Canada Gazette, Part I, Volume 146, Number 15: Heavy-duty Vehicle and Engine Greenhouse Gas Emission Regulations

April 14, 2012

Statutory authority

Canadian Environmental Protection Act, 1999

Sponsoring department

Department of the Environment

REGULATORY IMPACT ANALYSIS STATEMENT

(This statement is not part of the Regulations.)

Executive summary

Issue: As a result of human activities, predominantly the combustion of fossil fuels, the atmospheric concentrations of greenhouse gases (GHGs) have increased substantially since the onset of the industrial revolution. In view of the historical emissions of GHGs from anthropogenic sources, and the quantity of emissions expected in the near future, GHGs, as significant air pollutants, are expected to remain a key contributor to climate change.

Transportation is one of the largest sources of GHG emissions in Canada, accounting for about 28% of total emissions in 2009. Heavy-duty vehicles accounted for around 7% of total GHG emissions or 24% of transportation emissions. Accordingly, taking action to reduce emissions from new on-road heavy-duty vehicles is an essential element of the Government’s strategy to reduce air pollutants and GHG emissions to protect the environment and the health of Canadians.

Description: The objective of the proposed Heavy-duty Vehicle and Engine Greenhouse Gas Emission Regulations (the proposed Regulations) is to reduce GHG emissions by establishing mandatory GHG emission standards for new on-road heavy-duty vehicles and engines that are aligned with U.S. national standards. The development of common North American standards will provide a level playing field that will lead North American manufacturers to produce more advanced vehicles, which enhances their competitiveness.

The proposed Regulations would apply to companies manufacturing and importing new on-road heavy-duty vehicles and engines of the 2014 and later model years for the purpose of sale in Canada. They would apply to the whole range of new on-road heavy-duty vehicles from full-size pickup trucks and vans to tractors and buses, as well as a wide variety of vocational vehicles such as freight, delivery, service, cement, and dump trucks. The proposed Regulations would also include provisions that establish compliance flexibilities which include a carbon dioxide (CO2) emission credit system for generating, banking and trading emission credits. Flexibilities also include additional credits for hybrid vehicles and electric vehicles, as well as for innovative technologies to reduce GHG emissions. Companies would also be required to submit annual reports and maintain records relating to the GHG emission performance of their vehicles and fleets.

Cost-benefit statement: The proposed Regulations are estimated to result in a reduction of approximately 19.0 megatonnes (Mt) of carbon dioxide equivalent (CO2e) in GHG emissions over the lifetime of vehicles produced in the model years 2014–2018 (MY2014–2018) cohort.

The present value of the cost of the proposed Regulations is estimated at $0.8 billion, largely due to the additional vehicle technology costs required by the proposed Regulations. The total benefits are estimated at $5.0 billion, due to the avoided social cost of carbon, and fuel savings ($4.5 billion). Over the lifetime of vehicles produced in MY2014–2018, the present value of the net benefit of the proposed Regulations is estimated at $4.2 billion.

Business and consumer impacts: Although owners and operators of heavy-duty vehicles would not be subject to the proposed Regulations, they are expected to face higher purchase prices for new heavy-duty vehicles. The technologies embodied in the vehicles in order to comply with the proposed Regulations would bring fuel savings that would outweigh the costs of these technologies. These available technologies were carefully selected to ensure broad industry support through the adoption of safe and currently available “off-the-shelf” technologies. The technology improvements will enhance the competitiveness of heavy-duty vehicles manufacturers; the increased fuel efficiencies of the vehicles are also expected to make the trucking industry more competitive. Despite their benefits, and while there will likely be some vehicle technology improvement, it is not expected that those technologies would be introduced to the same extent in the market place in the absence of regulations.

Domestic and international coordination and cooperation: Consultations were conducted with industry, provincial and territorial governments, other federal government departments and environmental non-governmental organizations (ENGOs). Environment Canada and Transport Canada co-hosted three consultation group meetings that included representatives from the above-mentioned stakeholders. Environment Canada also released two consultation documents. Comments received during consultation served to inform the development of the proposed Regulations. In addition, Environment Canada has conducted joint testing and research with the United States Environmental Protection Agency (U.S. EPA) to support the development of common standards.

Performance measurement and evaluation plan: The Performance Measurement and Evaluation Plan (PMEP) describes the desired outcomes of the proposed Regulations, such as GHG emissions reductions, and establishes indicators to measure and evaluate the performance of the proposed Regulations in achieving these outcomes. The measurement and evaluation will be tracked on a yearly basis, with a five-year compilation assessment, and will be based on the information and data submitted in accordance with the reporting requirements and records of the companies.

1. Issue

As a result of human activities, predominantly the combustion of fossil fuels, the atmospheric concentrations of greenhouse gases (GHGs) have increased substantially since the onset of the industrial revolution. In view of the historical emissions of GHGs from anthropogenic sources, and the quantity of emissions expected in the near future, GHGs are expected to remain a key contributor to climate change.

Across Canada we are witnessing the negative impacts of a changing climate first-hand. For example, a warming climate has been linked to the melting of permafrost in the north that has destabilized the foundations of homes and schools. While the specific impacts vary by region, all of Canada’s provinces and territories are experiencing the effects of a changing climate. (see footnote 1)

While Canada accounts for just 2% of global GHG emissions, its per capita emissions are among the highest in the world and continue to increase. In 2009, GHG emissions in Canada totalled 690 megatonnes (Mt) as shown in Table 1 below:

| Source (Mt) | 2005 | 2009 |

|---|---|---|

| Total | 731 | 690 |

| Transportation | 193 | 190 |

| Heavy-duty vehicles | 44 | 45 |

Source: National Inventory report: 1990–2009

As this table indicates, the transportation sector (air, marine, rail, road and other modes) is a significant source of GHG emissions in Canada, accounting for 28% of total emissions in 2009. Within this sector, heavy-duty vehicles account for nearly 24% of GHG emissions, or approximately 7% of total emissions in Canada. (see footnote 2) Emissions in the overall transportation sector fell by about 3 Mt from 2005 to 2009, although heavy-duty vehicle emissions rose by about 1 Mt.

Accordingly, taking action to reduce GHG emissions from new on-road heavy-duty vehicles and their engines is an essential element of the Government of Canada’s strategy to reduce GHG emissions to protect the environment and the health of Canadians. Carbon dioxide (CO2) is the predominant GHG emitted by motor vehicles and is directly related to the amount of fuel that is consumed by vehicles. Vehicles also emit other GHGs, including tailpipe emissions of methane (CH4) and nitrous oxide (N2O), and hydrofluorocarbons (HFCs) through the leakage of air conditioning system refrigerant, gases which all have higher global warming potential than CO2. Reductions of those emissions are not related to or do not significantly contribute to fuel savings.

2. Objectives

2.1. GHG reductions

The Government of Canada is committed to reducing Canada’s total GHG emissions to 17% below its 2005 levels by 2020 (i.e. from 731 to 607 Mt) — a target that is identified in the Copenhagen Accord and the Cancun Agreements. By establishing mandatory GHG emission standards for new on-road heavy-duty vehicles and engines beginning in 2014, Canada will move closer to its Copenhagen 2020 target.

The implementation of a comprehensive set of national standards reflecting a common North American approach for regulating GHG emissions from new on-road heavy-duty vehicles and engines would lead to environmental improvements for Canadians and provide regulatory certainty for Canadian manufacturers. Aligning Canadian standards with new U.S. regulations would also set a North American level playing field in the transportation sector.

The proposed Regulations will require manufacturers selling heavy-duty vehicles and engines in Canada to deploy emission reduction technologies, which will benefit both the environment and Canadians.

2.2. Regulatory burden

The proposed Regulations are designed to achieve the objectives above while minimizing the regulatory compliance burden of regulated Canadian industries through the alignment of heavy-duty vehicle regulations in Canada and in the United States. The reporting requirements were designed to assess the performance of the proposed Regulations against the targets established in the Performance Measurement and Evaluation Plan (see section 15) while minimizing the reporting burden of industry. The proposed Regulations would also allow regulatees to use the same GHG emissions model (GEM) as regulatees in the United States will use. This GEM is an accurate and cost-effective tool to assess compliance in either country.

3. Description

3.1. Key elements of the proposed Regulations

The proposed Regulations would introduce progressively more stringent GHG emission standards for new on-road heavy-duty vehicles and engines that would align with the national GHG emission standards and test procedures of the United States Environmental Protection Agency (U.S. EPA) for the 2014 model year and subsequent model years. The proposed Regulations would apply to companies manufacturing and importing new on-road heavy-duty vehicles and engines for the purpose of sale in Canada.

3.2. Prescribed regulatory classes

The proposed Regulations would reduce greenhouse gas emissions from the whole range of new on-road heavy-duty vehicles, from full-size pickup trucks and vans to tractors, from a wide variety of vocational vehicles such as school, transit and intercity buses to freight, delivery, service, cement, garbage and dump trucks.

The new Regulations would be aimed at all on-road vehicles with a gross vehicle weight rating of more than 3 856 kg (8 500 lb.), except those vehicles that are subject to the Passenger Automobile and Light Truck Greenhouse Gas Emission Regulations. Trailers would not be subject to the proposed Regulations.

The proposed Regulations would recognize the utility of vehicles and introduce GHG emission standards that would apply to the three prescribed regulatory classes of heavy-duty vehicles. Under the proposed Regulations, the full-size pickup trucks and vans would be regulated as “Class 2B and Class 3 heavy-duty vehicles,” and combination tractors as “tractors.” All other heavy-duty vehicles not covered by the two previously mentioned prescribed regulatory classes would be regulated as “vocational vehicles,” which include buses. Furthermore, the proposed Regulations would establish a prescribed regulatory class for heavy-duty engines designed to be used in a vocational vehicle or a tractor.

3.3. Emission standards for CO2, N2O and CH4

The standards in the proposed Regulations would address emissions of CO2, N2O and CH4 from heavy-duty vehicles and engines. The proposed Regulations would also include measures to require reductions in leakage of the hydrofluorocarbon refrigerant used in cabin air-conditioning systems.

For Class 2B and Class 3 heavy-duty vehicles, the proposed Regulations would include emission standards for CO2, N2O and CH4. In regards to CO2 emissions, the standard would be a fleet average CO2 emission standard for all vehicles of a company’s fleet.

In regard to vocational vehicles and tractors, the proposed Regulations would include heavy-duty engine standards for CO2, N2O and CH4, and also separate vehicle standards for CO2.

The proposed standards are structured not to constrain the size and power of heavy-duty vehicles, recognizing that these vehicles are designed to perform work. The proposed standards would be expressed in grams per unit of work, therefore allowing a more powerful vehicle to proportionally emit more GHGs than a less powerful vehicle.

3.4. Compliance assessment and computer simulation model

For standards applicable to Class 2B and Class 3 heavy-duty vehicles, regulatees would measure the vehicle performance using prescribed test cycles on a chassis dynamometer, similarly to existing procedures for light-duty vehicles under the current Passenger Automobile and Light Truck Greenhouse Gas Emission Regulations.

The performance of engines installed on vocational vehicles and tractors would be measured using prescribed test cycles on an engine dynamometer, i.e. the same ones used to measure criteria air contaminants under the On-Road Vehicle and Engine Emission Regulations.

Compliance with the vehicle standards for vocational vehicles and tractors would be assessed using a computer simulation model. This model is readily available at no charge and would assess the emission reductions of a vehicle equipped with one or more non-engine-related technologies, such as aerodynamic fairings, low rolling resistance tires, a speed limiter, weight reduction technologies, and idle reduction technology. The simulation model will also assign to vehicles a pre-determined payload and engine size. As a result, Canadian manufacturers will not be disadvantaged compared to U.S. manufacturers due to the higher average payloads in Canada.

3.5. CO2 emission credit system

The proposed Regulations would include a system of emission credits to help meet overall environmental objectives in a manner that provides the regulated industry with compliance flexibility. The CO2 emission credit system would allow companies to generate, bank and trade emission credits. Under this system, companies would be allowed to manufacture or import vehicles and engines with emission levels worse than the applicable emission standard, and others performing better than the standard, provided that their average fleet emission level does not exceed the applicable emission standard.

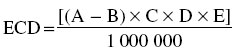

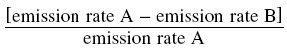

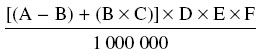

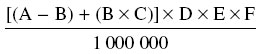

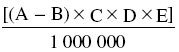

Credits would be obtained by companies whose average fleet emission levels fall below the applicable standard, while deficits would be incurred by companies whose fleet emissions exceed the applicable standard. Credits may be applied by a company to offset a past deficit for up to three model years prior to the year in which the credits were earned, or may be banked to offset a future deficit for up to five model years after the year in which the credits were obtained. Credits may also be transferred to another company. A company would calculate emission credits and deficits in units of megagrams of CO2, for each of its heavy-duty vehicle or engine fleets and averaging sets of a given model year.

3.6. Additional emission credits

The proposed Regulations would allow companies that incorporate certain technologies that provide improvements in reducing CO2e emissions to be eligible for additional emission credits when participating in the credit system.

Companies that manufacture or import, prior to the coming into force of the applicable standards, heavy-duty vehicles or engines that have emissions that are below the proposed required emissions standards would also have the possibility to generate early action credits.

The methods to calculate the additional credits would be aligned with those of the United States. A company would not be allowed to obtain additional credits more than once for the same type of GHG emission reduction technology.

3.7. Annual reporting requirements

Beginning with the 2014 model year, companies would be required to submit to the Minister an annual preliminary report for their Class 2B and Class 3 heavy-duty vehicles and an annual end of year model report for all their heavy-duty vehicles and engines.

The report would include, for each type of vehicle or engine of a prescribed regulatory class, all necessary information for the calculation of the company’s credits or deficits. This would include, amongst others, information such as the applicable emission standards, emission values or rates, and family emission limits.

3.8. Other administrative provisions

Several administrative provisions would be aligned with those under existing related regulations under the Canadian Environmental Protection Act, 1999 (CEPA 1999), including provisions respecting the national emissions mark, maintenance and submission of records, the cost for test vehicles, application for exemptions and notices of defect. The proposed Regulations would introduce requirements for vocational vehicles and tractors manufactured in stages, in line with similar requirements of the Motor Vehicle Safety Regulations under the Motor Vehicle Safety Act, governed by Transport Canada.

4. Sector profile

4.1. Heavy-duty vehicle manufacturing and importing

The proposed Regulations have divided these vehicles into three different categories: Class 2B and Class 3 heavy-duty vehicles (full-size pick-up trucks and vans), vocational vehicles, and tractors. Heavy-duty vehicles have a gross vehicle weight rating (GVWR) greater than 3 856 kg (8 500 lb.) and span several GVWR classes: tractors (often called combination tractors) are contained mainly within classes 7 and 8, and vocational vehicles span from class 2B through class 8. Vocational vehicles also comprise a range of vehicle types, including various types of buses.

There are currently only two Canadian manufacturers of heavy-duty trucks, Hino and Paccar, which produce approximately 6 400 vehicles annually that are primarily exported to the United States. There is little to no manufacturing of heavy-duty engines in Canada. There are some Canadian body manufacturers that produce finished vocational vehicles. Canadian bus manufacturers hold an important share of the North American market. Notably, MCI in Manitoba and Prevost in Quebec produce intercity buses; New Flyer, Nova Bus, and Orion produce transit buses; and Girardin Minibus produces school buses and smaller buses. All of these manufacturers sell in both American and Canadian markets.

4.2. Statistics of manufacturing and trade

The Canadian industry, classified in national statistics as Heavy-duty Truck Manufacturing in the North American Industry Classification System (NAICS 33612), includes producers of complete heavy-duty vehicles and chassis, which are either tractors or vocational vehicles under the proposed Regulations. Output of the industry has fallen sharply in the recent recession: from 11 321 vehicles in 2009 to 5 630 in 2010. (see footnote 3) Most of the vehicles produced are exported to the United States: over 90% in 2009, and about 80% in 2010. The decline in output reflects a reduction in total vehicles purchased in the United States in consequence of reduced economic activity. The industry defined as Motor Vehicle Body Manufacturing (NAICS 336211) included 197 Canadian establishments producing vocational vehicles in 2009.

In 2009, these two heavy-duty vehicle manufacturing industries together generated approximately $3.6 billion in gross revenue and $1.2 billion in gross domestic product; and employed over 10 500 workers. Of total revenue, some $2.1 billion was from exports, including $2.0 billion from the United States. Imports of heavy-duty vehicles and engines totalled $3.3 billion in the same year, of which $2.8 billion was from the United States. (see footnote 4)

4.3. Truck carriers

In 2009, there were some 750 000 heavy-duty trucks of GVWR over 4 536 kg in operation in Canada (Canadian Vehicle Survey, 2009). There were approximately 435 000 medium heavy-duty trucks below 14 970 kg GVWR and 314 000 heavier heavy-duty trucks. The medium heavy-duty truck usage was 8.2 billion vehicle-kilometres, an average of 18 900 km per truck, while the heavy heavy-duty truck usage totalled 21.2 billion vehicle-kilometres, an average of 67 500 km per vehicle. There were 194 000 trucks described as “for-hire,” only 26% of the total fleet, but responsible for 46% of total vehicle-kilometres. A further 128 000 trucks were owned by owner-operators, responsible for 21% of total vehicle-kilometres. Such trucks are usually contracted to a larger carrier or company. Some 319 000 vehicles were used in “private trucking,” the term used to describe trucks that are not for hire, but are used to carry the owners’ goods, including trucks owned by major manufacturers and retailers to transport the goods they own, and also trucks owned by farmers or tradesmen, for example. Such trucks were 43% of the fleet, but were used for only 23% of total vehicle-kilometres, at an average of only 21 000 km per vehicle.

| Ownership/ Use | Vehicles (thousands) | Vehicle-kilometres (billions) |

||||||

|---|---|---|---|---|---|---|---|---|

| Medium | Heavy | Total | Proportion | Medium | Heavy | Total | Proportion | |

| For-hire | 51.8 | 142.5 | 194.3 | 0.259 | 1.1 | 12.6 | 13.7 | 0.464 |

| Owner-operator | 63.3 | 64.2 | 127.6 | 0.170 | 1.8 | 4.5 | 6.3 | 0.221 |

| Private | 240.0 | 79.0 | 319.0 | 0.426 | 3.9 | 2.7 | 6.7 | 0.227 |

| Other | 79.5 | 28.5 | 108.0 | 0.144 | 1.4 | 1.4 | 2.8 | 0.095 |

| Total | 434.6 | 314.2 | 748.8 | 1.000 | 8.2 | 21.2 | 29.5 | 1.000 |

| Ownership/ Use | Kilometre/vehicle | ||

|---|---|---|---|

| Medium | Heavy | Total | |

| For-hire | 22 236 | 88 421 | 70 510 |

| Owner-operator | 28 436 | 70 093 | 49 373 |

| Private | 19 250 | 34 177 | 21 003 |

| Other | 17 610 | 49 123 | 25 926 |

| Total | 18 868 | 67 473 | 39 391 |

Source: Canadian Vehicle Survey, 2009, Statistics Canada

4.4. Trade by transport mode

Table 3 shows preliminary 2010 values of Canada’s merchandise trade with the United States and Mexico, combining imports and exports. Trucking is responsible for the largest proportion of North American merchandise trade by value — 57% in 2010.

| Mode | Trade 2010 (millions of U.S. dollars) |

|---|---|

| Road | 298,832 |

| Rail | 87,151 |

| Pipeline and other | 71,652 |

| Air | 29,267 |

| Marine | 27,305 |

| Total | 514,208 |

Source: North American Transportation Statistics Database

In 2008, employment in the for-hire trucking industry in Canada was estimated at 415 000. It included 182 000 full- and part-time employees of the medium and large for-hire carriers with annual operating revenues of $1 million or more; 26 000 employees of small for-hire carriers with annual operating revenues between $30,000 and $1 million; 104 000 owner-operators with annual operating revenues of $30,000 or more; and 103 000 delivery drivers. Of this total for-hire trucking employment, 36% was in Ontario, 20% in Quebec and 27% in the Prairie provinces, with smaller proportions in the other provinces and territories.

4.5. Bus carriers

Bus carrier companies operate in several sub-markets or sub-industries. A total of 1 371 companies earned service revenues of $6.4 billion, and received an additional $7.2 billion in Government contributions, primarily for urban transit services. Urban transit services earned 53% of total industry revenues excluding those contributions, and school bus services earned another 23%. Scheduled intercity, charter and shuttle services together earned 16% of total revenues.

5. Background on policy development

5.1. National context

In 2009, the Government of Canada committed in the Copenhagen Accord and the Cancun Agreements to reducing, by 2020, total GHG emissions by 17% from 2005 levels, a target that is aligned with that of the United States. An important step toward meeting that goal included the 2010 publication in the Canada Gazette, Part Ⅱ, of the Passenger Automobile and Light Truck Greenhouse Gas Emission Regulations that are aligned with those of the United States.

On May 21, 2010, the Government of Canada and the Government of the United States each announced the development of new regulations to limit GHG emissions from new on-road heavy-duty vehicles. Canada announced that the proposed Regulations would be made under CEPA 1999 and in alignment with those of the United States. On October 25, 2010, the Government of Canada released an initial consultation document describing the key elements being considered in the development of Canadian regulations to seek stakeholder views early in the process.

On August 9, 2011, Environment Canada published a second and more detailed consultation document to provide an additional opportunity for stakeholders to provide comments and to participate in the regulatory development process.

5.2. Canada’s collaboration with the U.S. EPA

Environment Canada, in partnership with Canada’s National Research Council, has conducted joint aerodynamic testing and research with the U.S. EPA as well as heavy-duty vehicle emissions testing at Environment Canada facilities to support regulatory development. This collaboration is taking place under the Canada-U.S. Air Quality Committee and builds on the joint work with the United States on the development and implementation of GHG emission standards for vehicles. This collaboration served to inform the development of the proposed Regulations in Canada.

5.3. Actions in other Canadian jurisdictions

Provinces and territories have not indicated any intention to regulate GHG emissions from new on-road heavy-duty vehicles. Furthermore, provincial environment ministries have communicated strong support for federal Canadian regulations aligned with those of the United Stated.

The provincial and territorial governments set requirements for in-use vehicles including tractor-trailer weights and trailer dimensions. All provinces will continue to be consulted to ensure a consistent pan-Canadian approach to regulating on-road heavy-duty vehicle emissions.

5.4. Actions in international jurisdictions

5.4.1. United States

On November 30, 2010, the National Highway Traffic Safety Administration (NHTSA) and the U.S. EPA jointly published a Proposed Rule describing a set of complementary new proposed regulations for heavy-duty vehicles and engines for model years 2014 and later. On September 15, 2011, the Final Rule was published in the U.S. Federal Register. The U.S. rules establish coordinated federal regulations to address the closely intertwined issues of energy efficiency and climate change under a joint Heavy-Duty National Program. In this joint rulemaking, the NHTSA implements fuel economy standards under the Energy Independence and Security Actof 2007, while the U.S. EPA regulations under the Clean Air Act implement the GHG emission standards for heavy-duty vehicles.

The U.S. National Program is based on a common set of principles, which includes, as stated in the Final Rule: (see footnote 5) “increased use of existing technologies to achieve significant GHG emissions and fuel consumption reductions; a program that starts in 2014 and is fully phased in by 2018; a program that works towards harmonization of methods for determining a vehicle’s GHG and fuel efficiency, recognizing the global nature of the issues and the industry; standards that recognize the commercial needs of the trucking industry; and incentives leading to the early introduction of advanced technologies.”

In 2004, the U.S. EPA launched SmartWay, a voluntary program that encourages the trucking sector to identify strategies and technologies for reducing fuel consumption and CO2e emissions and allows companies to be SmartWay certified.

The SmartWay program has allowed the U.S. EPA to work closely with heavy-duty vehicle manufacturers and fleet operators in evaluating numerous technologies and developing test procedures that achieve fuel and CO2e reductions. The experience and knowledge acquired with SmartWay served in developing the Heavy-Duty National Program of the GHG regulations of the United States.

5.4.2. California

The California Air Resources Board adopted a GHG emission regulation for heavy-duty vehicles in 2008. This regulation is to reduce GHG by improving the fuel efficiency of heavy-duty vehicles through aerodynamic enhancement of vehicles and the use of low rolling resistance tires. This regulation covers tractors that pull a 53-foot or longer box-type semi-trailer, as well as covering the trailers themselves, and applies to the users of these tractor-trailer vehicles.

Since January 1, 2010, 2011 and later model year sleeper-cab heavy-duty tractors pulling a 53-foot or longer box-type trailer operating on a highway within California must be U.S. EPA Certified SmartWay, which requires certified aerodynamic equipment and low rolling resistance tires. As for day-cab tractors, the regulation requires that they be equipped with SmartWay verified low rolling resistance tires. The California regulation also requires that existing tractors, mainly all 2010 model year and older sleeper-cab and day-cab tractors, be equipped with SmartWay verified low rolling resistance tires starting in January 2012. The regulation also includes similar requirements for 53-foot or longer box-type trailers.

5.4.3. Other international regulatory actions to reduce GHGs/fuel consumption of vehicles

Other international jurisdictions have established or are developing regulatory regimes that directly or indirectly serve to reduce GHG emissions from new heavy-duty vehicles.

Japan has implemented the Top-Runner Program, which identifies and designates as the “top-runner” the most fuel-efficient vehicle in each weight range. The program has the objective to improve the fleet average fuel-efficiency of all vehicles in a particular weight range to match that of its top-runner. In the case of heavy-duty vehicles, the most fuel-efficient vehicle of model year 2002 (excluding hybrids) was set as the baseline and regulation would start with model year 2015.

The European Commission is currently developing a new certification procedure and a strategy targeting fuel consumption and CO2e emissions from heavy-duty vehicles. Simulation modelling is being considered. A draft regulation is expected to be completed during 2012. It is expected that mandatory reporting would be effective in 2013–2014 and that possible regulation would be in a 2018–2020 timeframe.

6. Regulatory and non-regulatory options considered

6.1. Status quo approach

Currently, there is no federal requirement in Canada to reduce GHG emissions from new on-road heavy-duty vehicles. Heavy-duty vehicles are an important contributor to overall emissions and reducing GHGs from these vehicles is a key element in meeting the Government’s climate change goals. Maintaining the status quo would make it more difficult for Canada to achieve this goal, while preventing Canadians from benefiting from the associated environmental improvements. Therefore, for the Government of Canada, maintaining the status quo is not an appropriate option for reducing GHG emissions from new heavy-duty vehicles in Canada.

6.2. Voluntary approach

New regulations in the United States will require manufacturers to adopt more GHG-reducing technologies in new heavy-duty vehicles sold in the United States beginning in 2014. However, because of the highly customized nature of the heavy-duty vehicle industry, manufacturers may choose not to install those technologies in vehicles sold in Canada. Therefore, while a voluntary program can result in some emission reductions, it would not necessarily amount to the same emission reductions as a regulatory regime.

6.3. Regulatory approach

Given the importance of addressing climate change, most industrialized countries are moving to establish regulated requirements for the control of fuel consumption and/or GHG reductions from new vehicles. The implementation of a comprehensive set of national standards reflecting a common North American approach for regulating GHG emissions from new on-road heavy-duty vehicles and engines would lead to environmental improvements for Canadians, and provide regulatory certainty for Canadian manufacturers. Aligning Canadian standards with U.S. standards would also set a North American level playing field in the transportation sector.

6.3.1. Regulations under the Motor Vehicle Fuel Consumption Standards Act

The Government of Canada has previously considered reducing GHG emissions through the adoption of vehicle fuel consumption standards under the Motor Vehicle Fuel Consumption Standards Act (MVFCSA). When the Passenger Automobile and Light Truck Greenhouse Gas Emission Regulations were developed in 2010, it was determined that significant amendments were required to the MVFCSA in order to be able to put in place regulations that would align with the U.S. fuel economy standards. Therefore, the approach of proceeding with Canadian fuel consumption regulations under the MVFCSA was then excluded in favour of regulating under CEPA 1999.

6.3.2. Regulations under CEPA 1999

CEPA 1999 enables the implementation of innovative compliance flexibilities such as a system for the banking and trading of emission credits to help meet overall environmental objectives in a manner that provides the regulated industry with maximum compliance flexibility.

This approach is also consistent with the existing use of CEPA 1999 to establish standards limiting smog-forming air pollutant emissions from new vehicles and engines, as well as to regulate GHG emissions from light-duty vehicles under the Passenger Automobile and Light Truck Greenhouse Gas Emission Regulations.

The Government of Canada has determined that establishing regulated heavy-duty vehicle GHG emission standards under CEPA 1999 represents the best option to introduce these proposed Regulations and to align Canada’s requirements with the national regulated standards of the United States.

7. Benefits and costs

The proposed Regulations are estimated to result in a reduction of approximately 19.0 Mt of CO2e in GHG emissions over the lifetime of new on-road heavy-duty vehicles sold between 2014 and 2018 (MY2014–2018), the period during which the proposed Regulations first come into effect (2014) and then are gradually phased into full effect (2015 to 2018). The proposed Regulations are also expected to reduce fuel consumption by 7.2 billion litres over the lifetime of the MY2014–2018 fleet.

Over the lifetime of MY2014–2018 vehicles, the present value of the cost of the proposed Regulations is estimated at $0.8 billion, largely due to the additional vehicle technology costs required by the proposed Regulations. The total benefits are estimated at $5.0 billion, due to the value of GHG reductions ($0.5 billion) and fuel savings ($4.5 billion). Over the lifetime of MY2014–2018 vehicles, the present value of the net benefit of the proposed Regulations is estimated at $4.2 billion. The detailed analysis of benefits and costs is presented below.

7.1. Analytical framework

The approach to cost-benefit analysis identifies, quantifies and monetizes, to the extent possible, the incremental costs and benefits of the proposed Regulations. The cost-benefit analysis framework applied to this study incorporates the following elements:

Incremental impacts: Impacts due to the proposed Regulations are analyzed in terms of changes to vehicle technologies, emissions, and associated costs and benefits in the regulatory scenario compared to the business-as-usual (BAU) scenario. The two scenarios are presented in detail below. The incremental impacts are the differences between the estimated levels of technologies and emissions in the two scenarios, and the differences between the associated costs and benefits in the two scenarios. These differences (incremental impacts) are thus attributed to the proposed Regulations.

Timeframe: The analysis considers new heavy-duty vehicles sold between 2014 and 2018 (MY2014–2018), the period during which the proposed Regulations first come into effect (2014) and then are gradually phased into full effect (2015 to 2018). The analysis assumes that new vehicles survive for up to 30 years. This timeframe is consistent with other analyses, and with Canadian data that shows that few vehicles survive beyond 30 years. Thus the overall timeframe for the analysis is 35 years (2014 to 2048), the total lifespan of the MY2014–2018 new vehicle fleet. The impact of vehicles sold after 2018 is not considered in this analysis, but is expected to be similar to the impact for MY2018.

Costs and benefits have been estimated in monetary terms to the extent possible and are expressed in 2010 Canadian dollars. Whenever this was not possible, due either to lack of appropriate data or difficulties in valuing certain components, incremental impacts were evaluated in qualitative terms. Table 4 summarizes the benefits and costs which were evaluated quantitatively.

| Benefits | Costs |

|---|---|

| Pre-tax fuel savings Avoided GHG damages |

Technology costs Noise, accidents, congestion Government administration |

Discount rate: A social discount rate of 3% is used in the analysis for estimating the present value (2011 base year) of the costs and benefits under the central analysis. This level is within the range prescribed by the Treasury Board Secretariat’s cost-benefit analysis (CBA) guidelines. This is consistent with discount rates used for other GHG related measures in Canada, as well as those used by the U.S. EPA.

7.2. Key data and information

To assess the impact of the proposed Regulations, it was necessary to obtain Canadian estimates of future vehicle sales, fuel prices and monetary values for GHG reductions; to identify the technologies that manufacturers would likely adopt, and the costs they would incur in order to comply with the proposed Regulations; and then to model future vehicle emissions, fuel consumption and distance travelled, with and without the proposed Regulations. These key sources of data and information are described below.

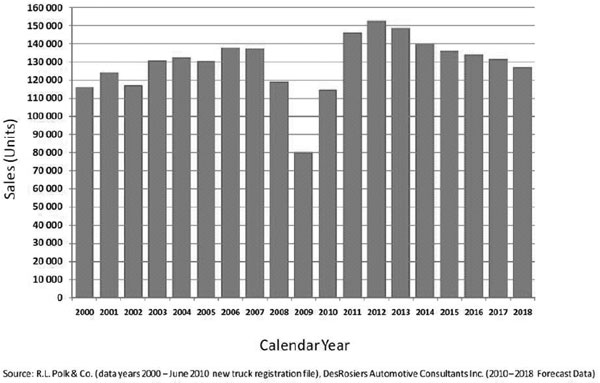

7.2.1. Canadian sales forecast

For years 2011 through 2018, a vehicle sales forecast from DesRosiers Automotive Consultants (DAC) was used in the analysis. For the purpose of this study, all historical (calendar year 2005 through year-to-date June 2010) medium and heavy-duty vehicle data was provided by R. L. Polk (Polk). Using the Polk data file, DAC developed aggregate medium and heavy-duty historical registration data and forecast data using proprietary DAC forecasting methodologies and input from industry representatives. This study required an in-depth review of core Canadian economic variables. A database containing historical and forecast economic factors from calendar year 2000 through 2018 was provided by Environment Canada’s Energy-Economy-Environment Model for Canada (E3MC) in March of 2011. DAC also considered provincial economic forecast data from Informetrica Limited (March 14, 2011), BMO Capital Markets Economics (March 14, 2011) and TD Economics (March 2011). The overall results of the DAC sales report are displayed below, with historical trends shown from 2000 to 2010, and projected trends shown from 2011 to 2018, based on DAC analysis and forecasts:

Figure 1: Sales forecast for Canadian medium and heavy-duty vehicles

The analysis of the proposed Regulations incorporates the same detailed DAC sales estimates, for each vehicle regulatory class, into the modelling of vehicle population growth from 2010 to 2018 for both the BAU and policy scenarios. DAC estimated total sales per calendar year, which are used as a proxy for model year sales in this analysis.

7.2.2. Canadian vehicle emissions modelling

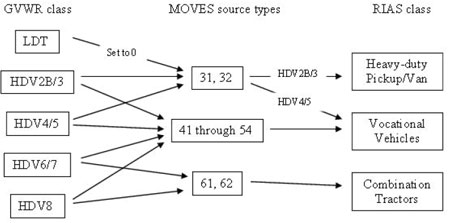

Estimates of Canadian vehicle emissions were developed using methods aligned with those initially developed by the U.S. EPA, together with key Canadian data to reflect the impact of the proposed Regulations. The emissions selected were those linked to climate change, air quality and human health, such as greenhouse gases (GHGs) and criteria air contaminants (CACs). The primary modelling tool used to calculate vehicle emissions was the Motor Vehicle Emissions Simulator (MOVES), which is the U.S. EPA’s official mobile source emission inventory model for heavy-duty vehicles. Key data for Canadian heavy-duty vehicle populations and distance travelled were then incorporated into the most current version of MOVES (MOVES2010a) in order to produce an analysis for Canada of the impacts of the proposed Regulations. Vehicle data collected by gross vehicle weight rating (GVWR) was mapped into MOVES2010a and then categorized according to the vehicle classifications in the proposed Regulations, as described in this RIAS and as shown in figure 2.

Figure 2: GVWR, MOVES and RIAS classes for this analysis

Canadian vehicle populations were estimated for all calendar years 2005 through 2050. For the purposes of this analysis, data purchased from Polk and Co. on the heavy-duty fleet in Canada for calendar years 2005 through 2010, were used by Environment Canada to develop vehicle population and age estimates for those years. After 2010, future vehicle populations are forecasted based on new vehicle sales and the number, age and estimated survival rates of existing vehicles. For years 2011 through to 2018, the DesRosiers sales forecast were used, as discussed above. For years 2019 and beyond, the default MOVES sales rates were used in the absence of Canada specific sales rates beyond 2018. Comprehensive validated survival estimates for Canadian heavy-duty vehicles were not available for this analysis. Instead, MOVES default vehicle survival rate estimates were generally used. These MOVES survival rate estimates appear similar to available Canadian data for vehicles less than 30 years old, but appear to underestimate survival for Canadian vehicles aged 30 years or more. Therefore, an adjustment was made in MOVES for the survival rate of vehicles aged 30 years or more, to make this rate more consistent with available Canadian data.

Along with vehicle populations, vehicle distance travelled is also important in overall emissions estimation for Canada. Estimates of Canadian vehicle kilometres travelled (VKT) and kilometre accumulation rates (KAR) were developed for all calendar years from 2005 through 2050. KAR is the product of VKT divided by the number of vehicles (the population). In 2010, Environment Canada contracted Stewart-Brown Associates (SBA) to generate KARs from inspection and maintenance (I/M) program data in Canada. Specifically, this was the Drive Clean program in Ontario, and the AirCare program in British Columbia. KARs generated in this manner from Ontario and British Columbia were then applied to Canada as a whole. This baseline Canadian KAR data was used to generate Canadian VKT estimates for each vehicle type and age, for all calendar years 2005 through 2010. Then the default MOVES growth rates were used to estimate VKT for the Canadian fleet for the calendar years 2011 to 2050.

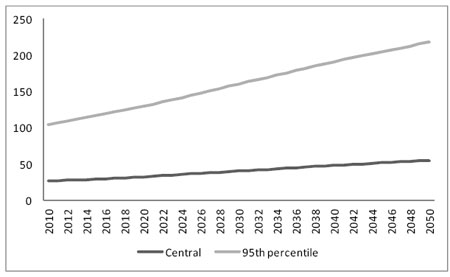

7.2.3. The social cost of carbon (SCC)

The estimated value of avoided damages from GHG reductions is based on the climate change damages avoided at the global level. These damages are usually referred to as the social cost of carbon (SCC). Estimates of the SCC between and within countries vary widely due to challenges in predicting future emissions, climate change, damages and determining the appropriate weight to place on future costs relative to near-term costs (discount rate).

Social cost of carbon values used in this assessment draw on ongoing work being undertaken by Environment Canada (see footnote 6) in collaboration with an interdepartmental federal government technical committee, and in consultation with a number of external academic experts. This work involves reviewing existing literature and other countries’ approaches to valuing greenhouse gas emissions. Preliminary recommendations, based on current literature and, in line with the approach adopted by the U.S. Interagency Working Group on the Social Cost of Carbon, (see footnote 7) are that it is reasonable to estimate SCC values at $26/tonne of CO2 in 2010, increasing at a given percentage each year associated with the expected growth in damages. (see footnote 8) Environment Canada’s review also concludes that a value of $104/tonne in 2010 should be considered, reflecting arguments raised by Weitzman (2011) (see footnote 9) and Pindyck (2011) (see footnote 10) regarding the treatment of right-skewed probability distributions of the SCC in cost-benefit analyses. (see footnote 11) Their argument calls for full consideration of low probability, high-cost climate damage scenarios in cost-benefit analyses to more accurately reflect risk. A value of $104 per tonne does not, however, reflect the extreme end of SCC estimates, as some studies have produced values exceeding $1,000 per tonne of carbon emitted.

The interdepartmental working group on SCC also concluded that it is necessary to continually review the above estimates in order to incorporate advances in physical sciences, economic literature, and modelling to ensure the SCC estimates remain current. Environment Canada will continue to collaborate with the federal technical committee and outside experts to review and incorporate as appropriate new research on SCC into the future.

Figure 3: SCC estimates (2010 CAN$/tonne)

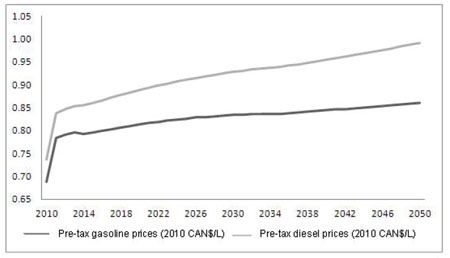

7.2.4. Fuel prices

Fuel price forecasts for both gasoline and diesel were adopted from Environment Canada’s E3MC model for the period of 2010 to 2035. The E3MC model is an end-use model that incorporates the National Energy Board’s (NEB) forecast for West Texas Intermediate crude oil price as reported in the NEB’s Energy Supply and Demand Projections to 2035 — Market Energy Assessment. (see footnote 12) The E3MC model uses this data to generate fuel price forecasts which are primarily based on consumer-choice modelling and historical relationships between macroeconomic and fuel price variables. Fuel prices beyond 2035 were projected based on the E3MC model average growth rate of fuel prices for the years 2020 to 2035. Uncertainty regarding these future fuel price forecasts was also considered in a sensitivity analysis.

Pre-tax fuel prices were used in the analysis as taxes are not generally considered in cost-benefit analyses given that they are a transfer rather than an economic cost. Post-tax gasoline and diesel price forecasts were used in a separate payback analysis. Due to regional variations in fuel taxes, post-tax fuel prices were calculated by weighting fuel sales by regional populations and then adding regional taxes accordingly.

Figure 4: Gas and diesel prices (2010 CAN$/L)

7.2.5. Vehicle technologies that reduce GHG emissions

Information on vehicle technologies, costs and adoption rates was obtained from the U.S. EPA’s regulatory impact analysis of its Final Rulemaking to Establish Greenhouse Gas Emission Standards for Medium- and Heavy-Duty Engines and Vehicles. (see footnote 13)

The technologies considered in this analysis are those most likely to be adopted during the period of the analysis (MY2014–2018) in response to the proposed Regulations, having been developed and being available to some extent already, and already shown by the U.S. EPA to be cost-effective. Table 5 below presents a list of technologies that manufacturers are likely to choose in order to comply with the proposed Regulations.

| Combination trucks | Engine improvements, more use of low rolling resistance tires, mass reduction, improved aerodynamics, increased use of auxiliary power units, reduced air conditioning leakage |

|---|---|

| Vocational vehicles | Engine improvements, more use of low rolling resistance tires |

Heavy-duty |

Engine improvements, more use of low rolling resistance tires, mass reduction, improved transmissions, reduced accessory loads |

7.2.6. Key assumptions

- Under the business-as-usual scenario, technology choices for MY2014–2018 remain the same as for MY2010. This assumption is further discussed in section 7.3.1 and in the “Rationale” section, and is evaluated in the “Sensitivity analysis” section.

- Under the policy scenario, all technology manufacturing costs will be passed onto vehicle purchasers, who will recoup these costs through fuel savings achieved by the technologies adopted to meet the proposed Regulations. This assumption is evaluated in the payback analysis section.

7.3. Analytical scenarios

This analysis considers two scenarios: a business-as-usual (BAU) scenario, which assumes the proposed Regulations are not implemented, and a regulatory scenario, which assumes the proposed Regulations are implemented. These two scenarios are based on the same volume of forecasted vehicle sales between 2014 and 2018. The differences between the scenarios are considered in terms of the estimated changes in vehicle technology choices in the regulatory scenario, and the impacts of these changes on vehicle costs, distance travelled, fuel consumption and emissions.

The analysis assumes that these technology changes will only occur in response to the proposed Regulations; thus, the BAU rate of technology change is zero. This assumption may underestimate any “natural” technology changes that could occur throughout the North American market due to normal technological development in the absence of any regulations, or “complementary” technology changes that might occur in Canada either in response to similar regulations in the United States or in anticipation of the proposed Regulations in Canada. These alternate rates of technology change are difficult to estimate, but are considered in a sensitivity analysis. Whatever the proportion of technology change attributable to the proposed Regulations, the entirety of the changes shown in the analysis is expected to occur, and the analysis can be interpreted to identify the entire costs that Canadians can expect to bear and the benefits they can expect to receive over the lifetimes of MY2014–2018 vehicles.

7.3.1. Business-as-usual scenario

The business-as-usual scenario assumes that the proposed Regulations are not implemented and that vehicle technologies which affect GHG emissions will remain unchanged over the sales period of the analysis. The analysis considers projected vehicle sales for 2014 to 2018 and estimates the impacts of these new vehicles in terms of distance travelled, fuel consumption and emissions, given that technologies will remain constant.

7.3.2. Regulatory scenario

The regulatory scenario assumes that certain GHG emission-reducing technologies will be chosen to comply with the proposed Regulations. These are assumed to be already existing technologies, so manufacturers can choose among available technologies and increase their usage in new vehicles in order to comply with the proposed Regulations. Given that technologies will change in this scenario, the analysis considers the same BAU projected vehicle sales for 2014 to 2018, and estimates the incremental impacts of the technical modifications to these vehicles in terms of changes in vehicle costs, distance travelled, fuel consumption and emissions.

7.4. Costs

7.4.1. Vehicle technology costs

The proposed Regulations align with the proposed national GHG emission standards of the U.S. EPA for the 2014 and later model years, in order to provide manufacturers with a common set of vehicle GHG emission standards. Therefore, the analysis of the proposed Canadian Regulations assumes that manufacturers will likely adopt similar technologies to meet these proposed common emission standards.

The U.S. EPA selected likely technology choices from existing technologies based on engineering analyses, estimated increased adoption rates for these technologies in order to comply with the proposed U.S. EPA standards, and then estimated the redesign and application costs per vehicle for those technology packages.

The U.S. EPA assessment of technologies that would be available for each of the engine classes and sub-categories of vehicles and the estimates of their effectiveness and costs were guided by published research and independent summary assessments. They first estimated the baseline emissions and fuel consumption rates for each of the regulated subcategories of engines and vehicles. It was assumed that these rates would remain unchanged in the absence of the standards. Then, for each subcategory of engine, they identified technologies which could be applied practically and cost-effectively. Effectiveness and costs of each technology were estimated and applied independently, then applied in combination. The availability and increase in penetration rates of technologies were assessed together with effectiveness and costs for each model year from 2014 to 2018. Costs were initially estimated as the direct costs to manufacturers of materials, components and assembly, to which some addition was required to represent development costs, the contribution of the manufacturer’s corporate resources and costs of distribution.

Given the integration of the North-American vehicle manufacturing sector and the alignment of the proposed Canadian Regulations with the U.S. EPA standards, the same U.S. EPA-estimated vehicle technology choices and adoption rates, and the same proportional costs per vehicle, adjusted for exchange rates, were used as in the U.S. EPA analysis. The resulting estimates of the present value of the costs of the technologies required to meet the proposed Regulations are presented in Table 6.

| MY2014 | MY2015 | MY2016 | MY2017 | MY2018 | Combined MYs 2014–18 | |

|---|---|---|---|---|---|---|

| Present value of technology costs | 138 | 133 | 135 | 138 | 151 | 695 |

MY = lifetime (30 years) impacts for each year of vehicle sales. Present value in 2010 CAN$, using a 3% discount rate.

The proposed Regulations would also include a system of CO2e emission credits to help meet overall environmental objectives in a manner that provides the regulated industry with compliance flexibility. As use of these credits is difficult to predict with any precision, the analysis did not model the benefits of these compliance flexibilities. It is therefore reasonable to conclude that the costs of vehicle technology may be somewhat overestimated.

The analysis of the proposed Regulations assumes that manufacturers will pass the GHG emission-reducing vehicle technology costs to their purchasers. Because these technologies are estimated to also generate substantial fuel savings for vehicle owners and operators, the proposed Regulations are assumed not to impact on the volume of new heavy-duty vehicle sales. No other potential operating cost impacts of new technologies (e.g. maintenance and repairs) were considered in the analysis, as any such incremental costs are expected to be quite small in relation to expected fuel savings.

7.4.2. Government costs

Costs of the Regulations to the Government of Canada fall into three principal categories: compliance promotion costs, enforcement costs, and regulatory program costs. The estimates of these are described below:

Compliance promotion: The overall present value of costs over the 2014–2018 period is estimated at approximately $100,000. Compliance promotion activities include information sessions for manufacturers and importers on the main requirements of the Regulations, in particular new emission standards and report submission. In subsequent years, the annual costs will be $20,000 (undiscounted) per year, and the compliance promotion activities would be adjusted according to the regulated community compliance level and to the compliance strategy.

Enforcement: The present value of overall costs over the 2014–2018 period is estimated at approximately $500,000 and will be used for inspections (which includes operation and maintenance costs, transportation and sampling costs), investigations, measures to deal with alleged violations (including warnings, environmental protection compliance orders and injunctions) and prosecutions.

Regulatory administration: The present value of overall costs over the 2014–2018 period is estimated at approximately $8 million. These costs include amendments to the Regulations, regulatory administration and verification testing, and also include salaries, operation and maintenance. Regulatory administration would be used to develop and maintain a reporting system to compile data submitted by companies related to their fleet emissions and related credits or deficits for each model year fleet. The costs for verification testing would be used to deliver and administer the testing and emissions verification program, including associated laboratory costs and vehicle and engine acquisition. These costs also include an upgrade to the testing facilities and associated equipment to accommodate heavy-duty vehicle and engine testing.

The present value of the costs related to these three categories are estimated to total $8.6 million over the 2014–2018 period in this analysis, and are presented in Table 7.

| 2014 | 2015 | 2016 | 2017 | 2018 | 5-Year Total | |

|---|---|---|---|---|---|---|

| Present value of compliance promotion costs | 0.035 | 0.017 | 0.017 | 0.016 | 0.016 | 0.100 |

| Present value of enforcement costs | 0.113 | 0.110 | 0.107 | 0.104 | 0.101 | 0.534 |

| Present value of regulatory program costs | 1.684 | 1.584 | 1.546 | 1.582 | 1.536 | 7.932 |

| Total | 1.833 | 1.711 | 1.670 | 1.701 | 1.652 | 8.566 |

Due to rounding, some of the totals may not match. Present value in 2010 CAN$, using a 3% discount rate.

7.4.3. Accidents, congestion and noise

As fuel savings lower vehicle operating costs, it is assumed that there will be some increase in vehicle distance travelled, which could lead to more accidents, congestion and noise. This analysis assumes that heavy-duty vehicle owners consider these savings within the total cost of vehicle operation. The increase in vehicle distance travelled in response to lower vehicle operating costs is referred to as the “rebound” effect, and is measured here in vehicle-kilometres travelled (VKT).

For heavy-duty vehicles, the U.S. EPA estimated the net rebound rate to be small overall and to vary by vehicle type: an approximate 0.5% to 1.5% increase in annual VKT per vehicle in response to total vehicle operating cost savings due to fuel savings. The Canadian analysis used the same rebound rates as the U.S. EPA, and applied them to annual Canadian fleet estimates of baseline VKT from MOVES in order to estimate the increase in VKT attributable to the rebound effect.

There are no identified Canadian estimates of heavy-duty vehicle costs per kilometre for accidents, congestion and noise. For Class 2B and Class 3 heavy-duty vehicles, this analysis used Canadian estimates for light-duty pickup trucks and vans. This is the same approach used by the U.S. EPA. The Canadian estimates for these vehicles are 46% lower than the U.S. EPA’s estimates. This analysis applied the U.S. EPA’s estimates per kilometre for heavy-duty vocational vehicles and tractors, assuming that Canadian estimates would also be 46% lower than the U.S. EPA’s estimates for the same heavy-duty vehicle classes. These per-kilometre cost estimates for accidents, congestion and noise were then applied to the Canadian VKT rebound estimates in order to obtain estimates of the overall value of accidents, congestion and noise for each vehicle class in this analysis. The results are presented below.

| MY2014 | MY2015 | MY2016 | MY2017 | MY2018 | Combined MYs 2014–18 | |

|---|---|---|---|---|---|---|

| Present value of noise, accidents, and congestion | 26 | 25 | 25 | 24 | 23 | 123 |

MY= lifetime (30 years) impacts for each year of vehicle sales. Present value in 2010 CAN$, using a 3% discount rate.

7.5. Benefits

7.5.1. GHG emissions reductions

The MOVES emissions model was used to estimate the impact of the proposed Regulations in terms of reductions in vehicle GHG emissions, as presented in Table 9 below. The proposed Regulations are estimated to result in a lifetime model-year reduction of 2.9 Mt beginning in MY2014 and increasing each year to 5.3 Mt for MY2018. Thus, as the proposed Regulations come into full effect over the MY2014–2018 period, they will result in a cumulative lifetime GHG emission reduction of 19 Mt arising from new vehicles entering the market in these five years.

For MY2019 and subsequent model years, the proposed Regulations would remain in full effect, and thus the lifetime reductions that would be observed under a regulatory scenario would likely be similar to the MY2018 level of 5.3 Mt for each subsequent MY, assuming similar sales and other modelling parameters. However, looking beyond MY2018, it also becomes more likely that some of these GHG emission reductions would have occurred even in the absence of the proposed Regulations and could not therefore be fully attributed to the proposed Regulations.

7.5.2. Value of avoided GHG emission damages

The estimated value of avoided damages from GHG reductions is based on the climate change damages avoided at the global level. Based on an estimated SCC of $26/tonne, the present value of incremental GHG emission reductions under the proposed Regulations is estimated to be over $0.5 billion over the lifespan of the MY2014–2018 new vehicle fleet. Under the $104/tonne SCC estimate, the present value of incremental GHG emission reductions would be estimated at over $1.8 billion for the 2014–2018 model year vehicles.

| MY2014 | MY2015 | MY2016 | MY2017 | MY2018 | Combined MYs 2014–18 | |

|---|---|---|---|---|---|---|

| Reduction in

GHG emissions — undiscounted (Mt CO2e) |

2.9 | 3.0 | 3.2 | 4.6 | 5.3 | 19.0 |

| Present value of

the reduction in GHG emissions (SCC at $26/tonne) |

73 | 74 | 80 | 115 | 130 | 472 |

| Present value of

the reduction in GHG emissions (SCC at $104/tonne) |

283 | 288 | 311 | 445 | 503 | 1,831 |

MY= lifetime (30 years) impacts for each year of vehicle sales. Due to rounding, some of the totals may not match. Present value in 2010 CAN$, using a 3% discount rate.

7.5.3. Fuel savings benefits

Manufacturers are expected to meet the requirements of the proposed Regulations by adopting vehicle technologies that reduce GHG emissions. Most of these technologies (e.g. low rolling resistance tires and improved aerodynamics) will achieve these GHG emission reductions by improving vehicle energy efficiency. MOVES was used to estimate vehicle energy efficiency improvements due to vehicle technology improvements, and then these energy savings were converted to fuel savings using standard metrics. Thus these technologies are expected to reduce fuel consumption by 7.2 billion litres (undiscounted) over the lifetime of the MY2014–2018 fleet, as presented in Table 10 below.

Based on projected fuel prices, the benefits to vehicle owners arising from these fuel reductions are estimated to be $4.5 billion in fuel savings, and these cumulative savings are estimated to outweigh the technology costs ($0.7 billion) by a ratio of more than 6:1 over the lifetime of the MY2014–2018 fleet. Fuel prices are calculated pre-tax, so vehicle owners could expect higher savings than those resulting from this analysis. A post-tax payback analysis for vehicle owners is also presented in section 11.

Fuel savings are also expected to reduce the frequency of refuelling, which is a time-saving benefit for vehicle operators. The analysis used refuelling fill rates to calculate the total time saved due to reduced fuel consumption. The value of these time savings was calculated using an estimated mean wage rate for a typical truck driver ($23.33 per hour in 2010 CAN$). (see footnote 14) Using these values, the benefits of refuelling time savings due to the proposed Regulations are expected to be $34 million over the lifetime of the MY2014–2018 fleet, as presented in Table 10.

| MY2014 | MY2015 | MY2016 | MY2017 | MY2018 | Combined MYs 2014–18 | |

|---|---|---|---|---|---|---|

| Fuel savings — undiscounted (million litres) | 1,080 | 1,111 | 1,215 | 1,758 | 2,015 | 7,179 |

| Present value of fuel savings | 716 | 718 | 764 | 1,079 | 1,204 | 4,481 |

| Present value of reduced refuelling time | 5 | 5 | 6 | 8 | 10 | 34 |

| Present value of the sum of fuel benefits | 720 | 723 | 770 | 1,088 | 1,214 | 4,515 |

MY = lifetime (30 years) impacts for each year of vehicle sales. Due to rounding, some of the totals may not match. Fuel savings are pre-tax. Present value in 2010 CAN$, using a 3% discount rate.

8. Non-quantified impacts

8.1. Fuel savings impacts on upstream petroleum sector

Canada is a small open economy and a price-taker in the world petroleum market. The estimated reduction in domestic fuel consumption resulting from the proposed Regulations would therefore not be expected to impact on the price of petroleum. Reduced domestic fuel consumption from any fuel savings resulting from the proposed Regulations would therefore be expected to be redirected from domestic consumption to increased exports, with no incremental impact on the upstream petroleum sector.

8.2. Criteria air contaminant impacts

The proposed Regulations are also expected to impact on CACs such as CO, NOx, PM2.5, SOx and VOC. Overall it is expected that vehicle emissions of most CACs will decrease slightly in response to the proposed Regulations, primarily due to anticipated fuel savings. Conversely, it is anticipated that emissions of PM2.5 will rise slightly, primarily due to the expected increased use of diesel-powered auxiliary power units as a fuel saving measure for extended idling in tractors. The net impact of these changes in emissions of CACs on air quality, and the resulting impacts on human health are expected to be very minor. Given the small scale of the expected CAC emissions and the challenges in estimating their value, these impacts have not been quantified.

8.3. Regulatory certainty and reduced compliance costs for manufacturers

The proposed Regulations are designed to align with similar regulations being introduced in the United States in 2014. The heavy-duty vehicle manufacturing sectors in Canada and the United States are highly integrated, so there are several benefits to regulatory alignment between the two countries. First, responding to new United States regulations with proposed Regulations in Canada provides a degree of regulatory certainty for Canadian manufacturers, which should facilitate their investment decision-making.

Then, by aligning regulations, as opposed to establishing different regulatory requirements than the United States, the proposed Regulations will further benefit Canadian companies subject to these regulations. Canadian companies manufacturing and/or importing into Canada vehicles that are concurrently sold in the United States can use U.S. information and data, such as emission tests results, to demonstrate compliance with the proposed standards. This significantly reduces the companies’ compliance assessment and administrative costs. Aligned regulations would also set a North American level playing field in the transportation sector by preventing any manufacturer from producing less expensive and higher emitting vehicles, and therefore putting other manufacturers in a competitive disadvantage. These benefits have been assessed qualitatively, as there are no available quantified estimates of the benefits of regulatory alignment.

9. Summary of costs and benefits

Over the lifetime of MY2014–2018 vehicles, the present value of the cost of the proposed Regulations is estimated at $0.8 billion, largely due to the additional vehicle technology costs required by the proposed Regulations. The total benefits for MY2014–2018 are estimated at $5.0 billion, due to the value of GHG reductions ($0.5 billion) and fuel savings ($4.5 billion). Over the lifetime of MY2014–2018 vehicles, the present value of the net benefits of the proposed Regulations is estimated at $4.2 billion. The results of the cost-benefit analysis of the proposed Regulations are presented in Table 11.

| Incremental

costs and benefits (millions of dollars) |

MY2014 | MY2015 | MY2016 | MY2017 | MY2018 | Combined MYs 2014–18 |

|---|---|---|---|---|---|---|

Monetized costs A. Sector costs |

||||||

| Present value of the technology costs | 138 | 133 | 135 | 138 | 151 | 695 |

| B. Societal costs | ||||||

| Present value of the noise, accidents and congestion | 26 | 25 | 25 | 24 | 23 | 123 |

| Present value of the government administration costs | 2 | 2 | 2 | 2 | 2 | 9 |

| Sum of costs | 166 | 160 | 162 | 164 | 175 | 827 |

Monetized benefits A. Sector benefits |

||||||

| Present value of the pre-tax fuel savings | 716 | 718 | 764 | 1,079 | 1,204 | 4,481 |

| Present value of the reduced refuelling time | 5 | 5 | 6 | 8 | 10 | 34 |

| B. Societal benefits | ||||||

| Present value of reduction in GHG emissions (SCC at $26/tonne) | 73 | 74 | 80 | 115 | 130 | 472 |

| Sum of benefits | 793 | 798 | 850 | 1,202 | 1,344 | 4,987 |

| NET BENEFIT — with SCC at $26/tonne | 627 | 638 | 688 | 1,039 | 1,168 | 4,160 |

| NET BENEFIT — with alternate SCC at $104/tonne | 837 | 852 | 919 | 1,369 | 1,542 | 5,519 |

| Qualitative and non-monetized impacts | Positive regulatory alignment impacts No net critical air contaminants impacts No net upstream fuel impacts |

|||||

MY = lifetime (30 years) impacts for each year of vehicle sales. Present value in 2010 CAN$, using a 3% discount rate. Due to rounding, some of the totals may not match.

The analysis indicates that in the first years of the proposed Regulations (MY2014–16), the lifetime costs will range from $160 to $166 million, the lifetime benefits will range from $793 to $850 million, and the lifetime net benefits will range from $627 to $688 million. These values reflect the impacts of the initial levels of compliance standards in the proposed Regulations, and the level of vehicles sales over this period. For MY2017–18, the proposed Regulations introduce higher compliance standards, resulting in higher costs ($164 to $175 million), higher benefits ($1,202 to $1,344 million) and higher net benefits ($1,039 to $1,168 million).

For MY2019 and subsequent model years, the proposed Regulations maintain the MY2018 compliance standards, and, all else being equal, results would be expected to be similar to those for MY2018, given similar volumes of annual vehicle sales.

| MY2014 | MY2015 | MY2016 | MY2017 | MY2018 | Combined MYs 2014–18 | |

|---|---|---|---|---|---|---|

| Benefit to cost ratio — discounted at 3% (SCC at $26/tonne) | 4.8 | 5.0 | 5.2 | 7.4 | 7.7 | 6.0 |

| Fuel savings — undiscounted (million litres) | 1,080 | 1,111 | 1,215 | 1,758 | 2,015 | 7,179 |

Reduction in GHG emissions — undiscounted |

2.9 | 3.0 | 3.2 | 4.6 | 5.3 | 19.0 |

| Present value of CO2 damages avoided (Mt CO2e) | 2.7 | 2.7 | 2.9 | 4.2 | 4.7 | 17.2 |

| Present value of the socio-economic costs which equal total costs minus non-GHG benefits (in millions of 2010 CAN$) | –3,688 | |||||

| Present value of the socio-economic cost per tonne of CO2 damages avoided ($/tonne) | –215 | |||||

MY = lifetime (30 years) impacts for each year of vehicle sales. CO2 damages are grown at 2% per year to reflect the growth in climate change damages over time as emissions cumulate in the atmosphere. Present value uses a 3% discount rate. Due to rounding, some of the totals may not match.

For the proposed Regulations, the benefit to cost ratio is estimated to be 6 to 1 for the overall MY2014–2018 fleet of new heavy-duty vehicles. The benefit to cost ratio also increases from 4.8 to 1 for MY2014 to 7.7 to 1 for MY2018. This trend reflects the positive impact of fully implementing the proposed Regulations.

Over the lifetime of the MY2014–2018 fleet, the proposed Regulations are expected to reduce fuel consumption by 7.2 billion litres, and reduce GHG emissions (CO2e) by 19.0 Mt.

In order to allow a comparison of social cost-effectiveness with other government climate change measures, we present the socio-economic cost per tonne of CO2 emissions avoided. This ratio is calculated by subtracting the present value of the sum of all non-GHG benefits from the present value of the costs of the proposed Regulations, and then dividing by the present value of the tonnes of CO2 emissions avoided. This ratio measures the lifetime socio-economic costs of reducing GHG emissions if the proposed Regulations are implemented over the MY2014–2018 analysis period, on a per tonne basis. For the proposed Regulations, the ratio of –$215/tonne is negative, indicating that the carbon emission reduction under the proposed Regulations would result in a net benefit rather than net cost.

10. Sensitivity analysis

A sensitivity analysis was done to consider the impact of uncertainty in key variables (i.e. changes in estimated sales, technology costs, fuel prices and discount rates). The sensitivity analysis shows that the results are robust in terms of demonstrating positive net benefits for the proposed Regulations across a broad range of plausible values for variables and assumptions.

| SENSITIVITY VARIABLES | NET BENEFIT | ||

|---|---|---|---|

| Lower | Central | Higher | |

| 1. Sensitivity to sales forecasts: (-30%, central, +30%) | 2,909 | 4,160 | 5,411 |

| 2. Sensitivity to technology costs: (+30%, central, -30%) | 3,966 | 4,160 | 4,354 |

| 3. Sensitivity to fuel prices: (-30%, central, +30%) | 2,816 | 4,160 | 5,504 |

| 4. Sensitivity to discount rates: (7%, 3%, undiscounted) | 2,669 | 4,160 | 6,307 |

All values are in millions of 2010 CAN$, using a 3% discount rate except where otherwise indicated.

A sensitivity analysis was also done to consider the impact of the assumption in the business-as-usual scenario (BAU) regarding the rate of technology change in the absence of the proposed Regulations. Throughout the regulatory analysis, it is assumed that this rate is zero. This sensitivity analysis shows, however, that by assuming instead that some technology change would occur even in the absence of the proposed Regulations, costs and benefits attributable to the Regulations would be reduced proportionately.

| BAU rate of technology adoption | 0% | 25% | 50% |

|---|---|---|---|

| Costs | 827 | 623 | 418 |

| Benefits | 4,987 | 3,740 | 2,494 |

| Net benefit | 4,160 | 3,118 | 2,076 |

| Rate of technology adoption attributable to the Regulations | 100% | 75% | 50% |

All figures are in million 2010CAN$, using a 3% discount rate.

The regulatory analysis provides information to the public and stakeholders about the costs they can expect to bear and the benefits they can expect to receive over the lifetime of new heavy-duty vehicles sold with more GHG emission reducing technologies. It is unclear whether some or many of the technologies would be adopted in the absence of the proposed Regulations. To the extent that they would, the costs and the benefits attributed to the proposed Regulations would be overstated. The sensitivity analysis shows that even if the BAU rate of technology adoption was as high as 50%, the proposed Regulations would still result in a positive net benefit.

11. Distributional impacts

The automotive manufacturing sector is concentrated within Ontario and Quebec, with other plants in Manitoba, Saskatchewan, Alberta, and British Columbia. (see footnote 15) The compliance costs of the proposed Regulations are estimated to increase the production cost of vehicles for manufacturers by more than $130 million per year. These costs are expected to be distributed according to the future purchases and use of these regulated heavy-duty vehicles, and it is not expected that there will be significantly disproportionate impacts on any region within Canada.

The proposed Regulations will require manufacturers to comply by adopting more GHG emission reducing technologies in new vehicles. The analysis of the proposed Regulations assumes that manufacturers will generally be able to pass on all GHG emission reducing technology costs to vehicle purchasers, because these purchase costs can be shown to be quickly recouped through fuel savings. All new heavy-duty vehicle purchasers are assumed to be businesses, not consumers, given that heavy-duty vehicles are generally designed for commercial use. Businesses are expected to evaluate costs and benefits in terms of the expected payback on investment costs.

A simple payback analysis of MY2018 vehicle costs (Table 15) shows that average first-year fuel savings (including taxes) for owners and operators are expected to be greater than the manufacturer’s average costs for adding new technologies. For all three heavy-duty vehicle regulatory classes, the payback period is less than one year.

| MY2018 | HD Pickups and Trucks | Vocation Vehicles | Combination Tractors |

|---|---|---|---|

| Technology costs per new vehicle | 1,071 | 455 | 6,476 |

| First-year fuel savings per new vehicle | 2,269 | 1,200 | 9,636 |

| Net first-year savings | 1,198 | 745 | 3,160 |

Fuel prices are post-tax, by MY2018 vehicle class. All figures are in 2010 CAN$.

Technology costs are the average cost for vehicles in their respective RIAS class.

12. Rationale