Vol. 149, No. 13 — July 1, 2015

Registration

SOR/2015-164 June 19, 2015

CANADA LABOUR CODE

Policy Committees, Work Place Committees and Health and Safety Representatives Regulations

P.C. 2015-848 June 18, 2015

His Excellency the Governor General in Council, on the recommendation of the Minister of Labour, the Minister of Transport, the Minister of Indian Affairs and Northern Development, and the Minister of Natural Resources, pursuant to subsections 135.2(1) and 136(11) (see footnote a) and section 157 (see footnote b) of the Canada Labour Code (see footnote c), makes the annexed Policy Committees, Work Place Committees and Health and Safety Representatives Regulations.

POLICY COMMITTEES, WORK PLACE COMMITTEES AND HEALTH AND SAFETY REPRESENTATIVES REGULATIONS

INTERPRETATION

1. In these Regulations, “Act” means Part II of the Canada Labour Code.

PART 1

POLICY COMMITTEES AND WORK PLACE COMMITTEES

APPLICATION

2. This Part applies in respect of policy committees and work place committees.

SELECTION OF MEMBERS

3. Employees who are not represented by a trade union must select members of a committee by a majority of votes.

QUALIFICATIONS OF MEMBERS SELECTED BY THE EMPLOYER

4. Subject to section 135.1 of the Act, the members of a committee selected by the employer must be employees who exercise managerial functions.

CHAIRPERSONS

5. (1) The chairpersons of a committee who are selected in accordance with subsection 135.1(7) of the Act must act alternately.

(2) The committee members must establish the responsibilities of the chairpersons, including the following:

- (a) scheduling the committee meetings and notifying the members of those meetings;

- (b) preparing the agenda of each committee meeting;

- (c) ensuring that each item under discussion at a committee meeting concludes with a decision; and

- (d) ensuring that the committee carries out its functions.

VACANCY

6. If a committee member ceases to be a member and by reason of the vacancy the composition of the committee fails to meet the requirements of section 135.1 of the Act, a new member must be selected and appointed

- (a) in the case of a policy committee, within 60 days after the day on which the vacancy occurs; and

- (b) in the case of a work place committee, within 30 days after the day on which the vacancy occurs.

QUORUM

7. A quorum of a committee consists of the majority of members, at least half of which are representatives of employees and at least one of which is a representative of the employer.

MINUTES

8. (1) As soon as possible after each committee meeting, the minutes must be provided to both chairpersons for their approval and the approval document, if any, must be attached to the minutes.

(2) As soon as possible after receiving the minutes and the approval document, the chairperson selected by the employer members of the committee must provide a copy of those documents to the employer and each member of that committee.

(3) As soon as possible after receiving a copy of the minutes and the approval document, the employer must provide a copy of them

- (a) to the work place committee, in the case of minutes of a policy committee meeting; and

- (b) to the policy committee, at its request, in the case of minutes of a work place committee meeting.

(4) As soon as possible after receiving a copy of the minutes and the approval document, the employer must make a copy of the minutes readily available to the employees for a period of one month.

(5) The employer must keep a copy of the minutes and the approval document at the following locations for a period of two years after the day on which the meeting was held:

- (a) in the case of a policy committee, at the employer’s head office; and

- (b) in the case of a work place committee, at the employer’s head office or at the work place.

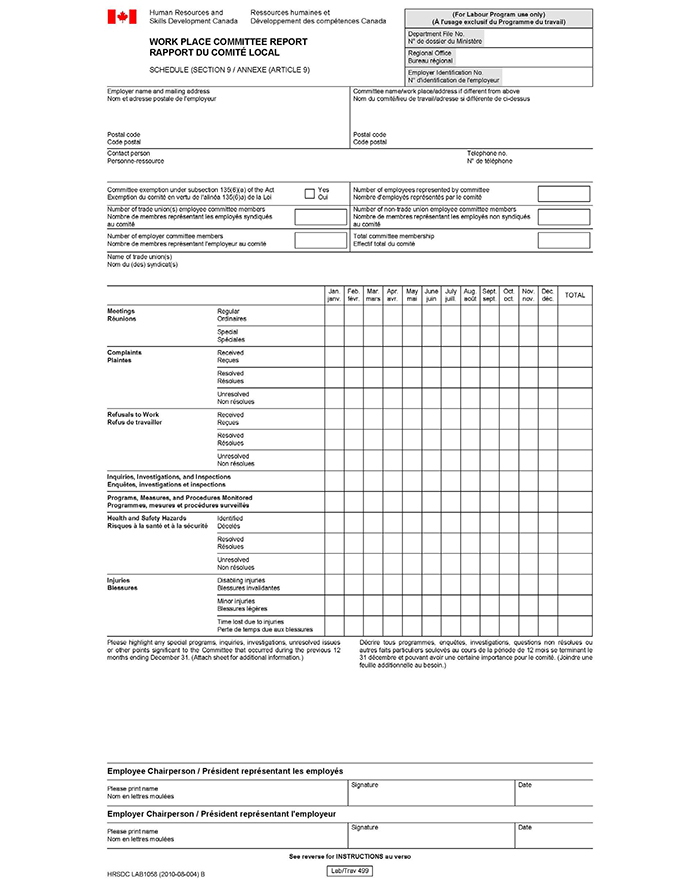

ANNUAL REPORT ON WORK PLACE COMMITTEE ACTIVITIES

9. (1) On or before March 1 each year, the chairperson selected by the employer members of the work place committee must submit to the Minister an annual report of the committee’s activities during the 12-month period ending on December 31 of the preceding year.

(2) The report must be in the form set out in the schedule, contain the information set out in the form, and be signed by both chairpersons.

(3) As soon as possible after the report has been submitted, the employer must post a copy of it in the conspicuous place or places in which the employer posts the information referred to in paragraph 125(1)(z.17) or subsection 135(5) of the Act and keep the copy posted for a period of two months.

PART 2

HEALTH AND SAFETY REPRESENTATIVES

APPLICATION

10. This Part applies in respect of health and safety representatives.

SELECTION OF REPRESENTATIVES

11. Employees who are not represented by a trade union must select their health and safety representatives by a majority of votes.

TERM OF OFFICE

12. The term of office of a health and safety representative is two years.

VACANCY

13. If a health and safety representative ceases to be a representative, the vacancy must be filled within 30 days after the day on which the vacancy occurred.

PART 3

HEALTH AND SAFETY TRAINING PROGRAM

TRAINING

14. (1) For the purposes of paragraph 125(1)(z.01) of the Act, training for members of policy and work place committees and health and safety representatives must be developed by the employer after consultation with the committees or representatives concerned and must include the following aspects:

- (a) the Act and any regulations made under it;

- (b) the means that allow the committee members and the health and safety representatives to fulfill their responsibilities under the Act;

- (c) the rules and procedures of each of the committees; and

- (d) the principles of consensus building regarding health and safety issues.

(2) The health and safety training program must be reviewed and updated at least once every three years, and whenever there is a change of circumstances that may affect the content of the training.

REPEAL

15. The Safety and Health Committees and Representatives Regulations (see footnote 1) are repealed.

COMING INTO FORCE

16. These Regulations come into force on the day on which they are registered.

SCHEDULE

(Subsection 9(2))

ANNUAL REPORT ON WORK PLACE COMMITTEE ACTIVITIES

REGULATORY IMPACT ANALYSIS STATEMENT

(This statement is not part of the Regulations.)

Executive summary

Issues: The Safety and Health Committees and Representatives Regulations (SHCRR) do not reflect certain amendments made to the Canada Labour Code (the Code) in 2000. One of the amendments introduced the concept of the internal responsibility system (IRS). Policy committees, work place committees and health and safety representatives are the main vehicles driving the IRS for health and safety in federal jurisdiction work places. The most significant gaps in the SHCRR include a lack of rules of procedure for policy committees, and the elements of the training required by the Code for policy committee members, work place committee members and health and safety representatives. The absence of the prescribed components of the training program creates inconsistencies in training across the federal jurisdiction and reduces the capacity of health and safety committees and representatives to detect and address work place hazards. Further, minor administrative and editorial changes are needed to harmonize the SHCRR with the Code.

Description: The Policy Committees, Work Place Committees and Health and Safety Representatives Regulations (the Regulations) will replace the SHCRR. In addition to existing requirements, the Regulations

- prescribe the components of the health and safety training program for policy committee members, work place committee members and health and safety representatives required by the Code;

- include administrative details for the policy committees;

- omit the selection process of the committee chairpersons, since it is now prescribed in the Code, but include elements to consider when the committees establish the chairpersons’ duties;

- allow for the electronic transmission of policy committee and work place committee meeting minutes; and

- introduce a number of minor editorial and administrative changes, notably to eliminate any existing legislative overlap, and harmonize the rules and procedures for policy committees and work place committees with the Code.

Cost-benefit statement: It is estimated (before discounting) that, over the span of 20 years, these Regulations will cost approximately $68M in constant 2011 dollars ($36,567,802 discounted), almost entirely due to the training requirements. However, the net direct and indirect benefits are estimated at approximately $155M ($36,580,272 discounted) given that the Regulations are expected to lower the injury and fatality rates in federal jurisdiction work places. Through an increase in health and safety training, policy and work place committee members, and health and safety representatives, should increase their capacity to identify and address health and safety hazards, which should lead to better recognition of work place hazards and a reduction in the number of injuries and fatalities.

“One-for-One” Rule and small business lens: The “One-for-One” Rule applies to the Regulations, and the proposal is considered an “OUT” under the Rule, as it would decrease administrative burden on business. The total annualized administrative cost decrease is estimated at $756,532 or $157 per business (in 2012 dollars). These savings would result primarily from a transition from physical posting of work place committee minutes to electronic posting.

The small business lens applies to these Regulations. The Regulations will affect approximately 5 800 small businesses under federal labour jurisdiction in 2016, rising to approximately 6 500 small businesses in 2025. It is estimated that the Regulations will cost approximately $1.9M per year for the first two years to the small business sector in general. Average annual costs for the remaining years of the 10-year period (years 2–10) are estimated at $640,000. The average annual cost to each small business is estimated at approximately $150 over the 2016–2025 period.

Domestic and international coordination and cooperation: These Regulations would bring the federal requirements for policy committees, work place committees and health and safety representatives up to date with the current practices and procedures in the provinces and territories.

Background

One of the objectives of the Code is to prevent accidents and injuries to health arising out of, linked with, or occurring in the course of employment. One of the key components in reaching this goal is the IRS. The IRS is a collaborative approach taken by an employer and the employees to resolve health and safety concerns in the work place. Several studies demonstrate that an effective IRS can reduce work place injuries, illnesses and fatalities through more proactive intervention. Health and safety committees and representatives are key to the effective operation of the IRS, as they are the main forum through which occupational health and safety issues are identified and addressed.

Prior to 2000, federally regulated employers (interprovincial and international transportation, chartered banks, telecommunications, the grain industry, most Crown Corporations, and certain activities undertaken by First Nations) were required to establish work place committees or have a health and safety representative depending on the size of the work place. Amendments to the Code in 2000 introduced a number of important changes. Key to these changes were requirements for employers to establish policy committees when employing 300 or more employees and to provide specific training to policy committee members, work place committee members, as well as health and safety representatives.

Work place committees are required in federal work places with 20 or more employees. Health and safety representatives are required in federal work places with less than 20 employees. Work place committees and health and safety representatives have many duties, including, but not limited to

- participating in the implementation and monitoring of programs for the prevention of work place hazards;

- participating in all of the inquiries, investigations, studies, and inspections pertaining to employee health;

- participating in the implementation and monitoring of a program for the provision of personal protective equipment, clothing, and devices;

- ensuring adequate records are kept on work accidents, injuries and health hazards;

- inspecting all or part of the work place once a month; and

- considering and dealing with health and safety complaints.

A policy committee is required for federally regulated employers with 300 employees or more. They address issues that, because of their nature, cannot be dealt with by the local work place health and safety committees. A policy committee can also ensure consistency across work sites. Their roles and responsibilities include, but are not limited to

- participating in the development of health and safety policies and programs;

- dealing with matters raised by members and those referred to it by a work place committee or health and safety representative;

- participating in the development and monitoring of a program for the prevention of work place hazards, according to Part XIX of the Canada Occupational Health and Safety Regulations, that also provides for the health and safety education of employees;

- monitoring data on work accidents, injuries and health hazards; and

- participating in the planning, and in the actual implementation, of changes that may affect health and safety, including work processes and procedures.

Policy committees and work place committees consist of employee and employer representatives who meet on a regular basis to deal with health and safety issues. The advantage of such committees is that the in-depth practical knowledge of specific tasks (employees) is brought together with the larger overview of company policies, and procedures (employer). Another significant benefit is the enhancement of cooperation among all parts of the work force toward solving health and safety problems.

Issues

Health and safety committees and representatives play a vital role in preventing work-related injuries and diseases, and are an important part of the IRS. The SHCRR prescribe the standards for the administration of work place committees and health and safety representatives in federally regulated work places.

As currently written, the SHCRR do not address the following elements added to the Code in 2000:

- the components of the health and safety training program now required by the Code;

- specific standards respecting the administration of policy committees; and

- some minor editorial and administrative changes, such as changing some of the terminology (e.g. “safety and health” to “health and safety” and “chairman” to “chairperson.”)

The absence of the prescribed components of the training program for health and safety committees and representatives creates inconsistencies in training across federal jurisdiction work places, decreasing the ability of health and safety committees and representatives to properly identify and address work place hazards. In addition, the lack of specific standards in the Regulations leaves room for interpretation and creates inconsistencies in the administration of policy committees.

Objectives

The objectives of the Regulations are to

- reduce accidents, illnesses and fatalities in federally regulated work places by improving the capacity of policy committees, work place committees and health and safety representatives to identify and address hazards in the work place;

- harmonize the SHCRR with the Code;

- provide more direction on administrative procedures and requirements regarding the policy committees, work place committees and health and safety representatives; and

- ensure the SHCRR are up to date with the current practices and procedures in other jurisdictions.

Description

The Regulations will replace the SHCRR as a result of changes to Part II of the Code (Occupational Health and Safety) that came into effect in September 2000. Many of these changes to the Code impact on and revolve around policy committees, work place committees, as well as health and safety representatives. The Regulations will introduce the following changes to the existing requirements:

- 1. Health and safety training program: The Regulations will prescribe the components of the health and safety training program required by the Code. Since 2000, Part II of the Code requires that every employer “ensure that members of policy committees, work place committees and health and safety representatives receive the prescribed training in health and safety.” However, this health and safety training has not yet been prescribed in regulations. The Regulations will address this void.

Employers will be required to provide minimum training on the following issues:- the Code and any regulations made under it;

- the means that allow a committee member or health and safety representative to fulfil his or her responsibilities under the Code;

- the rules and procedures of existing work place and/or policy committees; and

- the principles of consensus building regarding health and safety issues.

- The Regulations will also require employers to review and update the health and safety training program, as necessary, whenever there is a change of circumstances that may impact the content of the training, or at least once every three years. The development and review of the training program must be undertaken with the participation of the policy committee, work place committee or health and safety representatives.

- 2. Policy committees: The Regulations set administrative details and procedures for the policy committees on subjects such as the selection of members and the roles of the chairpersons. Since 2000, the Code requires employers that directly employ 300 employees or more to establish a policy committee to address health and safety matters in the work place. The administrative details and procedures of these policy committees are not currently expounded in the SHCRR i.e. the selection of members, the quorum. The Regulations rectify this gap.

- 3. Selection process and duties for chairpersons: The selection process for chairpersons in the SHCRR was added to the Code in 2000. Inclusion of this process in the Regulations is therefore redundant and will be repealed. The Regulations, however, will add the obligation of the committee members to designate the responsibilities of the chairperson including scheduling and notifying members of committee meetings, preparing the agenda, ensuring that each item under discussion concludes with a decision and ensuring that the committee carries out its functions.

- 4. Meeting minutes and rules of procedures: The Regulations will allow for electronic transmission of meeting minutes in order to harmonize the SHCRR with changes made to the Code in 2000.

- 5. Elimination of legislative duplication and lack of legislative authority: Certain sections in the SHCRR have been found to repeat requirements that are already stated in the Code, or have questionable legislative authority to be included [e.g. subsection 5(1) of the SHCRR repeats what is already stated in subsection 135.1(7) of the Code]. The Regulations will repeal such sections.

Regulatory and non-regulatory options considered

No other non-regulatory options were considered given that the SHCRR needed to be updated as a result of the changes made to the Code in 2000. Retaining the SHCRR would perpetuate their incompatibility with the Code, and revoking them could result in decreased protection for employees.

These new provisions were seen as the best means of achieving the goals of harmonizing the SHCRR with the Code and of reducing the number of work place injuries, illnesses, diseases and fatalities.

Benefits and costs

A cost-benefit analysis for the Regulations was completed in 2011 by the Labour Program of Employment and Social Development Canada (the Labour Program). A summary of economic benefits and costs to Canadians appears in Table 1 below.

It is estimated that, over the span of 20 years, the Regulations will cost approximately $68M in constant 2011 dollars (before discounting), or $36.6M (discounted), almost entirely due to the training requirements. These include both the initial core training and refresher training required every three years. At present, health and safety committee members and representatives receive about two hours of informal training every three years. The Regulations prescribe formal training that averages about one day in duration.

Direct and indirect benefits are estimated to be $155M over 20 years (before discounting), or $73.1M (discounted). The most significant economic benefit anticipated from this regulatory initiative stems from its impact on the injury and fatality rate. It is expected that the increased training requirements for policy committee members, work place committee members and health and safety representatives would lead to better recognition of potential work place safety hazards. This would in turn reduce the number of injuries and fatalities in the federal jurisdiction. A literature review was undertaken within the Labour Program and found that a large number of academic studies came to this same conclusion. Direct economic benefits include lower workers’ compensation and healthcare costs, as well as reduced absenteeism and improved productivity.

Overall, the proposal is expected to result in a net benefit to Canadians of $36.6M over 20 years, or approximately $4.3M per year.

A detailed cost-benefit report entitled Impact Assessment: Training of Health and Safety Committee Members and Representatives, Cost and Impact on the Injury Rate is available at the Service Canada Library and on request.

Risk assessment

A risk analysis was completed to assess the generalized risk of occupational accidents and disease in the federal jurisdiction because the Regulations do not deal with a specific risk factor. In 2011, the risk of suffering an occupational injury resulting in time lost from work in the federal jurisdiction as a whole was a little under 2% and the risk of suffering a fatality was 0.005% (1/200 of 1%). Risks vary depending on the industry. It is expected that the Regulations will lower these risks by approximately 1%. The significance of this reduction will be fully revealed over the next 20 years, as it is anticipated that the implementation of the Regulations will lead to up to 7 900 fewer injuries and 9 avoided fatalities over this period, translating into significant savings to the Canadian economy.

Training for members of policy and work place committees, and health and safety representatives, is expected to improve and enhance their capacity for identifying and addressing work place hazards. This is expected to lead to reductions in the number of safety hazards workers are exposed to in the work place and in turn lower the risk of occupational accidents and disease. The federal jurisdiction has a well established role for policy committees, work place committees and health and safety representatives, and studies show that training is a central component influencing their effectiveness. In the federal jurisdiction, the risk of a work place accident occurring has been more than halved in the last 20 years, in large part due to a greater emphasis on work place safety and its continued innovation. The Regulations are consistent with and will enhance this practice.

While initial costs are expected to be high, averaging approximately $7.7 million per year in the first two years after implementation, because all health and safety representatives and committee members will need to be trained per the new requirements, compliance costs are expected to drop to less than $3 million in subsequent years, as the number of employees requiring the core training is limited to new representatives and committee members (with previously-trained employees requiring only refresher training every three years).

Benefits are expected to be higher. For example, even if the Regulations were to have minimal impact (injury and fatality reductions of less than 1%), there would still be a net benefit to the Canadian economy. This is because the proposed Regulations will affect all work places and lead to injury reductions across the entire federal jurisdiction. The Regulations are expected to reduce risks by 1% resulting in a benefit of approximately over $7 million per year over the next 20 years.

Cost-benefit statement

Table 1: Summary of economic benefits and costs to all Canadians (select years)

| Cost-Benefit Statement | Key Stakeholders | Base Year: 2013 | 2015 | 2019 | 2021 | 2025 | 2027 | 2032 | Total (PV) | Average Annual |

|---|---|---|---|---|---|---|---|---|---|---|

| A. Quantified impacts in 2011 dollars | ||||||||||

| Benefits | Federal jurisdiction employers and employees | 4,288,654 | 8,247,269 | 8,200,165 | 8,172,884 | 8,113,159 | 8,081,514 | 8,000,102 | 73,148,074 | 7,743,130 |

| Costs | Federal jurisdiction employers | 7,325,707 | 1,571,269 | 3,039,053 | 2,452,783 | 3,117,010 | 2,896,467 | 3,335,740 | 36,567,802 | 3,419,348 |

| Net benefits | Federal jurisdiction employers and employees | –3,037,053 | 6,676,000 | 5,161,112 | 5,720,101 | 4,996,149 | 5,185,047 | 4,664,362 | 36,580,272 | 4,323,782 |

| B. Quantified impacts in non-dollars, e.g. Risk assessment | ||||||||||

| Positive impacts (avoided accidents (see reference *)) | Federal jurisdiction employers and employees | 217 | 417 | 417 | 416 | 415 | 414 | 412 | 395 | |

| C. Qualitative impacts | ||||||||||

| Safer work places, increased productivity, improved employee morale, increased awareness of work place safety. | ||||||||||

| D. Stakeholders impacts | ||||||||||

| Benefits | In the federal jurisdiction, injury rate reductions are expected to be 1% in unionized work places versus 0.5% in the non-unionized sector, with associated average yearly cost-savings in these sectors expected in the range of $5 million and $2.7 million, respectively. | |||||||||

| Costs | Costs related to occupational health and safety training will increase for federal jurisdiction employers, but costs on a per unit basis will not vary between employers. | |||||||||

Reference *

Avoided accidents resulting in occupational injury or fatality.

“One-for-One” Rule

When the proposed Regulations were published in the Canada Gazette, Part I, on June 8, 2013, the accompanying Regulatory Impact Analysis Statement indicated that the proposal did not result in any change in administrative burden. Following prepublication, modifications to the proposal and further analysis indicated that three requirements would result in changes in administrative burden costs. The Regulations would remove a requirement that work place health and safety committee meeting minutes be physically posted in work places; include a requirement that these minutes still be made available to employees, i.e. by electronic means; and require that policy committee meetings be similarly made available to employees.

The “One-for-One” Rule applies to these requirements, which result in a net OUT of $756,532, or $157 per business. Assumptions used to derive this result are provided in the table below. Affected employers include only those with at least one work place of 20 employees or more. Smaller employers are not required to have work place health and safety committees or policy committees, and, therefore, would experience no change in administrative costs.

| Administrative Requirement | Assumptions | Total Administrative Cost (Present Value) |

|---|---|---|

| Removal of requirement to physically post work place committee minutes. | Staff time required to format, print and physically post minutes. 20 minutes × 10 times per year × 6 517–13 522 work places × loaded wage rate of $29.00. | $909,564 OUT |

| Requirement to make work place committee meeting minutes readily available to employees for one month. | Staff time required to email or post minutes on a Web site. 10 minutes × 10 times per year × 6 517–13 522 work places (see note 1) × loaded wage rate of $29.00. | $149,483 IN |

| Requirement to make minutes of policy committee meetings readily available to employees for one month. | Staff time required to email or post minutes on a Web site. 10 minutes × 10 times per year × 240–270 employers (see note 2) × loaded wage rate of $29.00. | $3,549 IN |

| Total | $765,532 OUT |

- Note 1

The number of worksites is anticipated to increase from 6 517 in 2015, to 13 522 in 2024. - Note 2

The number of employers with policy committees is anticipated to increase from 240 in 2015, to 270 in 2024.

Administrative burden assumptions were developed in consultation with a federal jurisdiction work place health and safety committee, in February 2014.

Small business lens

The small business lens applies to these Regulations. The Regulations will affect approximately 5 800 small businesses under federal labour jurisdiction in 2016, with the number of small business growing annually by about 1.2% and reaching approximately 6 500 small businesses in 2025. The estimated number of health and safety representatives and members of work place health and safety committees in the small business sector is estimated at approximately 9 869 in 2016 rising to approximately 11 194 in 2025 or about, on average, two health and safety representatives per small business.

It is estimated that the Regulations will cost approximately $1.9M per year for the first two years to the small business sector in general. Average annual costs for the remaining years of the 10-year period (years 2–10) are estimated to be about $640,000.

The average annual cost to each small business is estimated at approximately $150 over the 2016–2025 period, with costs resulting primarily from training requirements for health and safety representatives and members of work place health and safety committees. Costs are higher in the first two years after implementation (2016 and 2017), as small businesses will have to provide core-certification training (CCT) to all health and safety representatives and committee members (estimated at approximately $700 per small business in this two-year period). In subsequent years, only new health and safety representatives and committee members (estimated at approximately 11% of all representatives and committee members) will require CCT. In the years after 2019, those employees who received CCT will require refresher training, which is approximately 25% of the cost of CCT (approximately $89 per employee versus the cost of CCT, estimated at approximately $355 per employee).

For the 2018–2025 period, costs of both CCT and refresher training are estimated at approximately $60 per year per small business over this eight-year period. It is unlikely that small businesses will be required to provide training to health and safety and committee members each year after 2017, as this depends on the number of new health and safety and committee members, which could number zero in a given year (plus refresher training is only required every three years after CCT). As a result, in years when there are new employees who require training, the cost will exceed $60.

For the 2016–2025 period, it is estimated that both CCT and refresher training will cost approximately $1,500 per small business (or approximately $1,100 when discounted).

Regulatory flexibility analysis statement

The initial option considered was to require the employer to review and update the health and safety training program at least once every three years. This means that refresher training must be taken at least once every three years after CCT is completed.

The flexible option considered would remove the requirement for employers to review and update their health and safety training program at least once every three years. This means that no refresher training would be required after CCT is completed. While the costs of CCT training are the same under both options, by omitting the requirement for refresher training, small business would save approximately $150 dollars (discounted) over the 2016–2025 period. The cost of both options is summarized in the table below.

Table 2: Summary of small business lens

| Flexible Option | Initial Option | |||

|---|---|---|---|---|

| Short Description | Core training without refresher training | Core training with refresher training every 3 years | ||

| Maximum number of small businesses impacted | 6 472 | 6 472 | ||

| Annualized Average ($ 2014) |

Present Value ($ 2014) |

Annualized Average ($ 2014) |

Present Value ($ 2014) |

|

| Compliance costs | $591,200 | $5,912,000 | $897,502 | $6,808,230 |

| Administrative costs | $0 | $0 | $0 | $0 |

Total costs |

$591,200 | $5,912,000 | $897,502 | $6,808,230 |

Average cost per small business |

$126 | $985 | $148 | $1,130 |

Between March 2003 and August 2010, small businesses were consulted throughout the development of the Regulations via the Regulatory Review Committee (RRC). One of the key members of the committee is the Federally Regulated Employers — Transportation and Communication (FETCO), which represents the trucking industry, and accounts for approximately 58% of all federally regulated small businesses.

Between December 2010 and November 2011, stakeholders who employ persons on ships, trains, and stakeholders involved in exploitation, drilling and transportation of oil or gas in frontier lands were also consulted by Transport Canada, Natural Resources Canada and Aboriginal Affairs and Northern Development Canada.

In 2014, the RRC was terminated. The Occupational Health and Safety Advisory Committee (OHSAC) was put in place, with employee and employer representatives to provide advice to the Labour Program on occupational health and safety issues. Like the RRC, the OHSAC meets twice a year. An update of the progress of the Regulations is shared regularly with OHSAC members. OHSAC stakeholders, include the Canadian Trucking Alliance (CTA) and the National Airlines Council, FETCO, which represents, among others, broadcasting and communications, and transportation (although not the trucking industry at the time of writing). The CTA has over 4 500 industry members, representing a broad cross-section of the industry, including carriers, owner-operators, and industry suppliers. The trucking industry has over 3 400 small businesses in the federal jurisdiction. The air transportation industry has over 1 000 small businesses in the federal jurisdiction. Broadcasting, communication, and water transport, all represented by FETCO have over 550 small businesses. Through OHSAC alone, approximately 82% of small businesses in the federal jurisdiction have effectively been consulted. Stakeholders sought assurance that the Regulations would soon come into force.

At the November 2014 OHSAC meeting, an update on the progress of the Regulations was shared with the stakeholders. No further comments have been received.

Reverse onus

The option of removing the requirement for employers to review and update their health and safety program at least once every three years would impose a cost on small businesses that was a $306,305 annualized average compared to the initial option. Even a flexible option that would require refresher training at longer intervals (e.g. five years) would not be advisable given that other Canadian jurisdictions, such as Ontario, require certification for the training of joint occupational health and committee members, with refresher training every three years. As a result, third-party training providers offer training programs leading to certification for three years, and in order to maintain certification, a refresher course must be taken after this three-year period has expired. The resulting lower cost to businesses would be achieved only by compromising the fundamental goal of the Regulations to ensure the ability of health and safety committees and representatives to properly identify and address work place hazards.

The cost of refresher training is relatively low when compared to CCT, by over $250 per unit ($89 per employee versus $355 per employee for CCT). It is standard for training programs to require refresher training after a period of time to maintain competencies, typically every three years.

Consultation

In 1986, Labour Canada, now the Labour Program, established the RRC for the technical revision of federal occupational health and safety regulations. This Committee consisted of an equal membership drawn from organized labour and employer organizations in the federal jurisdiction.

As a result of the changes to the Code that came into effect in September 2000, the RRC established a working group to review the proposals and positions of unions, management and the Labour Program. Seven meetings were held between March 2003 and August 2010. Representing a wide range of industrial sectors, the employee members of the working group were appointed by the Canadian Labour Congress (CLC) and the employer members were appointed by FETCO and the Canadian Bankers Association (CBA). A complete list of members is available upon request.

Further consultations were held between December 2010 and November 2011 with stakeholders who employ persons on ships, trains or aircraft as well as on, or in connection with exploration or drilling for the production, conservation, processing or transportation of oil or gas in frontier lands. A presentation on the proposed amendments was made during the fall 2011 National Canadian Marine Advisory Council meeting in Ottawa.

The training to be prescribed for policy committee members, work place committee members and health and safety representatives was a major item of discussion throughout the meetings. The possibility for non-unionized employees to select members through a secret ballot vote was part of the proposed amendments, published in the Canada Gazette, Part I, on June 8, 2013, to ensure that non-unionized employees would have access to such a mechanism. Although a consensus was achieved on the majority of amendments proposed, no consensus was reached on votes by secret ballot for non-unionized committee members or representatives.

Employers expressed concern that holding a vote by secret ballot to elect non-unionized committee members or representatives would not be administratively feasible, notably for larger employers. They mentioned the need to retain the right to explore the option(s) best suited for their environment for the selection of these members.

Prepublication in the Canada Gazette, Part I

Three submissions were received from federally regulated stakeholders, one from a department Labour Relations and Health and Safety Division and two from employee health and safety representatives, following prepublication of the Regulations in the Canada Gazette, Part I, on June 8, 2013. Most of the comments received were seeking clarifications with regard to the training of committee members and health and safety representatives, as well as the requirement for secret ballot selection of members representing non-unionized employees. The Labour Program provided stakeholders with detailed responses to all questions and comments received.

As a result of comments received and internal consultations, minor adjustments were made to the Regulations. A requirement has been added for employers to make minutes of policy committee meetings available to employees for one month, the specific reference to a vote by secret ballot was removed and minor editorial changes were made to harmonize the French and English versions.

Vote by secret ballot for non-unionized committee members or representatives

Following the comments received expressing concerns on the method of selecting members representing non-unionized employees, the Labour Program’s position evolved and the specific reference to a vote by secret ballot was removed in order to avoid confusion. The possibility for non-unionized employees to select members through a secret ballot vote was initially added to ensure that they would have access to such a mechanism. However, after internal consultations, it was agreed that the current Regulations do not prevent non-unionized employees from using a vote by secret ballot when selecting committee members.

Rationale

In 2012, over 61 000 employees in federal jurisdiction work places were injured, while 48 lost their lives, in work place-related accidents. The IRS is recognized worldwide as a best practice for ensuring a safe and disease-free work place. An effective IRS depends on properly trained employees.

By reducing the generalized risk of work place accidents, the Regulations are expected to provide savings estimated at $155M in current dollars ($35,580,272 when discounted) over a period of 20 years to employers and to the Canadian society as a whole, through reduction of 5 400 minor injuries, 2 500 lost-time injuries and 10 fatalities. Further, the Regulations will address outstanding legislative inconsistencies with the Code that must be corrected.

While it is expected that initial costs will average approximately $7.7 million per year in the first two years after implementation, because all health and safety representatives and committee members will need to be trained per the new requirements, compliance costs are expected to drop to less than $3 million in subsequent years, as the number of employees requiring the core training is limited to new representatives and committee members (with previously-trained employees requiring only refresher training every three years).

The “One-for-One” Rule applies to the Regulations, which would reduce the total annualized administrative cost by an estimated $756,532 or $157 per business (in 2012 dollars). These savings would result primarily from a transition from the physical posting of work place committee minutes to electronic posting.

Federal jurisdiction stakeholders, including employee representatives appointed by the CLC, employer representatives appointed by FETCO and the CBA, stakeholders who employ persons on ships, trains or aircraft as well as on, or in connection with exploration or drilling for the production, conservation, processing or transportation of oil or gas in frontier lands were consulted between 2003 and 2013. They are supportive of the Regulations.

It is therefore anticipated that the Regulations will result in a net benefit to Canadians.

Implementation, enforcement and service standards

Implementation

Following the coming into force of the Regulations, the Labour Program will conduct outreach directly to inform stakeholders of the new requirements. The Regulations will be posted on the Labour Program’s Web site, and interpretations, policies and guidelines will be updated, as required.

Enforcement

Overall, the Labour Program’s compliance policy outlines the proactive and reactive activities used by delegated officials to ensure compliance. However, policy committees and work place committees are the primary mechanisms through which employers and employees work together to solve job-related health and safety problems. Delegated officials assist the industry in establishing and implementing policy committees and workplace committees, and related programs.

The statutory powers of delegated officials allow them to enter work sites and perform various activities to enforce compliance with the Code and the Regulations. For example, delegated officials may conduct safety audits and inspections. They may also investigate the circumstances surrounding the report of a contravention, work accident, refusal to work, or hazardous occurrence.

If violations of the Regulations are observed and are not resolved via policy and workplace committees, enforcement actions for non-compliance would be used by delegated officials. Enforcement actions may range from the issuance of a written notice to further steps such as the initiation of prosecution.

Initially, an attempt to correct non-compliance with the Regulations, when non-compliance does not represent a dangerous condition, is made through the issuance of an Assurance of Voluntary Compliance (AVC). An AVC is a written commitment that a contravention will be corrected within a specified time. Failure to complete the corrective actions specified in the AVC may lead the delegated officials to issue a direction. A direction is issued whenever a serious contravention or dangerous condition exists and when an AVC is not obtainable or has not been fulfilled. Failure to comply with a direction is a violation of the Code, and therefore, is enforceable by prosecution. Offences can lead to imprisonment. The maximum penalty for offences is, on summary conviction, a fine of $1M, or on conviction on indictment, imprisonment for up to two years and/or a fine of $1M.

Contact

Shafi Askari-Farahani

Policy Analyst

Occupational Health and Safety Policy Unit

Program Development and Guidance Directorate

Labour Program

Employment and Social Development Canada

165, De l’Hôtel-de-Ville Street, 10th Floor

Place du Portage, Phase II

Gatineau, Québec

K1A 0J2

Telephone: 819-654-4468

Email: shafi.askarifarahani@labour-travail.gc.ca

Small Business Lens Checklist

1. Name of the sponsoring regulatory organization:

2. Title of the regulatory proposal:

3. Is the checklist submitted with a RIAS for the Canada Gazette, Part I or Part II?

![]() Canada Gazette, Part I

Canada Gazette, Part I ![]() Canada Gazette, Part II

Canada Gazette, Part II

A. Small business regulatory design

| I | Communication and transparency | Yes | No | N/A |

|---|---|---|---|---|

| 1. | Are the proposed Regulations or requirements easily understandable in everyday language? | |||

| 2. | Is there a clear connection between the requirements and the purpose (or intent) of the proposed Regulations? | |||

| 3. | Will there be an implementation plan that includes communications and compliance promotion activities, that informs small business of a regulatory change and guides them on how to comply with it (e.g. information sessions, sample assessments, toolkits, Web sites)? | |||

| The Labour Program will conduct outreach directly to inform stakeholders of the new requirements. The Regulations will be posted on the Labour Program Web site, and interpretations, policies and guidelines will be updated as required. | ||||

| 4. | If new forms, reports or processes are introduced, are they consistent in appearance and format with other relevant government forms, reports or processes? | |||

| No new forms, reports or processes are introduced by these amendments. | ||||

| II | Simplification and streamlining | Yes | No | N/A |

| 1. | Will streamlined processes be put in place (e.g. through BizPaL, Canada Border Services Agency single window) to collect information from small businesses where possible? | |||

| The amendments do not modify the collection of information. | ||||

| 2. | Have opportunities to align with other obligations imposed on business by federal, provincial, municipal or international or multinational regulatory bodies been assessed? | |||

| Throughout the regulatory development process, efforts were made to align the proposed Regulations with other Canadian jurisdictions and other countries. | ||||

| 3. | Has the impact of the proposed Regulations on international or interprovincial trade been assessed? | |||

| The Regulations are not expected to have any impact on domestic or international coordination and cooperation. These Regulations would bring the federal requirements for policy committees, work place committees and health and safety representatives up to date with the current practices and procedures in the provinces and territories. | ||||

| 4. | If the data or information, other than personal information, required to comply with the proposed Regulations is already collected by another department or jurisdiction, will this information be obtained from that department or jurisdiction instead of requesting the same information from small businesses or other stakeholders? (The collection, retention, use, disclosure and disposal of personal information are all subject to the requirements of the Privacy Act. Any questions with respect to compliance with the Privacy Act should be referred to the department’s or agency’s ATIP office or legal services unit.) | |||

| The data or information required to comply with the proposed Regulations is not collected by another department or jurisdiction. | ||||

| 5. | Will forms be pre-populated with information or data already available to the department to reduce the time and cost necessary to complete them? (Example: When a business completes an online application for a licence, upon entering an identifier or a name, the system pre-populates the application with the applicant’s personal particulars such as contact information, date, etc. when that information is already available to the department.) | |||

| The amendments do not modify the collection of information. No additional forms are required. | ||||

| 6. | Will electronic reporting and data collection be used, including electronic validation and confirmation of receipt of reports where appropriate? | |||

| The Regulations would remove a requirement that work place health and safety committee meeting minutes be physically posted in work places; include a requirement that these minutes still be made available to employees (i.e. by electronic means); and, require that policy committee meetings be similarly made available to employees. | ||||

| 7. | Will reporting, if required by the proposed Regulations, be aligned with generally used business processes or international standards if possible? | |||

| 8. | If additional forms are required, can they be streamlined with existing forms that must be completed for other government information requirements? | |||

| The amendments do not modify the collection of information. No additional forms are required. | ||||

| III | Implementation, compliance and service standards | Yes | No | N/A |

| 1. | Has consideration been given to small businesses in remote areas, with special consideration to those that do not have access to high-speed (broadband) Internet? | |||

| The amendments do not modify the collection of information. | ||||

| 2. | If regulatory authorizations (e.g. licences, permits or certifications) are introduced, will service standards addressing timeliness of decision-making be developed that are inclusive of complaints about poor service? | |||

| Authorizations are not being introduced by these amendments. | ||||

| 3. | Is there a clearly identified contact point or help desk for small businesses and other stakeholders? | |||

| The Labour Program has a toll-free (1-800) number where stakeholders can report a serious injury, fatality or refusal to work. See the first paragraph at www.hrsdc.gc.ca/eng/labour/contact_us.shtml. | ||||

B. Regulatory flexibility analysis and reverse onus

| IV | Regulatory flexibility analysis | Yes | No | N/A |

|---|---|---|---|---|

| 1. | Does the RIAS identify at least one flexible option that has lower compliance or administrative costs for small businesses in the small business lens section? Examples of flexible options to minimize costs are as follows:

|

|||

| 2. | Does the RIAS include, as part of the Regulatory Flexibility Analysis Statement, quantified and monetized compliance and administrative costs for small businesses associated with the initial option assessed, as well as the flexible, lower-cost option?

|

|||

| 3. | Does the RIAS include, as part of the Regulatory Flexibility Analysis Statement, a consideration of the risks associated with the flexible option? (Minimizing administrative or compliance costs for small business cannot be at the expense of greater health, security or safety or create environmental risks for Canadians.) | |||

| 4. | Does the RIAS include a summary of feedback provided by small business during consultations? | |||

| V | Reverse onus | Yes | No | N/A |

| 1. | If the recommended option is not the lower-cost option for small business in terms of administrative or compliance costs, is a reasonable justification provided in the RIAS? |

- Footnote a

S.C. 2000, c. 20, s. 10 - Footnote b

S.C. 2000, c. 20, s. 20 - Footnote c

R.S., c. L-2 - Footnote 1

SOR/86-305