Canada Gazette, Part I, Volume 152, Number 42: Calculation of Contribution Rates Regulations, 2018

October 20, 2018

Statutory authority

Canada Pension Plan

Sponsoring department

Department of Finance

REGULATORY IMPACT ANALYSIS STATEMENT

(This statement is not part of the regulations.)

Issues

A stronger Canada Pension Plan (CPP) is now a reality with the coming into force of Bill C-26, An Act to amend the Canada Pension Plan, the Canada Pension Plan Investment Board Act and the Income Tax Act, on March 3, 2017. The CPP enhancement will increase income replacement under the Plan and raise the maximum amount of earnings covered by the CPP.

A framework is now required to ensure that the enhanced portion of the Plan is appropriately funded over time. The Calculation of Contribution Rates Regulations, 2018 and the Additional Canada Pension Plan Sustainability Regulations (the proposed regulations) provide this necessary framework, consistent with the full-funding principle underpinning the CPP enhancement.

Background

The CPP is a mandatory public pension plan that provides a basic level of earnings replacement for workers throughout Canada, except in Quebec where the Québec Pension Plan (QPP) provides similar benefits.

Base CPP

The base CPP retirement benefit replaces 25% of career average earnings up to a maximum level of eligible earnings (year's maximum pensionable earnings or YMPE), which approximates the average Canadian wage ($55,900 in 2018). Earnings over an entire career, with certain exclusions, are taken into account when calculating benefits. A full CPP retirement benefit is available at age 65; however, it can be taken up on an actuarially adjusted basis with a permanent reduction as early as age 60, or with a permanent increase as late as age 70. Benefits are also provided for workers who become disabled and for spouses of contributors who pass away.

The base CPP is funded by contributions equalling 9.9% of earnings as well as by investment income. The contribution rate is split evenly between employers and employees, with the self-employed paying both shares.

The CPP is a shared responsibility, with the Canadian federal government and the 10 provincial governments serving as joint stewards of the plan. Federal and provincial ministers of finance formally review the CPP every three years and determine whether changes are required to benefits and/or contributions. As part of this triennial review, the Chief Actuary of Canada prepares a report on the CPP's financial state. This report, which is tabled in Parliament, launches the triennial review and provides context for the review by ministers of finance. Major changes to the federal legislation governing the CPP require the formal consent of the Parliament of Canada and at least 7 provinces representing two thirds of the population of the 10 provinces.

In the latest report as at December 31, 2015, the Chief Actuary concluded that the base CPP is sustainable at its current benefit and contribution levels across a 75-year projected horizon. CPP legislation also requires the Chief Actuary to calculate the minimum contribution rate for the base CPP, which is the lowest rate sufficient to financially sustain the base portion of the Plan over the long term without further increases. In the latest report (29th Actuarial Report on the CPP), the minimum contribution rate for the base CPP is 9.82% for years 2019 to 2033 and 9.80% for year 2034 and thereafter. The minimum contribution rate for the base CPP is calculated in accordance with the methodology in the Calculation of Contribution Rates Regulations, 2007.

The CPP legislation also details the circumstances in which the base CPP is considered to be in an unsustainable position and the automatic measures that would be taken to remedy a deficit in the event that Canada's ministers of finance are unable to reach a consensus.

CPP enhancement (or additional CPP)

Canada's federal and provincial ministers of finance agreed in June 2016 to enhance the CPP in response to growing concerns that young Canadians face different, and potentially more difficult, challenges in saving for retirement. The agreement, legislated under Bill C-26, increases the maximum level of earnings replacement provided by the CPP from 25% of eligible earnings to 33.33%, and extends the range of eligible earnings by 14% (i.e. if it were in place in 2018, this would extend eligible earnings from $55,900 to $63,700). Plan members will also need to contribute over the full 40-year accrual period to receive full benefits, although partial benefits will be available sooner based on the number of contributing years. As a result, young Canadians, who face the most uncertain savings prospects, will earn the largest benefit. These changes will increase the maximum CPP retirement pension over time by about 50%. Benefits will also be increased for workers who become disabled and for the spouses of contributors who pass away.footnote 1

To pay for the additional benefits, contribution rates will increase gradually over a seven-year period, starting in 2019:

- A contribution rate on earnings below the YMPE (the first additional contribution rate) will be phased in over five years and be set at 2% from 2023 onward;

- Beginning in 2024, a separate contribution rate of 8% will be implemented on earnings between the YMPE and a new upper earnings limit (the second additional contribution rate); and

- The new upper earnings limit will be phased in over two years, extending the earnings range by an additional 14%.

Canada's Chief Actuary has confirmed this is sufficient to ensure the sustainability of the CPP enhancement for at least 75 years. CPP legislation also requires the Chief Actuary to calculate the minimum contribution rates for the CPP enhancement. In the latest report (29th Actuarial Report on the CPP), the additional minimum contribution rates for the CPP enhancement are 1.98% over the base earnings range (first additional minimum contribution rate or FAMCR) and 7.92% over the additional earnings range (second additional minimum contribution rate or SAMCR).

CPP legislation provides authority to the Minister of Finance for the development of regulations to determine the actuarial methodology for the calculation of the enhancement's minimum contribution rates, as well as the default mechanisms to bring it back to sustainability in the event it is deemed to be outside prudent parameters and ministers of finance are unable to reach consensus.

New financing model

The base CPP was established in 1966 as a pay-as-you-go pension with a small contingency reserve, funded through a modest 3.6% of contributory earnings. Due to demographic and economic changes, by 1995 the Chief Actuary of Canada estimated that the contributory rate would have to increase to over 14% by 2030. In 1997, federal and provincial governments agreed to

- reduce the growth rate of benefits;

- increase the contribution rate to 9.9% by 2003 and remain at this rate indefinitely; and

- use the accumulated surplus, and associated investment returns, to build a more sizeable contingency reserve to be drawn down as the baby boom generation retired.

To maximize investment returns without undue risk of loss, federal and provincial governments created the Canada Pension Plan Investment Board (CPPIB). In addition, the legislation governing the CPP was changed to require that any new enhancement to CPP benefits be fully funded. This requirement was put in place to ensure that the CPP remains financially sustainable going forward.

As of 2018, benefits payable under the base CPP are entirely covered by contributions of current workers, with investment income only beginning to be drawn in the early 2020s. Over the long term, the base CPP will remain primarily funded from contributions, with roughly 65% of total revenues coming from contributions and 35% from investment returns.

Consistent with the legislative requirement, the CPP enhancement will be fully funded. This will have the effect of ensuring that each generation's contributions, and the associated investment returns, are sufficient to pay for their benefits. Full funding has the effect of equalizing returns on contributions to the CPP enhancement across generations.

Unlike the base CPP, the CPP enhancement will rely more heavily on investment income rather than contributions to pay for benefits. Due to the full funding requirement, the CPP enhancement will accumulate assets quickly in the first decades of the Plan and will begin to draw on investment returns to pay for benefits beginning in the 2050s. Over the long term, roughly 70% of total income is expected to come from investment returns.

While the CPP enhancement will be more resilient to demographic pressures, it will be more exposed to market volatility. Assets associated with the CPP enhancement are also projected to build up more quickly, surpassing the base CPP assets by 2055, notwithstanding the smaller benefits payable under the enhancement.

As a result, the framework for the financial sustainability of the CPP enhancement should reflect these differences in financing with the base CPP.

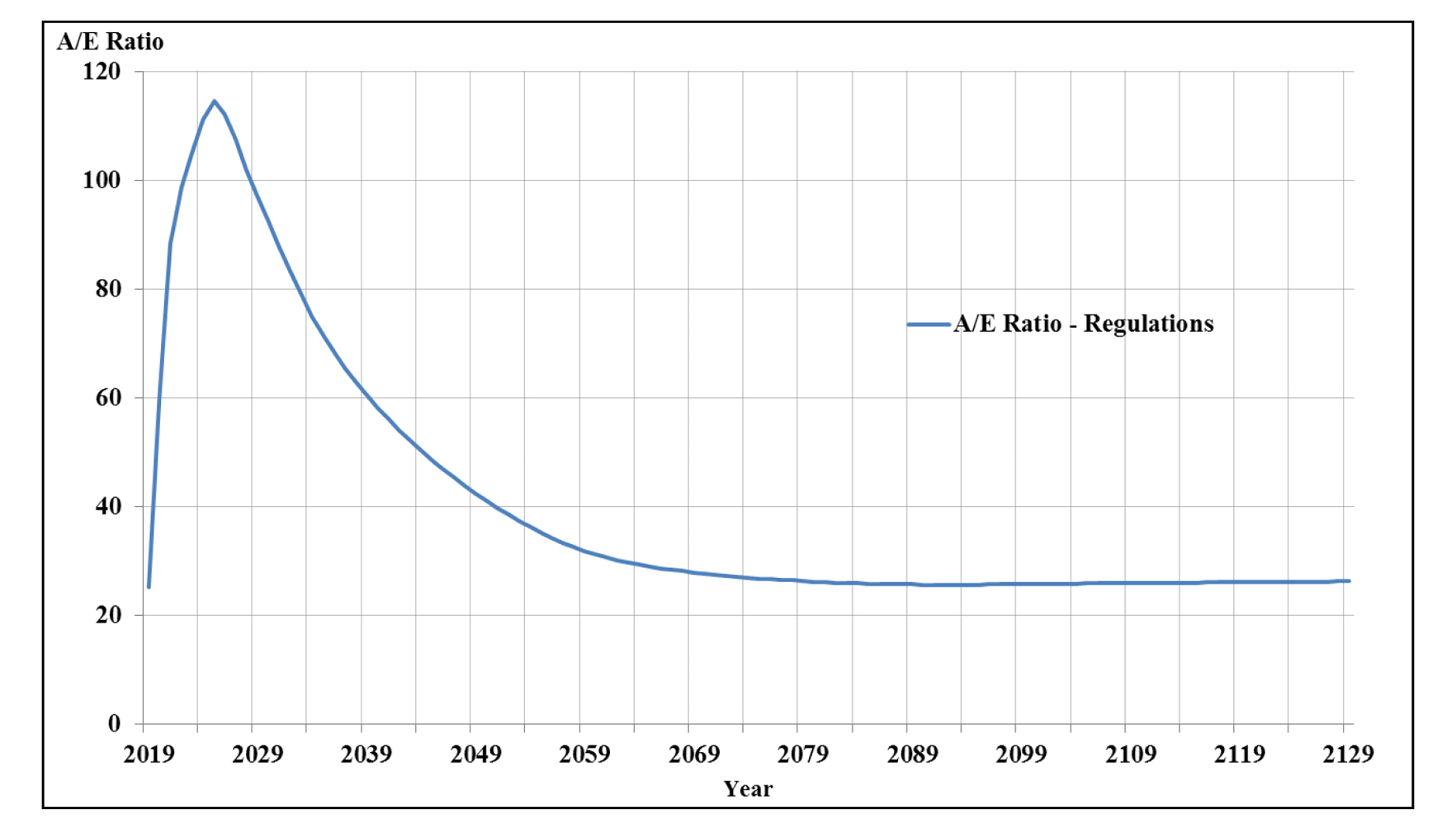

Chart 1: Asset-to-expenditure ratio — CPP enhancement under the minimum contribution rates

Source: Office of the Chief Actuary

Objectives

The objectives of this regulatory proposal are to

- establish the methodology for the actuarial calculation of the minimum contribution rates for the CPP enhancement;

- determine the acceptable range for these minimum contribution rates vis-à-vis the legislated rates over which the CPP enhancement would be considered to be in a sustainable position over the long term; and

- designate the automatic adjustments that would change benefits and contribution rates to bring the CPP enhancement back to a sustainable position, in the event that minimum contribution rates fall outside their sustainable range and ministers of finance cannot reach a consensus on changes.

This regulatory proposal aims to ensure that the enhanced portion of the Plan is appropriately funded over time while respecting intergenerational equity, consistent with the full funding principle underpinning the CPP enhancement.

Description

The proposed regulations were developed to ensure that the enhanced portion of the Plan is appropriately funded over time while respecting the fundamental differences between the base CPP and the CPP enhancement:

- The base CPP is a mature Plan while the CPP enhancement will not mature for decades (as shown in Chart 1); and

- The financing approaches, as noted, are different, with the base CPP being mainly a pay-as-you-go Plan while the CPP enhancement is fully funded and more reliant on investment income for revenues.

The design of the proposed regulations takes into account these differences while meeting the objectives outlined above.

Calculation of Contribution Rates Regulations, 2018

This regulatory proposal will repeal the Calculation of Contribution Rates Regulations, 2007 and replace them with the Calculation of Contribution Rates Regulations, 2018, which will set out the methodology for the actuarial calculation of the minimum contribution rates for both the base CPP and the CPP enhancement. The calculation of the base CPP minimum contribution rates will continue to follow the rules currently in place under the Calculation of Contribution Rates Regulations, 2007.

For the calculation of the additional minimum contribution rates (i.e. the minimum contribution rates for the enhancement), new rules will be established by the Regulations. The amendments to the legislation in 2016 required that the CPP enhancement be financed through contribution rates that

- result in projected contributions and associated investment income sufficient to fully pay projected expenditures over the foreseeable future; and

- are the lowest constant rates that can be maintained over the foreseeable future.

Essentially, CPP legislation requires that the CPP enhancement maintain a fully funded position considering multiple generations of participants (sufficiency) while maintaining stable contribution rates over the long term (stability).

In order to satisfy these two conditions, the Regulations will require that the Chief Actuary of Canada calculate the CPP enhancement minimum contribution rates such that for

- sufficiency, at the valuation date, assets are at least 100% of liabilities, on an open group basis;footnote 2and

- stability, the projected assets-to-expenditures ratio is not lower in the 60th year after the end of the review period than in the 50th year after the end of the review period, with the added caveat that this 10-year stabilization period cannot start before year 2088.footnote 3

The stabilization years have been chosen to balance the following objectives:

- the stabilization years should be far enough in the future as to not interfere with the natural decrease in the asset-to-expenditure ratio resulting from the maturation of the plan;

- the stabilization years should not be too far into the future in order to minimize the uncertainty related to projections; and

- the "time gap" between the first and second stabilization years should be minimized, while ensuring the stabilization of the asset-to-expenditure ratio, to minimize uncertainty related to projections.

Based on simulations conducted by the Office of the Chief Actuary, in terms of the first two objectives, choosing to start the stabilization period earlier than 2088 would result in increasing asset-to-expenditure ratios over time, meaning the eventual overfunding of the CPP enhancement. Conversely, starting the stabilization period later than 2088 would not result in improved stability of the asset-to-expenditure ratio. In terms of the third objective, choosing more than 10 years between stabilization years would result in essentially the same minimum contribution rates and asset-to-expenditure ratios.

Additional Canada Pension Plan Sustainability Regulations

In addition, new Regulations, the Additional Canada Pension Plan Sustainability Regulations, will address two policy questions regarding the sustainability of the CPP enhancement:

- By how much, and for how long, can the minimum contribution rates deviate from the legislated contribution rates before action is required? and

- If the minimum contribution rates deviate from the legislated rates by too much and/or for too long, and ministers of finance do not reach agreement on whether or how to adjust Plan parameters, what happens?

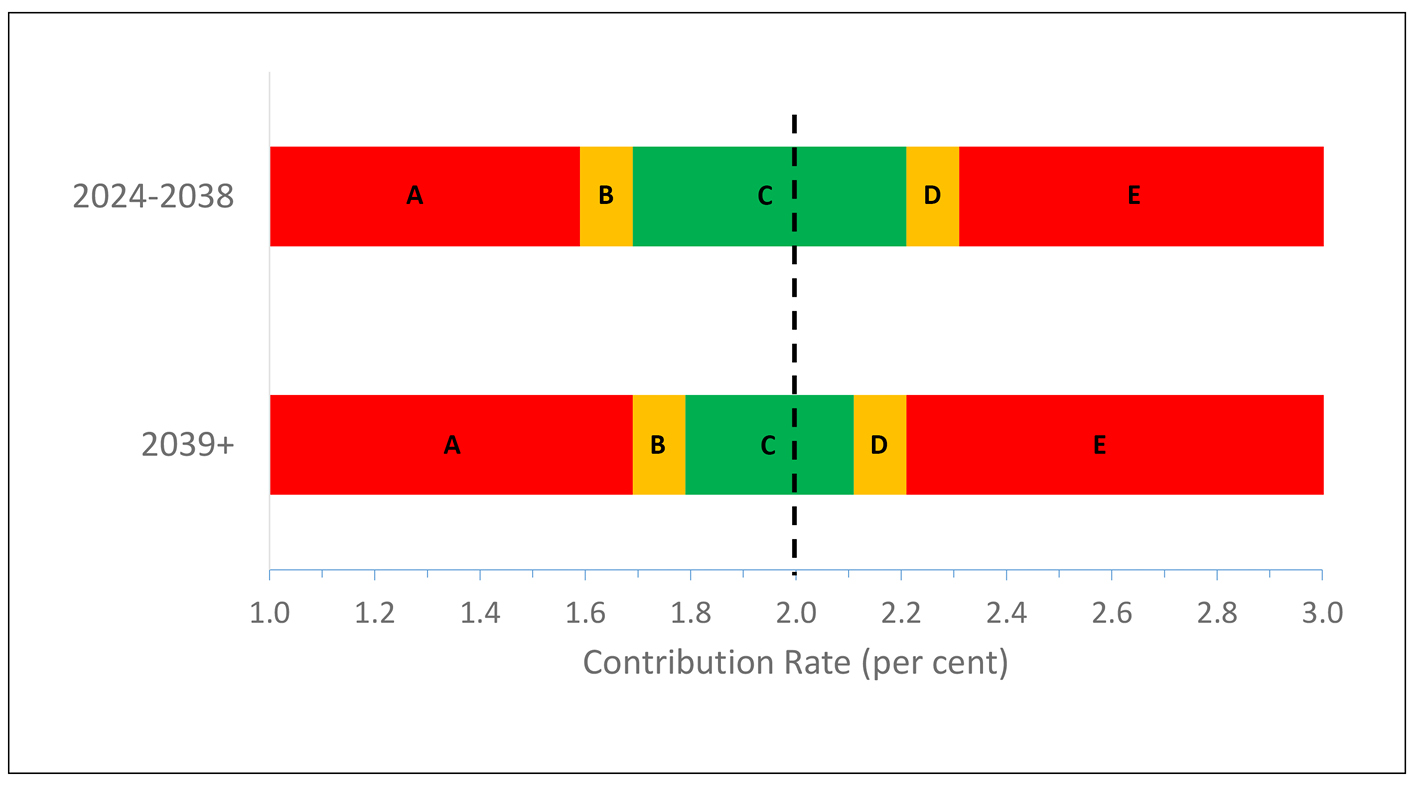

With regard to the first question, these Regulations allow for significant leeway in fluctuations of the minimum contribution rates before action is required, as illustrated by Chart 2 below, which shows the action ranges of the first additional minimum contribution rate categorized according to whether no action is required (green zone), action is required in the case of a warning (yellow zone) and immediate action is required (red zone). The application for the second additional minimum contribution rate would be similar except the ranges would be four times greater.footnote 4

Of note, the ranges differ in the early years of the Plan and the later years. Further, these ranges are anchored to the current legislated rate of 2%; if the legislated rates are changed, the ranges would shift accordingly.

Chart 2: Action triggers — First additional minimum contribution rate

- A and E: Immediate Action Required

- B and D: Warning - Action Required ONLY after two consecutive reports

- C: No Action Required

Beyond 2039, if the first additional minimum contribution rate is calculated by the Chief Actuary to be 31 basis points below the legislated rate, or 21 basis points above the legislated rate, action is required immediately (red zone). Alternatively, if the first additional minimum contribution rate is calculated to be between 21 and 30 basis points below the legislated rate, or between 11 and 20 basis points above the legislated rate, for two consecutive triennial reviews, action is also required (yellow zone).

As can be seen, there is greater tolerance for deviations as the Plan is maturing. Before 2039, immediate action is required if the first additional minimum contribution rate is calculated by the Chief Actuary to be 41 basis points below the legislated rate, or 31 basis points above the legislated rate. This is a consequence of a wider No Action Required range (green zone).

The year 2039 was chosen because it is projected to be the first year when investment income and contributions are equal. After 2039, investment income is projected to become the main source of revenues for the CPP enhancement and its volatility will have an increasingly important impact on the financial stability of the Plan.

Table 1 below shows the ranges for the additional minimum contribution rates (AMCRs) relative to current legislated rates categorized by requirement of action (assuming the AMCRs are rounded to four decimals).

| Range | Requirement of Action | FAMCR (%) |

Difference 2.0% − FAMCR |

SAMCR (%) |

Difference 8.0% − SAMCR |

|---|---|---|---|---|---|

| Years 2024 to 2038 | |||||

| A | Immediate Action Required | ≤1.59 | 41 bps or higher | ≤6.36 | 164 bps or higher |

| B | Warning - Action Required ONLY after being in this range for TWO consecutive reports | [1.60 to 1.69] | 31 to 40 bps | [6.40 to 6.76] | 124 to 160 bps |

| C | No Action Required | [1.70 to 2.20] | −20 to 30 bps | [6.80 to 8.80] | −80 to 120 bps |

| D | Warning - Action Required ONLY after being in this range for TWO consecutive reports | [2.21 to 2.30] | −30 to −21 bps | [8.84 to 9.20] | −120 to −84 bps |

| E | Immediate Action Required | ≥2.31 | −31 bps or lower | ≥9.24 | −124 bps or lower |

| Years 2039 and thereafter | |||||

| A | Immediate Action Required | ≤1.69 | 31 bps or higher | ≤6.76 | 124 bps or higher |

| B | Warning - Action Required ONLY after being in this range for TWO consecutive reports | [1.70 to 1.79] | 21 to 30 bps | [6.80 to 7.16] | 84 to 120 bps |

| C | No Action Required | [1.80 to 2.10] | −10 to 20 bps | [7.20 to 8.40] | −40 to 80 bps |

| D | Warning - Action Required ONLY after being in this range for TWO consecutive reports | [2.11 to 2.20] | −20 to −11 bps | [8.44 to 8.80] | −80 to −44 bps |

| E | Immediate Action Required | ≥2.21 | −21 bps or lower | ≥8.84 | −84 bps or lower |

Notes

|

|||||

Allowing for even greater tolerance for deviations in the early years of the Plan minimizes the frequency and magnitude of required changes over the first two decades of the CPP enhancement while assets accumulate and benefit expenditures are modest. Based on 10 000 simulations of investment experience, if current economic and demographic trends persist, the Office of the Chief Actuary estimates that the probability of triggering action (yellow or red zone) prior to the 2039 valuation date because of underfunding is approximately 1% with a first additional minimum contribution rate of 1.98%.

With regard to the second question, the amendments to the legislation in 2016 set out that, if the CPP enhancement is calculated by the Chief Actuary to be in an unsustainable position, it is the responsibility of federal and provincial ministers of finance to agree on adjustments to benefits and/or contributions to return the Plan to a sustainable position. Alternatively, ministers of finance may agree to not take any action.

If ministers of finance do not reach an agreement to modify (or not modify) Plan parameters, automatic adjustments, as set out in these Regulations, would apply. Similar provisions exist for the base CPP in legislation that set out a combination of benefit reductions and contribution rate increases.

The Regulations would, as a first step, reverse any previous actions taken as a result of the operation of these Regulations in an opposite direction (e.g. if the Plan is currently in a deficit situation, prior increases to benefits would be reversed as a result of the application of these Regulations). In the event that reversing prior actions is insufficient to restore the Plan to a sustainable position, these Regulations would set out a different approach depending on whether the Plan is in a surplus position (i.e. minimum contribution rates are below the legislated rates) or a deficit position (i.e. minimum contribution rates are above the legislated rates):

- If the CPP enhancement is in a surplus position, these Regulations would increase benefits for both current and future beneficiaries; and

- If the CPP enhancement is in a deficit position, adjustments would be shared sequentially between contributors, employers and beneficiaries by

- first reducing the growth in benefits for both current and future beneficiaries within a certain limit, and

- if such reduction is insufficient to restore the Plan to a sustainable position, then contribution rates would be increased.

Moreover, the automatic adjustments would restore the Plan to a different target value depending on whether the Plan is in a surplus or deficit position. If the Plan is in a deficit position, the automatic adjustments would aim to return the minimum contribution rates to the legislated rates. However, if the Plan is in a surplus position, the automatic adjustments would aim to return the minimum contribution rates to target values that are lower than the legislated rates in order to minimize the risk of future corrections. The chosen values (10 and 40 basis points) represent the halfway point within the green zone C (zone C) that is below the legislated contribution rates for 2039 and beyond.

The Regulations would adjust benefits by modifying the indexation for current beneficiaries and applying a benefit multiplier to future benefits. The benefit multiplier is a factor applied to future benefits that would ensure that a future beneficiary would see an equivalent percentage increase/decrease in benefits relative to the percentage increase/decrease in benefits for current beneficiaries.

The Regulations would limit the indexation when the Plan is in a deficit position such that it is not lower than 60% of the increase in the consumer price index (CPI), which, in turn, limits the maximum value for the benefit multiplier by applying the same percentage decrease to benefit amounts for current and future beneficiaries. That being said, a reduction in indexation only affects current beneficiaries and, as a result, will always have a lesser total impact than the benefit multiplier, which impacts a much larger group (current and future contributors).

The following tables provide an illustrative example of the application of the Additional Canada Pension Plan Sustainability Regulations. Table 2 shows a scenario where, after the 2046–2048 review period, the application of the Regulations results in the indexation of benefits in pay of 60% over the six years following the end of the review period (i.e. from 2049 to 2054 inclusively) and in the application of benefit multipliers for new benefits. Assuming that the inflation rate is 2% per year, at the end of the six-year adjusted indexation period in 2054, benefits in pay will be equal to 95% of what their value would have been with no adjustment to indexation. After 2054, regular indexation (at 2%) resumes, so that adjusted benefits remain equal to 95% of their unadjusted amounts.

Table 2 shows the impact on a typical beneficiary who is being paid a monthly retirement pension of $1,000 starting on January 1, 2048.

| Year | Original Benefit (January 1) | Adjusted Benefit (January 1) | Ratio of Adjusted to Original Benefit (Rounded to two decimals) |

||

|---|---|---|---|---|---|

| Indexation | Amount ($) | Indexation | Amount ($) | ||

| 2048 | 1.02 | 1,000 | 1.020 | 1,000 | 1.00 |

| 2049 | 1.02 | 1,020 | 1.012 | 1,012 | 0.99 |

| 2050 | 1.02 | 1,040 | 1.012 | 1,024 | 0.98 |

| 2051 | 1.02 | 1,061 | 1.012 | 1,036 | 0.98 |

| 2052 | 1.02 | 1,082 | 1.012 | 1,049 | 0.97 |

| 2053 | 1.02 | 1,104 | 1.012 | 1,061 | 0.96 |

| 2054 | 1.02 | 1,126 | 1.012 | 1,074 | 0.95 |

| 2055 | 1.02 | 1,149 | 1.020 | 1,096 | 0.95 |

Table 3 below shows the scenario of a new beneficiary who starts her retirement benefit on January 1, 2050 (within the adjustment indexation period), with an original initial monthly benefit amount of $1,000. The combined application of a benefit multiplier and reduced indexation for this new beneficiary is shown. Since she starts her benefit in 2050, her benefit multiplier is 0.984, and her original benefit of $1,000 will be adjusted to $984. Her benefit will then be indexed going forward according to the adjusted indexation of 1.2% until 2054, with reversion to regular indexation from 2055 onward.

| Year | Original Benefit (January 1) | Adjusted Benefit (January 1) | Ratio of Adjusted to

Original Benefit (Rounded to two decimals) |

|||

|---|---|---|---|---|---|---|

| Indexation | Amount ($) | Benefit Adjustment Factor | Indexation | Amount ($) | ||

| 2050 | n/a | 1,000 | 0.984 | n/a | 984 | 0.98 |

| 2051 | 1.02 | 1,020 | n/a | 1.012 | 996 | 0.98 |

| 2052 | 1.02 | 1,040 | n/a | 1.012 | 1,008 | 0.97 |

| 2053 | 1.02 | 1,061 | n/a | 1.012 | 1,020 | 0.96 |

| 2054 | 1.02 | 1,082 | n/a | 1.012 | 1,032 | 0.95 |

| 2055 | 1.02 | 1,104 | n/a | 1.020 | 1,053 | 0.95 |

Finally, Table 4 below shows the scenario of a new future beneficiary who starts her retirement benefit on January 1, 2054, with an original benefit amount of $1,000. Her benefit multiplier is then 0.95, and her adjusted benefit would be $950. Her benefit will be indexed from 2055 onward with full indexation, and the ratio of her benefit to the unadjusted benefit will remain 0.95. All new beneficiaries after January 1, 2054, would likewise have a benefit multiplier of 0.95 applied to their benefits with full indexation applied thereafter.

| Year | Original Benefit (January 1) | Adjusted Benefit (January 1) | Ratio of Adjusted to Original Benefit (Rounded to two decimals) |

|||

|---|---|---|---|---|---|---|

| Indexation | Amount ($) | Benefit Adjustment Factor | Indexation | Amount ($) | ||

| 2054 | n/a | 1,000 | 0.95 | n/a | 950 | 0.95 |

| 2055 | 1.02 | 1,020 | n/a | 1.02 | 969 | 0.95 |

| 2056 | 1.02 | 1,040 | n/a | 1.02 | 988 | 0.95 |

| 2057 | 1.02 | 1,061 | n/a | 1.02 | 1,008 | 0.95 |

| 2058 | 1.02 | 1,082 | n/a | 1.02 | 1,028 | 0.95 |

| 2059 | 1.02 | 1,104 | n/a | 1.02 | 1,049 | 0.95 |

Table 5 illustrates the impact at maturity (2075) on benefits and contributions of the application of the Regulations under different values of the first additional minimum contribution rate (FAMCR) and assuming a CPI of 2%, which translates into a maximum reduction in benefits for future and current beneficiaries of 5%. As can be seen, if the FAMCR is in the yellow zone (zone B), the burden of adjustment will fall on benefit reductions. As the FAMCR increases, the burden of adjustment will shift towards contribution rate increases. In this scenario, the FAMCR required for a 50/50 share in benefit and contribution adjustments would be 2.3%.

| Action Zone | First Additional Minimum Contribution Rate (FAMCR) | Shortfall Addressed by Benefit Reductions (bps) | Shortfall Addressed by Benefit Reductions (%) | Shortfall Addressed by Contribution Increases (%) |

|---|---|---|---|---|

| A | 2.00 | N/A | N/A | N/A |

| 2.05 | ||||

| 2.10 | ||||

| B | 2.11 | 0.11 | 100% | 0% |

| 2.15 | 0.15 | 100% | 0% | |

| 2.20 | 0.15 | 75% | 25% | |

| C | 2.25 | 0.15 | 60% | 40% |

| 2.30 | 0.15 | 50% | 50% | |

| 2.35 | 0.15 | 43% | 57% | |

| 2.40 | 0.15 | 38% | 63% | |

| 2.45 | 0.15 | 33% | 67% | |

| 2.50 | 0.15 | 30% | 70% | |

Notes:

|

||||

The automatic adjustments, depending on whether the Plan is in a surplus position ("benefits only") or a deficit position (sequential adjustment of benefits and contributions), strike a balance between being consistent with the principle of intergenerational equity, which was central to the design of the CPP enhancement, and ensuring that employers are not insulated from the burden of returning the Plan to a sustainable position in a deficit situation.

"One-for-One" Rule

The "One-for-One" Rule does not apply, as the proposed regulations do not impose any new administrative burden on businesses.

Small business lens

The small business lens does not apply to this proposal, as no new administrative or compliance costs would be imposed on small businesses.

Consultation

In 2017, provincial and territorial officials were consulted and extensively engaged in the development of this regulatory proposal. The proposed regulations were developed and discussed through the federal-provincial committee of officials on the CPP. Significant analysis and advice were also sought from the Office of the Chief Actuary during the policy development process for these regulations and was incorporated into this regulatory proposal. Following the publication of this Regulatory Impact Analysis Statement in the Canada Gazette, Part I, the Office of the Chief Actuary will release Actuarial Study no. 20, Technical Paper on the Additional Canada Pension Plan Regulations, which will provide technical analysis on the design and potential applications of the regulations.

In addition, analysis and options related to this regulatory proposal were discussed at a seminar in July 2017 with some of Canada's leading pension actuaries. The basic design laid out in the proposed regulations was validated by the pension actuaries invited to this seminar.

Finally, at their December 2017 meeting, ministers of finance unanimously agreed to bring forward these regulations.

Rationale

Given the differences between the base CPP and the CPP enhancement, the proposed regulations address the three objectives outlined above as follows:

- 1. Methodology: The methodology for the calculation of the additional minimum contribution rates in the proposed regulations satisfies the conditions of sufficiency and stability for the CPP enhancement as required by the legislation. These provisions are similar to those for the base CPP, with the main difference being that the stabilization period is extended further into the future, reflecting the fact that the enhancement will not mature for decades.

- 2. Acceptable ranges: Considering that

- (a) unlike the base CPP, the full funding approach to the CPP enhancement results in a high sensitivity to cyclical market volatility, and

- (b) during the early years of the CPP enhancement there will be a rapid accumulation of assets while benefit expenditures are modest,

- the proposed regulations provide the acceptable ranges for the additional minimum contribution rates, with these rates being allowed to exceed legislated contribution rates by up to roughly 10% at maturity before ministers of finance would be required to take action on Plan changes. If additional minimum contribution rates are between 5 and 10% above legislated rates for two consecutive periods, ministerial action would also be required.

- In addition, action would also be required if the additional minimum contribution rates are below the legislated rates. However, there is more leeway for fluctuations in surplus than deficit situations, reflecting that, in terms of public confidence, correcting a funding shortfall is likely more important than correcting a funding surplus. Finally, there would be a greater tolerance for deviations in the early years as the Plan matures.

- 3. Automatic adjustments: The proposed regulations provide a set of actions in the event that the additional minimum contribution rates are outside their acceptable ranges and ministers of finance are unable to reach consensus on a course of action. The proposed actions differ depending on whether the Plan is in a surplus position ("benefits only") or a deficit position (sequential adjustment of benefits and contributions).

- This approach is consistent with the concept of intergenerational equity and ensures that Plan members, whether they are current retirees or contributors, share in a relatively equitable way in the adjustments to the Plan. Moreover, the proposed regulations also ensure that adjustments are shared between Plan members and their employers in the event that the CPP enhancement is in a significant deficit situation.

The CPP is financed from employer and employee contributions, and associated investment returns; therefore, there is no impact on the fiscal position of federal and provincial governments from these proposed regulations. In the unlikely event that the CPP enhancement is deemed to be in a surplus or deficit position, and ministers of finance cannot agree on a course of action, the growth of benefits might be increased or reduced. In addition, in the event of a deficit position, contribution rates paid by employees and employers might also be increased.

Implementation, enforcement and service standards

Pursuant to the legislation and similar to other major changes to the CPP, the proposed regulations require formal provincial consent from at least 7 provinces representing at least two thirds of the population of the 10 provinces to come into force.

In the unlikely event that the automatic adjustments are triggered, Service Canada would adjust the growth rate of benefits in pay and future benefits in accordance with the parameters set out in these proposed regulations. In addition, in the event of a deficit position, if contribution rate increases are required, the proposed regulations will deem an increase of the contribution rates in Schedule 2 of the CPP legislation. The Canada Revenue Agency would administer the collection of CPP contributions in accordance with these deemed contribution rates.

Contact

Galen Countryman

Director General

Federal-Provincial Relations Division

Department of Finance

90 Elgin Street

Ottawa, Ontario

K1A 0G5

Email: fin.cppenhancement-bonificationdurpc.fin@canada.ca

PROPOSED REGULATORY TEXT

Notice is given that the Governor in Council, pursuant to paragraph 101(1)(d.1) footnote a of the Canada Pension Plan footnote b, proposes to make the annexed Calculation of Contribution Rates Regulations, 2018.

Interested persons may make representations concerning the proposed Regulations within 30 days after the date of publication of this notice. All such representations must cite the Canada Gazette, Part I, and the date of publication of this notice, and be addressed to Galen Countryman, Director General, Federal-Provincial Relations Division, Department of Finance, 90 Elgin Street, Ottawa, Ontario K1A 0G5 (email: fin.cppenhancement-bonificationdurpc.fin@canada.ca).

Ottawa, October 4, 2018

Jurica Čapkun

Assistant Clerk of the Privy Council

Calculation of Contribution Rates Regulations, 2018

Interpretation

Definitions

1 The following definitions apply in these Regulations.

Act means the Canada Pension Plan. (Loi)

- additional contribution rate ratio means the ratio — rounded to the nearest whole number or, if equidistant from two whole numbers, to the higher whole number — of the percentage specified in paragraph 46(1)(c) of the Act to the percentage specified in paragraph 46(1)(b) of the Act. (rapport du taux de cotisation supplémentaire)

- contributory earnings means the contributory salary and wages and the contributory self-employed earnings referred to in sections 12 and 13, respectively, of the Act. (gains cotisables)

- increased or new benefits means the increased or new benefits referred to in paragraph 113.1(4)(e) of the Act. (accroissement ou établissement de prestations)

- review period means any three-year period for which the Chief Actuary prepares a report for the purpose of subsection 115(1) of the Act. (période d'examen)

Calculation of Contribution Rates

Base contribution rate

2 For the purpose of subparagraph 115(1.1)(c)(i) of the Act, the contribution rate is the smallest multiple of 0.0001 percentage points that results in a projected ratio of assets to expenditures for the 60th year after the review period that is not lower than the projected ratio of assets to expenditures for the 10th year after the review period, with those ratios being determined by the formula

(A − B) ⁄ (C − D)

where

- A

- is the projected value on December 31 of that year of all assets of the base Canada Pension Plan;

- B

- is the projected value on December 31 of that year of all assets of the base Canada Pension Plan in respect of any increased or new benefits that result in a contribution rate calculated under section 3 that exceeds zero;

- C

- is the projected amounts charged to the Canada Pension Plan Account under subsection 108(3) of the Act for the year following that year; and

- D

- is the projected amounts charged to the Canada Pension Plan Account under subsection 108(3) of the Act for the year following that year in respect of any increased or new benefits that result in a contribution rate calculated under section 3 that exceeds zero.

Base contribution rate — increased or new benefits

3 (1) For the purpose of subparagraph 115(1.1)(c)(ii) of the Act, the contribution rate with respect to any increased or new benefits is equal to the permanent increase in the contribution rate plus, if applicable, the temporary increase in that rate.

Permanent increase

(2) The permanent increase in the contribution rate is the smallest multiple of 0.0001 percentage points that results in the following formula being satisfied:

A + B = C

where

- A

- is the projected value of all assets of the base Canada Pension Plan in respect of the increased or new benefits that are based on the contributory earnings for each year starting with the year in which the increased or new benefits come into effect;

- B

- is the present value of contributions to be made as a result of the permanent increase in the contribution rate; and

- C

- is the present value of the projected extra costs of the increased or new benefits that are based on the contributory earnings for each year starting with the year in which the increased or new benefits come into effect.

Temporary increase

(3) The temporary increase in the contribution rate applies for a number of years that is consistent with common actuarial practice and is the smallest multiple of 0.0001 percentage points that results in the following formula being satisfied:

A + B = C

where

- A

- is the projected value of all assets of the base Canada Pension Plan in respect of the increased or new benefits that are based on the contributory earnings for each year before the year in which the increased or new benefits come into effect;

- B

- is the present value of contributions to be made as a result of the temporary increase in the contribution rate; and

- C

- is the present value of the projected extra costs of the increased or new benefits that are based on the contributory earnings for each year before the year in which the increased or new benefits come into effect.

De minimis

(4) If the contribution rate calculated under subsection (1) for the first year after the review period or, if later, the year in which the increased or new benefits come into effect is less than 0.02 percentage points, without regard to section 7, the contribution rate for that year and all subsequent years is deemed to equal zero.

Additional contribution rates

4 (1) For the purpose of subparagraphs 115(1.1)(d)(i) and (e)(i) of the Act, the first additional contribution rate and the second additional contribution rate are the smallest multiples of 0.0001 percentage points that result in

- (a) the second additional contribution rate being equal to the first additional contribution rate multiplied by the additional contribution rate ratio;

- (b) the present value, as at the date referred to in subsection 115(1) of the Act, of the projected expenditures of the additional Canada Pension Plan, determined without taking into account any increased or new benefits that are based on the contributory earnings for each year starting with the year in which the increased or new benefits come into effect and any increased or new benefits that result in a contribution rate increase under subsections 5(3) and (4), being less than or equal to the sum of

- (i) the present value, as at the same date, of the projected contributions under the additional Canada Pension Plan, determined without taking into account those increased or new benefits, and

- (ii) the projected value, as at the same date, of all assets of the additional Canada Pension Plan, determined without taking into account those increased or new benefits; and

- (c) the projected ratio of assets to expenditures for the 60th year after the review period being no lower than the projected ratio of assets to expenditures for the 50th year after the review period, with those ratios being determined by the formula

(A − B) ⁄ (C − D)

where

- A

- is the projected value on December 31 of that year of all assets of the additional Canada Pension Plan;

- B

- is the projected value on December 31 of that year of all assets of the additional Canada Pension Plan in respect of any increased or new benefits that result in contribution rates calculated under section 5 that exceed zero;

- C

- is the projected amounts charged to the Additional Canada Pension Plan Account under subsection 108.2(3) of the Act for the year following that year; and

- D

- is the projected amounts charged to the Additional Canada Pension Plan Account under subsection 108.2(3) of the Act for the year following that year in respect of any increased or new benefits that result in contribution rates calculated under section 5 that exceed zero.

Review period ending before 2038

(2) For the purpose of paragraph (1)(c), if the 60th year after the review period is earlier than 2098, it is deemed to be 2098 and the 50th year after the review period is deemed to be 2088.

Exception — rates for 2022 and 2023

(3) Despite subsection (1), the first additional contribution rate for 2022 is equal to the first additional contribution rate calculated for 2024 multiplied by 0.75, the first additional contribution rate for 2023 is equal to the first additional contribution rate calculated for 2024 and the second additional contribution rate for 2022 and 2023 is equal to zero.

Additional contribution rates — increased or new benefits

5 (1) For the purpose of subparagraphs 115(1.1)(d)(ii) and (e)(ii) of the Act, the first additional contribution rate and the second additional contribution rate with respect to any increased or new benefits are equal, respectively, to the permanent increase in the first additional contribution rate plus, if applicable, the temporary increase in that rate and to the permanent increase in the second additional contribution rate plus, if applicable, the temporary increase in that rate.

Permanent increases

(2) The permanent increases in the first additional contribution rate and the second additional contribution rate are equal, respectively, to the difference obtained by subtracting the first additional contribution rate calculated under section 4 from the first additional contribution rate that would be calculated under that section if the following variations applied, and to the difference obtained by subtracting the second additional contribution rate calculated under section 4 from the second additional contribution rate that would be calculated under that section if those variations applied:

- (a) the present value of projected expenditures and contributions and the projected value of assets referred to in paragraph 4(1)(b) are to be determined without taking into account any increased or new benefits that result in a contribution rate increase under subsections (3) and (4);

- (b) the description of B in paragraph 4(1)(c) is limited to the projected value of assets of the additional Canada Pension Plan in respect of any increased or new benefits that result in a contribution rate increase under subsections (3) and (4); and

- (c) the description of D in paragraph 4(1)(c) is limited to the projected amounts charged to the Additional Canada Pension Plan Account under subsection 108.2(3) of the Act in respect of any increased or new benefits that result in a contribution rate increase under subsections (3) and (4).

Temporary increases

(3) Subject to subsection (4), the temporary increases in the first additional contribution rate and the second additional contribution rate apply for a number of years that is consistent with common actuarial practice and are the smallest multiples of 0.0001 percentage points that result in

- (a) the temporary increase in the second additional contribution rate being equal to the temporary increase in the first additional contribution rate multiplied by the additional contribution rate ratio; and

- (b) the following formula being satisfied:

A + B = C

where

- A

- is the projected value of all assets of the additional Canada Pension Plan in respect of the increased or new benefits that are based on the contributory earnings for each year before the year in which the increased or new benefits come into effect;

- B

- is the present value of contributions to be made as a result of the temporary increases in the first additional contribution rate and the second additional contribution rate; and

- C

- is the present value of the projected extra costs of the increased or new benefits that are based on the contributory earnings for each year before the year in which the increased or new benefits come into effect.

De minimis

(4) There is no temporary increase in the first additional contribution rate or the second additional contribution rate if the increase in the first additional contribution rate calculated under subsection (3) is less than 0.02 percentage points.

Exception — rates for 2022 and 2023

(5) Despite subsection (1), the first additional contribution rate for 2022 is equal to the first additional contribution rate calculated for 2024 multiplied by 0.75, the first additional contribution rate for 2023 is equal to the first additional contribution rate calculated for 2024 and the second additional contribution rate for 2022 and 2023 is equal to zero.

Projected and present values

6 The projected and present values referred to in subsections 3(2) and (3) and 5(2) and (3) are to be determined as at January 1 of the year after the review period or, if later, the day on which the increased or new benefits come into effect.

Rounding

7 If a contribution rate calculated under section 2 or subsection 3(1), 4(1) or 5(1) is not a multiple of 0.01 percentage points, it is to be rounded to the nearest multiple of 0.01 or, if it is equidistant from the two multiples, to the higher multiple.

Repeal

8 The Calculation of Contribution Rates Regulations, 2007 footnote 5 are repealed.

Coming into Force

Registration

9 These Regulations come into force on the day on which they are registered.