubricants designed primarily for loosening metal parts that have bonded together, | 25 | ||

| (iv) aerosol anti-seize lubricant, | 40 | ||

| (v) non-aerosol anti-seize lubricant, | 3 | ||

| (vi) aerosol cutting or tapping oil, | 25 | ||

| (vii) non-aerosol cutting or tapping oil, | 3 | ||

| (viii) aerosol gear, chain or wire lubricant, excluding lubricant designed solely for use on chains of chain-driven vehicles, | 25 | ||

| (ix) non-aerosol gear, chain or wire lubricant, excluding lubricant designed solely for use on chains of chain-driven vehicles, | 3 | ||

| (x) aerosol rust-preventative or rust-control lubricant, | 25 | ||

| (xi) non-aerosol rust-preventative or rust-control lubricant | 3 | ||

| 27 | Metal polish or cleanser, excluding any product that is

|

(i) aerosol, | 15 |

| (ii) non-aerosol | 3 | ||

| 28 | Air freshener, including air fresheners with disinfecting properties but excluding any product that

|

(i) single-phase aerosol, | 30 |

| (ii) double-phase aerosol, | 20 | ||

| (iii) liquid or pump spray, | 18 | ||

| (iv) solid or semi-solid, | 3 | ||

| (v) aerosol that is designed for use as a disinfectant and air freshener | 60 | ||

| 29 | Bathroom or tile cleaner | (i) aerosol, | 7 |

| (ii) non-aerosol | 1 | ||

| 30 | Carpet or upholstery cleaner, excluding any product that is

|

(i) aerosol, | 5 |

| (ii) non-aerosol | 1 | ||

| 31 | Disinfectant, excluding any product that

|

(i) aerosol, | 70 |

| (ii) non-aerosol | 1 | ||

| 32 | Dusting aids designed to remove dust or other dirt from any surface without leaving a wax or silicone-based coating | (i) aerosol, | 17 |

| (ii) non-aerosol | 3 | ||

| 33 | Electrical-equipment cleaner that is designed to remove heavy dirt (such as grease or oil) from electrical equipment (such as an electric motor, armature, relay, electric panel or generator), excluding any product that is

|

45 | |

| 34 | Electronics cleaner that is designed to remove dirt, dust, moisture, flux or oxides from the internal components of electronic or precision equipment (such as circuit boards) or the internal components of electronic devices (such as radios, compact disc players, digital video disc players or computers), excluding any product that is

|

75 | |

| 35 | Fabric refresher that is designed to neutralize or eliminate odours on soft surfaces (such as fabric, rugs, carpeting, footwear or athletic equipment), excluding any product that is designed for use on both fabric and human skin | (i) aerosol, | 15 |

| (ii) non-aerosol | 6 | ||

| 36 | Fabric protector that is designed to protect against soiling or reduce the absorption of liquid, excluding any product that is

|

(i) aerosol, | 60 |

| (ii) non-aerosol | 1 | ||

| 37 | Floor polish or wax that is designed for polishing, waxing, conditioning, protecting, temporarily sealing or otherwise enhancing floor surfaces by leaving a temporary protective finish | (i) product designed for use on flexible flooring, | 1 |

| (ii) product designed for use on non-flexible flooring, | 1 | ||

| (iii) product designed solely for use on wood flooring, excluding any product that cleans and waxes or cleans and polishes | 70 | ||

| 38 | Floor maintenance products that are designed to maintain, restore or enhance a previously applied floor finish, excluding any product that is

|

1 | |

| 39 | Floor wax stripper, excluding any product that is designed to remove wax or polish solely by abrasion | (i) non-aerosol products that are designed to remove a light or medium buildup of polish or wax, | 3 |

| (ii) non-aerosol products that are designed to remove a heavy buildup of polish or wax | 12 | ||

| 40 | Footwear or leather care products that are designed to clean or protect footwear or leather articles or maintain, enhance or modify their appearance, durability, fit or flexibility, excluding any product that is

|

(i) aerosol, | 75 |

| (ii) solid, | 55 | ||

| (iii) all other forms | 15 | ||

| 41 | Furniture maintenance products that are designed for polishing, protecting or enhancing finished surfaces, excluding any product that is designed solely for the purpose of cleaning or to leave a permanent finish (such as stains, sanding sealers or lacquers) | (i) aerosol, | 12 |

| (ii) non-aerosol, except one that is in solid or paste form | 3 | ||

| 42 | General-purpose hard-surface cleaner | (i) aerosol, | 8 |

| (ii) non-aerosol | 0.5 | ||

| 43 | General-purpose degreaser, excluding any product that is designed for use solely in solvent cleaning tanks or related equipment | (i) aerosol, | 10 |

| (ii) non-aerosol | 0.5 | ||

| 44 | Glass cleaner, excluding any product that is designed solely for the purpose of cleaning eyeglasses or cleaning lenses used in photographic equipment, scientific instruments or photocopiers | (i) aerosol, | 10 |

| (ii) non-aerosol | 3 | ||

| 45 | Graffiti remover | (i) aerosol, | 50 |

| (ii) non-aerosol | 30 | ||

| 46 | Laundry pre-wash that is designed to enhance the effectiveness of laundry detergents during wet-cleaning | (i) aerosol or solid, | 22 |

| (ii) all other forms | 5 | ||

| 47 | Laundry starch or sizing or finishing products | 4.5 | |

| 48 | Multi-purpose solvent that is designed to disperse, dissolve or remove contaminants or other organic materials, excluding any product that is designed

|

(i) aerosol, | 30 |

| (ii) non-aerosol | 30 | ||

| 49 | Hard-surface anti-odour product | (i) aerosol, | 25 |

| (ii) non-aerosol | 6 | ||

| 50 | Oven or grill cleaner that is designed to remove grease or deposits from food-preparation or food-cooking surfaces | (i) aerosol or pump spray, | 8 |

| (ii) non-aerosol | 4 | ||

| 51 | Paint or coating remover or stripper, excluding any product that is a paintbrush cleaner or hand cleaner | 50 | |

| 52 | Thinner or viscosity reducer for paints, lacquers or other coatings, excluding any product that is

|

(i) aerosol, | 30 |

| (ii) non-aerosol | 30 | ||

| 53 | Pressurized-gas duster, excluding any product that is

|

1 | |

| 54 | Spot remover | (i) aerosol, | 15 |

| (ii) non-aerosol | 3 | ||

| 55 | Toilet or urinal cleaning or deodorizing products | (i) aerosol, | 10 |

| (ii) non-aerosol | 3 | ||

| 56 | Wood cleaner, excluding any product that is designed solely for preserving or colouring wood | (i) aerosol, | 17 |

| (ii) non-aerosol | 4 | ||

| Adhesives, Adhesive Removers, Sealants and Caulks | |||

| 57 | Acoustical sealant | 10 | |

| 58 | Structural waterproof adhesive | 7 | |

| 59 | Non-aerosol adhesive | (i) special-purpose contact adhesive that | |

(A) is packaged in a quantity of more than 236 ml but less than 3.785 l and is designed for use in bonding the following to any surface:

|

80 | ||

(B) is designed for use in the following automotive applications:

|

80 | ||

| (ii) general-purpose contact adhesive that is packaged in a quantity of less than 3.785 l, | 55 | ||

(iii) single-component construction, panel or floor-covering adhesive — other than floor-seam sealers that are designed for use on installed flexible sheet flooring — that is packaged in a quantity of less than or equal to 475 ml or less than or equal to 454 g and that is designed for use on

|

7 | ||

| (iv) general-purpose adhesive that is packaged in a quantity of less than or equal to 475 ml or less than or equal to 454 g | 10 | ||

| 60 | Aerosol adhesive with a spray mechanism that is permanently housed in a non-refillable can that is designed for hand-held application without the need for any other hose or spray equipment | (i) the following special-purpose spray adhesives: | |

| (A) mounting adhesive designed for permanently affixing photographs, artwork or any other drawn or printed media to a backing (such as paper, board or cloth), | 70 | ||

| (B) adhesive for flexible vinyl that has at least 5% by weight of plasticizer content, | 70 | ||

| (C) adhesive that is designed for use in automotive engine compartments and that, at temperatures of 93°C to 135°C, provides resistance to oil and plasticizer and has high shear strength, | 70 | ||

| (D) polystyrene foam adhesive, | 65 | ||

| (E) automotive headliner adhesive, | 65 | ||

| (F) polyolefin adhesive, | 60 | ||

(G) laminate-repair or edge-banding adhesive designed for

|

60 | ||

| (ii) mist or particle spray adhesive, | 65 | ||

| (iii) web spray adhesives other than those referred to in subparagraph (i) or (ii) | 55 | ||

| 61 | Adhesive remover | (i) floor or wall covering adhesive remover, | 5 |

| (ii) gasket or thread-locking adhesive remover, including products designed for use as both a paint stripper and gasket or thread-locking adhesive remover, | 50 | ||

| (iii) specialty adhesive remover that is designed to remove reactive adhesives (such as epoxies, urethanes or silicones) that require a hardener or catalyst for the bond to occur, | 70 | ||

| (iv) general-purpose adhesive remover | 20 | ||

| 62 | Sealant or caulking compound that is packaged in a quantity of less than or equal to 475 ml or less than or equal to 454 g and that is designed to fill, seal, waterproof or weatherproof gaps or joints between two surfaces, excluding any product that is

|

4 | |

| Miscellaneous Products | |||

| 63 | Anti-static product | (i) aerosol, | 80 |

| (ii) non-aerosol | 11 | ||

| 64 | Non-stick aerosol cooking spray | 18 | |

SCHEDULE 2

(Subsections 1(4), 2(1) and 3(2), paragraph 6(b), subsection 18(1), paragraphs 18(2)(d), (e), (i) and (j) and subsections 19(1), 22(1) and 24(1))

| Item | Column 1 Product Category |

Column 2 Maximum VOC Emission Potential |

|---|---|---|

| 1 | Charcoal lighter products that are incorporated in or designed for use with charcoal to enhance ignition, excluding any product that is

|

9 g per ignition, when used in accordance with the manufacturer’s instructions |

| 2 | Single-use dryer products that are designed to impart softness to, or control the static cling of, fabric | 0.05 g per load, when used in accordance with the manufacturer’s instructions |

REGULATORY IMPACT ANALYSIS STATEMENT

(This statement is not part of the Regulations.)

Executive summary

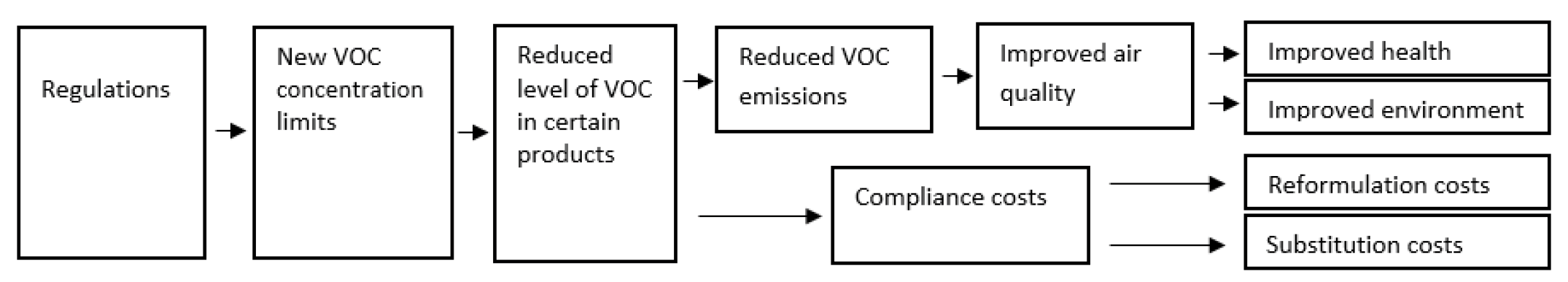

Issues: Volatile Organic Compounds (VOCs) are precursors in the formation of ground-level ozone and particulate matter, two main components of smog. Currently, Canada does not have regulations in place to limit VOC emissions from certain product categories and meet its commitments under the Ozone Annex to the Canada-United States Air Quality Agreement. The existing voluntary guidelines recommending VOC concentration limits for consumer product categories have not been sufficient in meeting these objectives. A technical study commissioned by the Department of the Environment in 2014 found that VOC concentrations for some product categories are still above the voluntary limits. Currently, an estimated 50 kilotonnes of VOCs continue to be emitted annually from products used by consumers and in institutional, industrial and commercial applications.

Description: The Volatile Organic Compound Concentration Limits for Certain Products Regulations (the Regulations) will apply to Canadian manufacturers and importers and will establish VOC concentration limits for approximately 130 product categories and subcategories. This will include personal care products; automotive and household maintenance products; adhesives; adhesive removers; sealants and caulks; and other miscellaneous products.

Rationale: The Regulations will achieve VOC emission reductions and help Canada meet its national and international commitments. The reductions of VOC emissions are expected to lead to improvements in air quality. Between 2024 and 2033, the Regulations are expected to result in 250 kilotonnes of VOC emission reductions. The benefits of the proposed Regulations are expected to be approximately $886 million over the time frame of analysis, with total costs incurred by industry and government expected to be around $235 million between 2022 and 2033. The net benefits of the Regulations are estimated to be approximately $651 million.

Issues

Volatile Organic Compounds (VOCs) are precursors in the formation of ground-level ozone and particulate matter (PM2.5), two main components of smog. Exposure to smog is linked to adverse health impacts, including increased risk of premature death, chronic and short-term respiratory and cardiac problems, as well as negative environmental effects on vegetation, buildings and visibility. Currently, Canada does not have regulations in place to limit VOC emissions from certain product categories and meet its commitments under the Ozone Annex to the Canada-United States Air Quality Agreement. The existing voluntary guidelines recommending VOC concentration limits for consumer product categories have not been sufficient in meeting these objectives. A technical study commissioned by the Department of the Environment (the Department) in 2014 found that VOC concentrations for many product categories are still above the voluntary limits. The study indicated that an estimated 50 kilotonnes of VOCs continue to be emitted annually from certain products used by consumers and in institutional, industrial and commercial applications.

Background

VOCs are a large group of organic chemicals that can be emitted from different natural and anthropogenic sources. VOCs are released from a diverse range of products including paints, varnishes, cosmetics, as well as cleaning, disinfecting and degreasing products. In 2003, VOCs were added to the List of Toxic Substances (Schedule 1) under the Canadian Environmental Protection Act, 1999 (CEPA) due to their role as precursors in the formation of ground-level ozone and particulate matter, two main components of smog.

Adverse health and environmental effects are experienced across Canada due to smog. Health impacts include thousands of premature deaths each year, as well as increased hospital visits, doctor visits, and lost days at work and school. Scientific evidence also suggests that smog can have harmful environmental impacts such as reductions in agricultural crop and commercial forest yields.footnote 2

National and international commitments to address VOC emissions

In 1991, the United States-Canada Air Quality Agreement was established by both countries to address transboundary air pollution leading to acid rain. In 2000, the Ozone Annex was added to the Agreement with the long-term goal of establishing ozone air quality standards in both countries by reducing emissions of nitrogen oxides and VOCs from products.

On March 27, 2004, the Department and the Department of Health published Canada’s Federal Agenda on the Reduction of Emissions of Volatile Organic Compounds from Consumer and Commercial Products (PDF). The agenda outlined a series of measures that were developed between 2004 and 2010 to protect the health of Canadians and the environment by reducing VOC emissions from products. An update to the agenda was released for public comment in March 2021.footnote 3

One of these measures included the release of the Regulatory Framework for Air Emissions (PDF) in April 2007, which outlined further commitments and actions to reduce VOC emissions in Canada. Key components of this framework included developing regulations to limit VOC concentrations in automotive refinishing products, architectural coatings and certain products. It also aimed to align VOC concentration limits, where applicable, with similar requirements in the United States.

In November 2017, Canada ratified the Gothenburg Protocol and its 2012 amendments, which require ratifying parties to control and reduce VOC emissions. As part of the protocol and its amendment, Canada committed to establishing a VOC emission ceiling of 2 100 kilotonnes and a 20% reduction in VOC emissions to be attained by 2020 based on the 2005 VOC emissions level.

Regulatory and voluntary measures addressing VOC emissions

The Government of Canada has taken a number of actions to encourage voluntary reductions in VOC emissions from consumer and commercial products. The Guidelines for Volatile Organic Compounds in Consumer Products were published in November 2002. These voluntary guidelines recommended VOC concentration limits for 41 product categories and subcategories and were reflective of VOC concentration limits established by the United States Environmental Protection Agency (U.S. EPA) at the time. Most recently, the Code of Practice for the Reduction of Volatile Organic Compound (VOC) Emissions from Cutback and Emulsified Asphalt was published in the Canada Gazette, Part I, on February 25, 2017.

The Department has also taken regulatory measures to address VOC emissions. It published the Volatile Organic Compound (VOC) Concentration Limits for Automotive Refinishing Products Regulations and the Volatile Organic Compound (VOC) Concentration Limits for Architectural Coatings Regulations on July 8, 2009, and September 30, 2009, respectively.

On April 26, 2008, the proposed Volatile Organic Compound (VOC) Concentration Limits for Certain Products Regulations (the 2008 proposed Regulations) were published in the Canada Gazette, Part I. At the time of publication, the proposed Regulations aimed to align with the California Air Resources Board’s (CARB) Regulations for Reducing Emissions from Consumer Products and the Regulations for Reducing VOC Emissions from Antiperspirants and Deodorants (referred to as the General Consumer Product Regulations). The proposed Regulations would have established VOC concentration limits for certain product categories including personal care products; automotive and household maintenance products; adhesives, adhesive removers, sealants and caulks; and other miscellaneous products. These products are not covered by regulations previously published by the Department.

Since publication in the Canada Gazette, Part I, the Department has expanded the scope of the 2008 proposed Regulations to cover a wider range of products to align with the 2010 Consumer Product Regulations under CARB. The Department has consulted with stakeholders throughout this process. Given the significance of the changes to the regulatory proposal, republication in the Canada Gazette, Part I, occurred on July 6, 2019.

Relevant regulatory measures in other jurisdictions

CARB’s Consumer Product Regulations (Regulations for Reducing Emissions from Consumer Products and Regulations for Reducing VOC Emissions from Antiperspirants and Deodorants) set VOC limits for numerous categories of consumer products. Under these regulations, retailers, distributors, importers, and manufacturers of consumer products are responsible for ensuring the products they sell comply with California’s VOC limits. These regulations came into force in 1991. Since these initial regulations, California has made numerous amendments, which include amendments in 2010 and 2013 to add VOC limits for various product categories and subcategories.

Objective

The objective of the Regulations is to reduce VOC emissions by setting VOC concentration limits on products being imported or manufactured in Canada in order to protect the environment and health of Canadians from adverse impacts associated with these emissions.

Description

The Regulations will establish VOC concentration limits for products under approximately 130 product categories and subcategories. These categories and subcategories cover a wide range of products used by consumers, or in institutional, industrial or commercial applications and will include personal care products; automotive and household maintenance products; adhesives, adhesive removers, sealants and caulks; and other miscellaneous products (hereinafter referred to as certain products). The Regulations product categories will align, for the most part, with CARB’s amendments to the Consumer Product Regulations implemented in 2010. At the request of stakeholders, a few product category definitions have been aligned with CARB’s 2013 amendments, and an acoustical sealant category has been added. Product category limits align with CARB 2010 for all categories, with the exception of certain sealants and caulks, paint thinners and multipurpose solvents. These categories have higher limits to adapt to Canadian climate or marketplace conditions.

Accompanying the Regulations are consequential amendments to the Regulations Designating Regulatory Provisions for Purposes of Enforcement (Canadian Environmental Protection Act, 1999) [Designation Regulations]. The Designation Regulations identify provisions of various regulations made under CEPA as being subject to an enhanced fine range following a successful prosecution of an offence involving harm or risk of harm to the environment, or obstruction of authority. The amendments are needed to include the Regulations in the Schedule to the Designation Regulations.

VOC concentration limits for manufacturers and/or importers

The Regulations will prohibit the manufacture and import of products with VOC concentrations in excess of their respective category-specific limits unless a permit is obtained. The concentration limits and product categories and subcategories are identified in the Schedule to the Regulations. While the Regulations that were prepublished in 2008 included a prohibition on sale, the current Regulations will only apply to the manufacture and import of products in order to reduce administrative burden and impacts on small businesses.

Labelling, reporting and record-keeping requirements

Manufacturers and/or importers of a regulated product will be required to indicate, on the product container, the date on which the product was manufactured or a code representing that date. The Regulations will not include mandatory testing requirements to be conducted by regulated parties to ensure regulated products meet the VOC concentration limits. However, they would be required to keep information regarding the manufacture and import of regulated products in Canada to ensure that the Department is able to access records and reports, if required.

Alternative compliance options

A number of alternative compliance options are being put in place to provide flexibility in complying with the Regulations. To promote transparency, information regarding products and associated permits will be made publicly available.

Permit — Compliance not technically or economically feasible

The Regulations will include a provision for temporary permit applications for products that will be otherwise unable to meet the regulatory requirements for technical or economic reasons. Temporary permits would allow regulated parties to continue manufacturing or importing products if the conditions outlined in the Regulations are met, including a plan to show how the products will be brought into compliance. A permit would be valid for a period of up to two years from the date it is issued and could be extended for an additional two years, provided the application is submitted 90 days prior to the expiry of the first period.

Permit — Products whose use results in lower VOC emissions

The Regulations will include a provision for a permit allowing products to exceed the VOC concentration limits if, as a result of product design, formulation, delivery or other factors, the total VOC emissions from that product will be lower than those from a comparable compliant product when used in accordance with the manufacturer’s written instructions. The permit would be valid for a period of four years from the date it is issued and could be renewed every four years, provided the application is submitted at least 90 days prior to the expiry of the previous period.

VOC Compliance Unit Trading System

The Regulations will include a VOC Compliance Unit Trading System similar to CARB’s Alternative Control Plan Regulation for Consumer Products and Aerosol Coating Products with certain differences that take into consideration the Canadian context. The program will provide an alternative method for complying with VOC concentration limits by providing a permit that will allow companies to manufacture or import products that exceed concentration limits in the following ways:

- Balancing emissions from products that exceed the concentration limits with compliance units earned from products that were reformulated to have a VOC concentration lower than the regulatory limits; or

- By transferring compliance units from other companies.

To apply, participate and maintain a permit in the program, companies will be required to follow the requirements and deadlines as set out by the Regulations. Permits under the program will be valid indefinitely if participating companies continue to submit the required annual reports and meet conditions set out by the Regulations. Further, regulated parties will be required to submit a report for each calendar year during which they participate in the program.footnote 4

Modifications from the proposed Regulations

The Department carefully reviewed all comments received on the proposed Regulations published in 2019 in the Canada Gazette, Part I. Key concerns from stakeholders related to the alignment of product category definitions with existing California regulations. The Department has completed a detailed analysis of the comments, and consulted with CARB staff to ensure alignment. As a result, a number of definitions have been revised to ensure more precise alignment with CARB definitions. The coming into force for certain aspects of the regulations has been modified, to allow for the application for permits and the building of compliance units one year in advance of the coming into force of the product limits. In addition, the obligation to keep on record the port of entry through which a product is imported has been removed to decrease burden on stakeholders. Finally, the deadline for reporting under the VOC Compliance Unit Trading System has been extended from January 31 to March 1 to allow more time for regulatees to compile year-end data.

Regulatory development

Consultation