Canada Gazette, Part I, Volume 152, Number 17: GOVERNMENT NOTICES

April 28, 2018

DEPARTMENT OF THE ENVIRONMENT

DEPARTMENT OF HEALTH

CANADIAN ENVIRONMENTAL PROTECTION ACT, 1999

Ministerial Condition No. 19456

Ministerial condition

(Paragraph 84(1)(a) of the Canadian Environmental Protection Act, 1999)

Whereas the Minister of the Environment and the Minister of Health have assessed information pertaining to the substance benzene, 1,1′-(1,2-ethanediyl)bis(2,3,4,5,6- pentabromo-, Chemical Abstracts Service Registry No. 84852-53-9;

And whereas the ministers suspect that the substance is toxic or capable of becoming toxic within the meaning of section 64 of the Canadian Environmental Protection Act, 1999,

The Minister of the Environment, pursuant to paragraph 84(1)(a) of the Canadian Environmental Protection Act, 1999, hereby permits the manufacture or import of the substance in accordance with the conditions of the following annex.

George Enei

Assistant Deputy Minister

Science and Technology Branch

On behalf of the Minister of the Environment

ANNEX

Conditions

(Paragraph 84(1)(a) of the Canadian Environmental Protection Act, 1999)

1. The following definitions apply in these ministerial conditions:

"engineered hazardous waste landfill facility"

means a facility that is part of an overall integrated hazardous waste management system where wastes that do not require additional treatment or processing are sent and where hazardous materials are confined or controlled for the duration of their effective contaminating lifespan."notifier"

means the person who has, on February 2, 2018, provided to the Minister of the Environment the prescribed information concerning the substance, in accordance with subsection 81(1) of the Canadian Environmental Protection Act, 1999."substance"

means benzene, 1,1′-(1,2-ethanediyl)bis(2,3,4,5,6-pentabromo-, Chemical Abstracts Service Registry No. 84852-53-9."waste"

means the effluents that result from rinsing equipment or vessels used for the substance, disposable vessels used for the substance, any spillage that contains the substance, the process effluents that contain the substance, and any residual quantity of the substance in any equipment or vessel.

2. The notifier may manufacture or import the substance in accordance with the present ministerial conditions.

Restrictions

3. The notifier may import the substance in order to use it only as a flame retardant component to manufacture thermoplastic parts, thermoplastic coatings, thermoset parts and thermoset coatings.

4. The notifier shall transfer the physical possession or control of the substance only to a person who will use it in accordance with item 3.

5. At least 120 days prior to beginning manufacturing the substance in Canada, the notifier shall inform the Minister of the Environment, in writing, and provide the following information:

- (a) the information specified in paragraph 7(a) of Schedule 4 to the New Substances Notification Regulations (Chemicals and Polymers);

- (b) the address of the manufacturing facility within Canada;

- (c) the information specified in paragraphs 8(a) to (e), item 9 and paragraph 10(b) of Schedule 5 to those Regulations; and

- (d) the following information related to the manufacturing of the substance in Canada:

- (i) a brief description of the manufacturing process that details the precursors of the substance, the reaction stoichiometry and the nature (batch or continuous) and scale of the process,

- (ii) a flow diagram of the manufacturing process that includes features such as process tanks, holding tanks and distillation towers, and

- (iii) a brief description of the major steps in manufacturing operations, the chemical conversions, the points of entry of all feedstock and the points of release of substances, and the processes to eliminate environmental release.

Disposal of the substance

6. The notifier or the person to whom the substance has been transferred must collect any waste in their physical possession or under their control and destroy or dispose of it in the following manner:

- (a) incineration in accordance with the laws of the jurisdiction where the incineration facility is located; or

- (b) disposal in an engineered hazardous waste landfill facility, in accordance with the laws of the jurisdiction where the facility is located, if it cannot be incinerated in accordance with paragraph (a).

Application

7. Item 6 does not apply if the substance is imported already compounded into thermoplastic or thermoset material in the form of pellets or flakes.

Environmental release

8. Where any release of the substance or waste to the environment occurs, the person who has the physical possession or control of the substance or waste shall immediately take all measures necessary to prevent any further release, and to limit the dispersion of any release. Furthermore, the person shall, as soon as possible in the circumstances, inform the Minister of the Environment by contacting an enforcement officer designated under the Canadian Environmental Protection Act, 1999.

Record-keeping requirements

9. (1) The notifier shall maintain electronic or paper records, with any documentation supporting the validity of the information contained in these records, indicating:

- (a) the use of the substance;

- (b) the quantity of the substance that the notifier manufactures, imports, purchases, sells and uses;

- (c) the name and address of each person to whom the notifier transfers the physical possession or control of the substance; and

- (d) the name and address of each person in Canada who has disposed of the substance or of the waste for the notifier, the method used to do so, and the quantities of the substance or waste shipped to that person.

(2) The notifier shall maintain the electronic or paper records mentioned in subsection (1) at their principal place of business in Canada, or at the principal place of business in Canada of their representative, for a period of at least five years after they are made.

Other requirements

10. The notifier shall inform any person to whom they transfer the physical possession or control of the substance or of the waste, in writing, of the terms of the present ministerial conditions. The notifier shall obtain, prior to the first transfer of the substance or waste, written confirmation from this person that they were informed of the terms of the present ministerial conditions. This written confirmation shall be maintained at the principal place of business in Canada of the notifier or of their representative in Canada for a period of at least five years from the day it was received.

Coming into force

11. The present ministerial conditions come into force on April 5, 2018.

DEPARTMENT OF THE ENVIRONMENT

DEPARTMENT OF HEALTH

CANADIAN ENVIRONMENTAL PROTECTION ACT, 1999

Publication after screening assessment of two substances in the Organic Peroxides Group — hydroperoxide, 1-methyl-1-phenylethyl (CHP), CAS RNfootnote1 80-15-9, and peroxide, bis(1-methyl-1-phenylethyl) [DCUP], CAS RN 80-43-3 — specified on the Domestic Substances List (subsection 77(1) of the Canadian Environmental Protection Act, 1999)

Whereas CHP and DCUP are substances identified under subsection 73(1) of the Canadian Environmental Protection Act, 1999;

Whereas a summary of the draft screening assessment conducted on CHP and DCUP pursuant to section 74 of the Act is annexed hereby;

And whereas it is proposed to conclude that the substances do not meet any of the criteria set out in section 64 of the Act,

Notice therefore is hereby given that the Minister of the Environment and the Minister of Health (the ministers) propose to take no further action on these substances at this time under section 77 of the Act.

Notice is further given that options are being considered for follow-up activities to track changes in exposure to DCUP.

Public comment period

As specified under subsection 77(5) of the Canadian Environmental Protection Act, 1999, any person may, within 60 days after publication of this notice, file with the Minister of the Environment written comments on the measure the ministers propose to take and on the scientific considerations on the basis of which the measure is proposed. More information regarding the scientific considerations may be obtained from the Canada.ca (Chemical Substances) website. All comments must cite the Canada Gazette, Part I, and the date of publication of this notice and be sent to the Executive Director, Program Development and Engagement Division, Department of the Environment, Gatineau, Quebec K1A 0H3, by fax to 819-938-5212, or by email to eccc.substances.eccc@canada.ca. Comments can also be submitted to the Minister of the Environment, using the online reporting system available through Environment and Climate Change Canada's Single Window.

In accordance with section 313 of the Canadian Environmental Protection Act, 1999, any person who provides information in response to this notice may submit with the information a request that it be treated as confidential.

Jacqueline Gonçalves

Director General

Science and Risk Assessment Directorate

On behalf of the Minister of the Environment

David Morin

Director General

Safe Environments Directorate

On behalf of the Minister of Health

ANNEX

Summary of the draft screening assessment of the Organic Peroxides Group

Pursuant to section 74 of the Canadian Environmental Protection Act, 1999 (CEPA), the Minister of the Environment and the Minister of Health (the ministers) have conducted a screening assessment of two of the six substances referred to collectively under the Chemicals Management Plan as the Organic Peroxides Group. These two substances were identified as priorities for assessment, as they met categorization criteria under subsection 73(1) of CEPA. Four of the six substances were subsequently determined to be of low concern through other approaches, and decisions for these substances are provided in a separate report.footnote2 Accordingly, this screening assessment addresses the two substances listed in the table below, which will hereinafter be referred to as the Organic Peroxides Group.

| CAS RN | Domestic Substances List name | Common name |

|---|---|---|

| 80-15-9 | Hydroperoxide, 1-methyl-1-phenylethyl | Cumene hydroperoxide (CHP) |

| 80-43-3 | Peroxide, bis(1-methyl-1-phenylethyl) | Dicumyl peroxide (DCUP) |

Cumene hydroperoxide (CHP) and dicumyl peroxide (DCUP), herein referred to as CHP and DCUP, do not occur naturally in the environment. According to information submitted pursuant to a survey under section 71 of CEPA, there were no reports of manufacture in Canada for either CHP or DCUP in 2011. In the same calendar year, 10 319 kg of CHP and 100 000 to 1 000 000 kg of DCUP were imported into Canada. Both CHP and DCUP are used as industrial processing agents and are expected to be present in negligible quantities in finished materials after processing. CHP has been reported under section 71 of CEPA to be used in commercial products such as adhesives and sealants, building and construction materials, and paints and coatings. DCUP has been reported under section 71 of CEPA to be used in commercial products such as building and construction materials and plastic and rubber materials, as well as in products used in automotive, aircraft and transportation applications.

The ecological risks of the substances CHP and DCUP were characterized using the ecological risk classification (ERC) of organic substances. The ERC is a risk-based approach that employs multiple metrics for both hazard and exposure, with weighted consideration of multiple lines of evidence for determining risk classification. Hazard profiles are based principally on metrics regarding mode of toxic action, chemical reactivity, food web–derived internal toxicity thresholds, bioavailability, and chemical and biological activity. Metrics considered in the exposure profiles include potential emission rate, overall persistence, and long-range transport potential. A risk matrix is used to assign a low, moderate or high level of potential concern for substances on the basis of their hazard and exposure profiles. The ERC identified CHP and DCUP as having low potential to cause ecological harm.

Considering all available lines of evidence presented in this draft screening assessment, there is a low risk of harm to the environment from CHP and DCUP. It is proposed to conclude that CHP and DCUP do not meet the criteria under paragraph 64(a) or (b) of CEPA, as they are not entering the environment in a quantity or concentration or under conditions that have or may have an immediate or long-term harmful effect on the environment or its biological diversity or that constitute or may constitute a danger to the environment on which life depends.

CHP was reviewed internationally as part of a hydroperoxides group through the Organisation for Economic Co-operation and Development (OECD) in 2008 and was also one of the organic peroxides reviewed by the Department of Health of the Government of Australia in 2016. General toxicity for the oral, inhalation, and dermal routes of exposure were identified for the hydroperoxides group.

Exposure of the general population of Canada to CHP through environmental media and food is expected to be negligible. Exposure to CHP for the general population can occur from its use in adhesive products available to consumers. The margins between estimated dermal and inhalation exposures to CHP and the no adverse health effect levels derived from laboratory studies are considered adequate to address uncertainties in the health effects and exposure databases.

DCUP can cause adverse effects on the reproductive system. Exposure of the general population of Canada to DCUP from environmental media, food, and products is not expected; therefore, the risk to human health is considered to be low.

On the basis of the information presented in this draft screening assessment, it is proposed to conclude that CHP and DCUP do not meet the criteria under paragraph 64(c) of CEPA, as they are not entering the environment in a quantity or concentration or under conditions that constitute or may constitute a danger in Canada to human life or health.

Proposed conclusion

It is proposed to conclude that CHP and DCUP do not meet any of the criteria set out in section 64 of CEPA.

Considerations for follow-up

While exposure of the environment or of the general population to these substances is not of concern at current levels, DCUP is associated with health effects of concern. Therefore, there may be concern for human health if exposure levels were to increase. Follow-up activities to track changes in exposure or commercial use patterns are under consideration.

Stakeholders are encouraged to provide, during the 60-day public comment period on the draft screening assessment, any information pertaining to the substance that may help inform the choice of follow-up activity. This could include information on new or planned import, manufacture or use of this substance, if the information has not previously been submitted to the ministers.

The screening assessment for these substances is available on the Canada.ca (Chemical Substances) website.

DEPARTMENT OF FINANCE

CUSTOMS TARIFF

Invitation to submit views on proposed amendments to the NAFTA and Non-NAFTA Country of Origin Marking Regime

The Government of Canada is seeking the views of interested parties on aligning Canada's country of origin marking regime with that of the United States for certain steel and aluminum products. Canada's country of origin marking regime is set out in regulations, including

- the Determination of Country of Origin for the Purposes of Marking Goods (NAFTA Countries) Regulations; and

- the Determination of Country of Origin for the Purpose of Marking Goods (Non-NAFTA Countries) Regulations.

These regulations establish the scope of products and the criteria used to determine country of origin for the purposes of marking.

The Government of Canada is proposing amendments to the scope of products and criteria for country of origin marking for both NAFTA and non-NAFTA countries under the Determination of Country of Origin for the Purposes of Marking Goods (NAFTA Countries) Regulations and the Determination of Country of Origin for the Purpose of Marking Goods (Non-NAFTA Countries) Regulations.

Background

Certain goods when imported into Canada are required to be marked to indicate clearly the country in which the goods were made. The foreign exporter or producer applies the country of origin marking. However, Canadian importers are responsible for ensuring that imported goods comply with marking requirements at the time they import the goods. Since the implementation of NAFTA, Canada has had two country of origin marking regimes, one for goods imported from NAFTA countries and one for goods imported from non-NAFTA countries.

The objective of these amendments is to align Canada's marking regime with the U.S. marking regime with respect to certain steel and aluminum products in order to address the transshipment and diversion of unfairly cheap foreign steel and aluminum, which poses a threat to Canadian jobs and the North American market.

Proposed amendments

On product scope, Canada requires that goods specifically identified in the regulations be marked with the country of origin, while the U.S. regime requires that all steel and aluminum goods of foreign origin be marked. The Government of Canada is proposing to expand the scope of the goods that must be marked to align with the treatment of certain steel and aluminum products under the U.S. regime. This will require amendments to both the Determination of Country of Origin for the Purposes of Marking Goods (NAFTA Countries) Regulations and the Determination of Country of Origin for the Purpose of Marking Goods (Non-NAFTA Countries) Regulations.

On criteria, Canada and the United States use substantially equivalent criteria to determine the country of origin for non-NAFTA goods. In Canada, the criteria are where goods are "substantially manufactured"

and in the United States, the criteria are where work on the good effects a "substantial transformation."

However, the rules of origin set out in the Canadian and the U.S. NAFTA country of origin marking regulations vary. The Government of Canada is therefore proposing amendments to the Determination of Country of Origin for the Purposes of Marking Goods (NAFTA Countries) Regulations consistent with the current U.S. requirements.

The proposed amendments are set out in tables 1 and 2.

Submissions

Interested parties wishing to comment on the proposed amendments to Canada's marking regime should submit their views in writing by May 14, 2018. Submissions should include, at a minimum, the following information:

- Canadian company/industry association name, address, telephone number, and contact person.

- Reasons for the expressed support for, or concern with, the proposed amendments, including detailed information substantiating any expected beneficial or adverse impact.

- Whether or not the information provided in the submission is commercially sensitive.

Address for submissions

Submissions should be sent to the following address: International Trade Policy Division (Marking), Department of Finance Canada, 90 Elgin Street, 14th Floor, Ottawa, Ontario K1A 0G5, fin.tariff-tarif.fin@canada.ca (email), 613-369-4024 (fax).

General inquiries can be directed to the Tariff and Trade Policy Section, Department of Finance Canada, 613-369-4043 or 613-369-4038.

| Existing Text | Proposed Amendments |

|---|---|

None (add in new section in Schedule 1) |

Add in new text after Schedule 1 (Subsection 2(1)): 1 Goods of Steel or Aluminum Goods of steel or aluminum classified in headings 72.06 through 72.15, subheadings 7216.10 through 7216.50 or 7216.99, headings 72.17 through 72.29, subheading 7301.10, 7302.10, 7302.40 or 7302.90, headings 73.04 through 73.06, heading 76.01, headings 76.04 through 76.09 or castings or forgings of subheading 7616.99, except wire (other than barbed wire) |

2(12) Iron or steel pipes and tubes |

Delete "or steel" Renumber sections to reflect new section 1 |

Schedule II (Subsection 2(2)) 4. Used goods, with the exception of iron or steel pipes and tubes |

4. Used goods, with the exception of iron pipes and tubes, or goods of steel or aluminum listed in Schedule 1, section 1 |

5. Goods that are for the exclusive use of the importer or the importer's employees and not for resale to the general public, with the exception of iron or steel pipes and tubes |

5. Goods that are for the exclusive use of the importer or the importer's employees and not for resale to the general public, with the exception of iron pipes and tubes, or goods of steel or aluminum listed in Schedule 1, section 1 |

8. Goods that are imported for subsequent exportation from Canada, with the exception of iron or steel pipes and tubes |

8. Goods that are imported for subsequent exportation from Canada, with the exception of iron pipes and tubes, or goods of steel or aluminum listed in Schedule 1, section 1 |

| Existing Text | Proposed Amendments |

|---|---|

Schedule III

|

Replace rules 72.01 through 72.29 with the following:

|

|

|

DEPARTMENT OF INDUSTRY

OFFICE OF THE REGISTRAR GENERAL

Appointment

Name and position

Instrument of Advice dated March 26, 2018

Johnston, The Right Hon. David, C.C., C.M.M., C.O.M., C.D.

Queen's Privy Council for Canada

Member

April 20, 2018

Diane Bélanger

Official Documents Registrar

DEPARTMENT OF INDUSTRY

OFFICE OF THE REGISTRAR GENERAL

| Name and position | Order in Council |

|---|---|

| Barker, Elizabeth Catherine | 2018-384 |

Canadian Transportation Agency |

|

Member and Vice-Chairperson |

|

| Bobb, Gaylene | 2018-428 |

Court of Queen's Bench of Alberta |

|

Justice |

|

Court of Appeal of Alberta |

|

Judge ex officio |

|

| Domm, John C. | 2018-316 |

Parole Board of Canada |

|

Full-time member and Vice-Chairperson |

|

| Guay, Chantal | 2018-303 |

Standards Council of Canada |

|

Executive Director |

|

| Penner, Ann | 2018-391 |

Canadian International Trade Tribunal |

|

Temporary member |

|

| Williams, The Hon. James W. | 2018-364 |

Supreme Court of the Northwest Territories |

|

Deputy judge |

April 20, 2018

Diane Bélanger

Official Documents Registrar

DEPARTMENT OF PUBLIC SAFETY AND EMERGENCY PREPAREDNESS

CRIMINAL CODE

Designation as fingerprint examiner

Pursuant to subsection 667(5) of the Criminal Code, I hereby designate the following persons of the Royal Canadian Mounted Police as fingerprint examiners:

- Cheryl Dominie

- Erik Flynn

- Simon Labine

- Bradley Wolbeck

Ottawa, April 11, 2018

Kathy Thompson

Assistant Deputy Minister

Community Safety and Countering Crime Branch

INNOVATION, SCIENCE AND ECONOMIC DEVELOPMENT CANADA

DEPARTMENT OF INDUSTRY ACT

Revised Competition Bureau filing fee for merger reviews

Notice is hereby given that the Minister of Innovation, Science and Economic Development, pursuant to sections 18 and 20 of the Department of Industry Act (DIA), fixes May 1, 2018, for the coming into force of the revised filing fee for pre-merger notifications and requests for advance ruling certificates (ARC) under the Competition Act.

INTRODUCTION

This document provides an overview of the process followed and factors considered in relation to the revised filing fee for pre-merger notifications and requests for ARCs, which has been increased from $50,000 to $72,000. The document presents the legislative and policy framework under which the Competition Bureau (Bureau) reviews mergers and imposes a fee for merger filings, the rationale for the revised fee, a costing and impact analysis of the revised fee, and an overview of consultations with stakeholders.

About the Competition Bureau

As an independent law enforcement agency, the Bureau ensures that Canadian businesses and consumers can prosper in an innovative and competitive marketplace. The Bureau is responsible for the administration and enforcement of the Competition Act, the Consumer Packaging and Labelling Act (except as it relates to food), the Textile Labelling Act and the Precious Metals Marking Act.

The Bureau conducts a variety of activities relating to the enforcement and promotion of competition in Canada, such as investigating anti-competitive activities, advocating the benefits of competition, promoting compliance with the Competition Act and reviewing merger transactions. The Bureau charges fees for some of these activities, such as for CA Identification Numbers for textile dealers, merger reviews and written opinions.

The Bureau's Mergers Directorate undertakes activities relating directly and indirectly to merger enforcement. The Directorate's direct enforcement activities include reviewing notifiable and non-notifiablefootnote3 mergers in all sectors of the economy. The other work it undertakes in support of its enforcement mandate includes but is not limited to developing technical guidance publications, establishing memoranda of understanding (MOUs) with other government agencies, and undertaking various projects aimed at improving the timeliness and effectiveness of merger reviews.

Legislative and policy framework

The Competition Act prohibits mergers that prevent or lessen, or are likely to prevent or lessen, competition substantially. Under subsection 114(1) of the Competition Act, where merging parties and their transaction exceed certain thresholds, the parties are required to notify the Commissioner of Competition about the proposed transaction and provide prescribed information. Parties must do so by submitting a pre-merger notification, and/or requesting an ARC. Since November 1997, the payment of fees has been required for notification filings and ARC requests. In 2003, the fee was increased to $50,000 by the Minister of Industry pursuant to sections 18 and 20 of the DIA and has remained unchanged since that time. Under the DIA, the Minister is required to consult stakeholders before establishing and or revising service fees.

Merger filing fees are also subject to the Service Fees Act (SFA). Implemented in June 2017, the SFA replaced the User Fees Act (UFA), which was repealed as part of the Government's initiative to modernize business fees. The SFA introduced a number of changes aimed at enhancing government accountability and stewardship of taxpayer dollars. These changes include performance standards and annual reporting for all fees, and an annual adjustment of fees based on the Consumer Price Index (CPI). The SFA also requires departments and agencies to establish a mechanism for remitting fees when service standards are not met. The Bureau also consulted Government of Canada guidance documents during the development of its fee proposal. The Treasury Board of Canada Secretariat Guidelines on Costing were used to calculate the full costs, including indirect and direct costs and resource allocations, associated with merger reviews. The Guide to Establishing the Level of a Cost-Based User Fee or Regulatory Charge was used to determine the pricing of the fee.

BACKGROUND

Why did the Competition Bureau propose a revision to the merger filing fee?

There has been no increase in merger filing fees since 2003. When compound inflation alone is considered, the merger filing fee would be $65,500. In addition, rising operating and salary costs have made the Bureau's efforts to deliver merger reviews within the limits of current funding unsustainable. While the number of merger filings received by the Bureau dropped considerably after the size-of-transaction threshold increased in 2009, the revenue shortfall from the significant decrease in filings submitted to the Bureau has not been accompanied by a workload decrease, as there has not been a corresponding decrease in the number of complex cases.

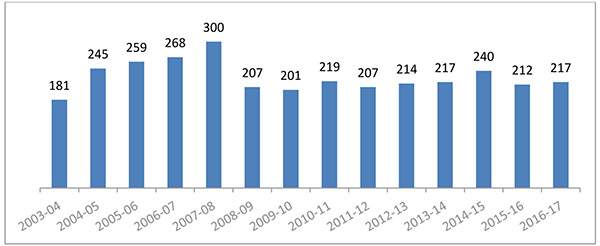

Although the total number of mergers reviewed by the Bureau has been relatively constant since fiscal year 2008–09, there has been an increase in the number of resource-intensive complex cases reviewed in recent years. For example, the number of concluded complex cases reviewed rose from 48 in 2013–14 to 65 in 2015–16. Maintaining the filing fee at $50,000 for the last 14 years, despite these changes, has led the mergers program to incur revenue deficits over the last few years. Recent judicial decisions have contributed significantly to the deficits and changes experienced by the Bureau. In particular, the Supreme Court of Canada's decision in Tervita footnote4 established a requirement for more complex quantification of anti-competitive effects, which has increased the time and cost of merger reviews. A trend toward more complex, strategic mergers requiring greater analysis has been observed in relation to domestic and global transactions.footnote5 The fee increase, therefore, will assist the Bureau in its efforts to complete effective reviews within applicable service standard periods.

Other related factors that contribute to the mergers program's revenue shortfalls include the increasing volume of documents and data requiring analysis, higher costs associated with hiring economic and industry experts, and an increase in the salaries of Bureau officers as a result of collective bargaining agreements. The Bureau is also subject to a 5% budget reduction over the next three years associated with a restructuring within Innovation, Science and Economic Development Canada (ISED) to support the Government of Canada's Innovation and Skills Plan announced in 2017.

| 2014–15 | 2015–16 | 2016–17 | |

|---|---|---|---|

| Revenues ($M) | 11.9 | 10.5 | 10.8 |

| Costs ($M) | 12.1 | 13.4 | 13.6 |

| Deficit ($M) | 0.2 | 2.9 | 2.8 |

The Bureau has taken some steps to address these challenges, such as more frequent use of in-house economists and Bureau officers for econometric or efficiencies analyses instead of hiring external experts. However, despite these efforts, the deficits continue to persist, making an increase in the filing fee a necessary and appropriate solution.

This increase will ensure that the Bureau can continue to effectively review mergers and manage its mergers program. Revenues generated by the $72,000 merger filing fee will be used to cover 100% of the merger-related costs incurred by the Bureau. The increased revenue will help the Bureau improve its services. Changes the Bureau will implement include more frequent hiring of economic, industry and legal experts, and continuing to improve document management and review processes.

WHAT IS THE REVISED FEE AND HOW WAS IT DETERMINED?

The Bureau proposed a single fee of $72,000 for pre-merger notifications and ARC requests (single fee for both). To establish the costing basis for the fee, the Bureau calculated current and forecasted merger review costs and full costs of the mergers program. Merger review costs are costs incurred by the Mergers Directorate and other Bureau branches that provide support to the Mergers Directorate for activities such as electronic evidence management, finance and administration, planning, communications, legal services, and economic analysis. Merger review costs also include costs incurred by federal government departments that support the Mergers Directorate's operations. Full costs were determined by calculating direct costs and costs associated with the Bureau's and ISED's internal services support provided to the mergers program.

Direct costs associated with merger reviews can be broken down into salary costs, such as the salaries of officers who conduct reviews, and non-salary costs, such as the costs of hiring lawyers and economic and industry experts. In 2016–17, the Bureau reviewed 217 mergers. The direct costs of the Mergers Directorate during this period were $6,673,000, while the direct merger-related costs from other Bureau branches providing support to the Mergers Directorate were $4,476,000.

Costing analysis for the revised fee also included indirect costs. Indirect costs associated with merger reviews include internal IT and administration support provided to the Mergers Directorate. In 2016–17, indirect costs were $979,000 for accommodations (i.e. rent) and $1,507,000 for employee benefits.

| Costs | 2016–17 (in Thousands of Dollars) |

2015–16 (in Thousands of Dollars) |

2014–15 (in Thousands of Dollars) |

2013–14 (in Thousands of Dollars) |

|---|---|---|---|---|

| Direct costs | ||||

| Mergers Directorate | 6,673 | 6,704 | 5,738 | 6,206 |

| Competition Bureau supportnote1* | 4,476 | 4,288 | 4,010 | 4,343 |

| New collective agreementnote2* | 398 | |||

| Indirect costs | ||||

| Accommodations | 979 | 962 | 922 | 963 |

| Employee benefits | 1,507 | 1,480 | 1,419 | 1,482 |

| Total | 14,033 | 13,434 | 12,089 | 12,994 |

| Number of merger filings | 217 | 212 | 240 | 218 |

| Costs per merger filing | 64,668 | 63,368 | 50,371 | 59,606 |

The Bureau's cost-cutting measures were also factored into the costing analysis. Limited funding for the mergers program has led the Bureau to cut back on work performed by external industry, economic, and efficiencies experts, as well as external legal counsel. Cost-cutting has also resulted in understaffed case teams. These cutbacks have created constrained capacity for officers and paralegals, which can impact costs or availability of staff.

| Costs | 2016–17 (in Thousands of Dollars) |

2017–18 (in Thousands of Dollars) |

2018–19 (in Thousands of Dollars) |

2019–20 (in Thousands of Dollars) |

|---|---|---|---|---|

| Direct costs | ||||

| Mergers Directorate | 6,673 | 6,673 | 6,673 | 6,673 |

| Competition Bureau supportnote3* | 4,476 | 4,476 | 4,476 | 4,476 |

| New collective agreementnote4* | 398 | 398 | 398 | 398 |

| Indirect costs | ||||

| Accommodations | 979 | 979 | 979 | 979 |

| Employee benefits | 1,507 | 1,507 | 1,507 | 1,507 |

| Indirect costs | ||||

| External/internal resource deficiencies | 745 | 745 | 745 | |

| Legal costs of outside counselnote5* | 0 | 650 | 650 | 650 |

| Inflation Indexnote6* | 0 | 210 | 297 | 299 |

| Total | 14,033 | 15,638 | 15,725 | 15,727 |

| Number of merger filings | 217 | 220 | 220 | 220 |

| Costs per merger filing | 64,668 | 71,084 | 71,478 | 71,485 |

The Bureau also determined the amount of the revised fee by conducting a pricing analysis of the fee using the Treasury Board of Canada Secretariat Guide to Establishing the Level of a Cost-Based User Fee or Regulatory Charge, which outlines factors that should be assessed when setting a fee. These factors include the private and public benefits of the service, the impact of the fee on stakeholders, the public policy objectives associated with the fee, and stakeholder consultations. The guide also recommends that federal departments and agencies compare the proposed fees to those in other jurisdictions.

Private vs. public benefits

With the guidance of the Treasury Board of Canada Secretariat, the benefits of the service were assessed to be 100% private, which means that merging parties are the direct and primary beneficiaries of merger reviews. Merging parties are also impacted by other activities undertaken as part of the mergers program. For example, non-notifiable merger reviews brought before the Competition Tribunal or the courts can result in judicial guidance that provides clarity to mergers program stakeholders; developing technical guidance publications supports transparency and predictability of the merger review process; improvement of electronic information management and analytics helps to speed up merger reviews; efforts to coordinate with foreign competition agencies can speed up review times or lead to cooperation on remedial action for mergers; and MOUs or arrangements with other government agencies to coordinate timing or share information can result in more timely outcomes for stakeholders.

Impact analysis

The Bureau is of the view that the revised fee does not place an unreasonable financial burden on merging parties. To assess the impact of the fee on merging parties, the Bureau considered the fee against the monetary thresholds for determining whether a transaction is notifiable under the Competition Act. A $72,000 filing fee represents 0.07% of the minimum $92 million size-of-transaction threshold and 0.02% of the $400 million size-of-parties threshold. As the merger filing fee applies to mergers that exceed high notification thresholds, it is not expected that a meaningful number of small and medium-sized enterprises would be affected.

Public policy objectives

Filing fee revenues support the activities of the Bureau's mergers program. By reviewing proposed mergers to ensure they do not substantially lessen or prevent competition, the Bureau is contributing to the Government's efforts to keep the Canadian economy competitive, innovative and accessible to businesses. The revised fee also aligns with the Government's 2017 initiative to modernize business service fees and ensures that merging parties pay appropriate costs associated with the review of mergers.

Did the Bureau consider other fee options?

The Bureau considered various fee structures for the merger filing fee. In addition to a flat fee, fees may be imposed through a tiered fee structure. Tiered fees can be based on the time used to examine a merger, the size of assets or revenues of merging parties, or the complexity of the merger review. The Bureau finds the flat fee to be a simple, efficient and transparent way to charge fees for merger reviews. In the Bureau's view, the flat fee approach does not discriminate against industries and poses fewer issues than some of the other fee options available. For example, a time-based fee could suffer from inconsistent application. Although the flat fee model has been maintained, the Bureau will continue to assess the benefits and suitability of the flat fee approach, as well as consider other fee options in the future.

International comparison

An international comparison of fees shows that the revised filing fee conforms with international norms, even when the fee structures of the agencies differ.

| Country | Fees (2017) |

|---|---|

| Canada | Flat fee: $50,000 (CAD) *Revised fee: $72,000 (CAD) |

| United States | Tiered fees (based on size of transaction):footnote7

|

| United Kingdom | Tiered fees (based on value of revenues):footnote8

|

| Australia | Flat fee:footnote9 $24,600 (CAD) |

| Germany | Variable fee (case-by-case basis):footnote10

|

The revised fee also aligns with the International Competition Network's recommendation that merger notification filing fees should be easily understood, readily determinable at the time of filing, easily administered, and consistent with the jurisdiction's legislative and policy framework.

Consultations with stakeholders

To obtain the input of interested parties on its fee proposal, the Bureau organized consultations with stakeholders in two phases.

The following stakeholders were invited to participate in the consultations: Senior members of the Canadian Bar Association (CBA) [Competition Law Section]; industry associations from the real estate, oil and gas, manufacturing, grocery, telecommunications and retail sectors; consumer groups; and the Canadian public.

Phase 1 consultations

- September 25, 2017: Quiet consultation with the senior members of the CBA.

- October 17, 2017: In-person meeting with stakeholders in Toronto, Ontario.

- October 31, 2017: In-person and teleconference meeting with stakeholders in Montréal, Quebec.

The Bureau also organized a session for stakeholders in Calgary, Alberta. However, the Bureau did not receive any requests to hold the session.

Phase 2 consultation

- The fee proposal was posted on the Bureau's website for 30 days from October 20, 2017, to November 20, 2017.

- The consultation was publicized via an information notice and through the Bureau's various social media pages (i.e. Facebook, Twitter, and LinkedIn).

- The Bureau received two submissions from stakeholders on the fee proposal during the consultation period.

Over the course of the consultations, Bureau representatives answered questions from stakeholders regarding costing, service standards and the fee-setting process. The following statements represent the common questions and comments received during the consultations:

- Stakeholders acknowledge that financial challenges pose constraints to the Bureau's ability to review mergers.

- The flat fee is an appropriate method for administering the fee. However, the Bureau should continue to explore other fee structures. Under the flat fee approach, non-complex merger transactions can subsidize the costs for complicated merger reviews.

- Merger reviews pose benefits to both businesses and the general public.

- Additional revenues from the fee increase should be used to improve the merger services to stakeholders.

- The Bureau may need to revise its service standards to reflect the changes outlined in the Service Fees Act.

- The Bureau should consider revising its current complexity designations.

- Exemption from pre-merger notification requirements should be considered for merger transactions that generally do not raise competition issues.

Stakeholders generally supported the fee increase and the flat fee structure at the $72,000 level. The Bureau will use the feedback it received to improve its services and has already begun taking steps to address some of the concerns raised by stakeholders. For example, the Bureau and the Canadian Bar Association have established a working group to discuss issues raised during the consultations, including alternative fee models, exemptions, and service standards.

Service standards

Under the SFA, federal departments and agencies are required to establish performance standards and report annually on fees. The Bureau has had service standards in place for merger reviews since 1997, and reports its performance on merger reviews annually to ISED and the public. Currently, the Bureau classifies mergers under two complexity levels: non-complex and complex. The service standards for reviews are based on the complexity of the competition issues raised by a proposed merger. The service standards are 14 calendar days for non-complex cases and 45 days for complex cases, except when the Bureau issues a Supplementary Information Request (SIR), where the service standards would then be 30 days after the parties have complied with the SIR. In 2016–2017, the Bureau met the service standards in 74% of complex cases and 99% of non-complex cases.footnote11

The current merger review complexity levels and the related service standards will not change with the introduction of the revised fee. However, the Bureau will continue to consider updating the complexity level designations and service standards to better reflect the time, work and information required to review mergers, including through the working group with the Canadian Bar Association.

Remission of fees

The SFA requires that departments and agencies establish a mechanism for remitting fees when service standards are not met. Guidelines on remissions are currently being developed by ISED and the Treasury Board of Canada Secretariat.

Annual adjustment of fees

The SFA includes a provision for adjusting fees to account for inflation. Beginning in 2019, fees will be increased by the percentage change over 12 months in the CPI for Canada for the previous fiscal year. The adjusted merger filing fee will be published on the Bureau's website annually.

CONCLUSION

The merger filing fee was revised in accordance with the SFA and DIA, and is based on a thorough costing analysis of merger reviews. The Bureau also consulted stakeholders extensively on the fee proposal. The Bureau believes that mergers can have significant effects on the economy and that an effective mergers program maintains and promotes competitiveness in Canadian markets.

APPENDIX

Total annual notification and ARC request filings

Navdeep Bains

Minister of Innovation, Science and Economic Development

PRIVY COUNCIL OFFICE

Appointment opportunities

We know that our country is stronger — and our government more effective — when decision-makers reflect Canada's diversity. The Government of Canada has implemented an appointment process that is transparent and merit-based, strives for gender parity, and ensures that Indigenous peoples and minority groups are properly represented in positions of leadership. We continue to search for Canadians who reflect the values that we all embrace: inclusion, honesty, fiscal prudence, and generosity of spirit. Together, we will build a government as diverse as Canada.

The Government of Canada is currently seeking applications from diverse and talented Canadians from across the country who are interested in the following positions.

Current opportunities

The following opportunities for appointments to Governor in Council positions are currently open for applications. Every opportunity is open for a minimum of two weeks from the date of posting on the Governor in Council Appointments website.

| Position | Organization | Closing date |

|---|---|---|

| President and Chief Executive Officer | Canada Deposit Insurance Corporation | |

| President and Chief Executive Officer | Canada Infrastructure Bank | |

| Chairperson | Canada Lands Company Limited | |

| President and Chief Executive Officer | Canada Post Corporation | |

Chief Executive Officer |

Canadian Dairy Commission | |

Regional Member (British Columbia / |

Canadian Radio-television and Telecommunications Commission |

May 17, 2018 |

| Chairperson | Civilian Review and Complaints Commission for the Royal Canadian Mounted Police | |

| Commissioner of Corrections | Correctional Service Canada | |

Members |

International Trade and International Investment Dispute Settlement Bodies |

|

Parliamentary Librarian |

Library of Parliament | |

| Director | National Gallery of Canada | |

| President | National Research Council of Canada | |

Chief Electoral Officer |

Office of the Chief Electoral Officer | |

| Commissioner of Competition | Office of the Commissioner of Competition | |

Parliamentary Budget Officer |

Office of the Parliamentary Budget Officer | |

| Superintendent | Office of the Superintendent of Bankruptcy Canada | |

Veterans Ombudsman |

Office of the Veterans Ombudsman | |

| Chairperson | Social Security Tribunal of Canada | |

| Chief Statistician of Canada | Statistics Canada | |

| Executive Director | Telefilm Canada | |

| Chairperson and Vice-Chairperson | Transportation Appeal Tribunal of Canada |

May 7, 2018 |

Chief Executive Officer |

Windsor-Detroit Bridge Authority |

Ongoing opportunities

| Position | Organization | Closing date |

|---|---|---|

| Full-time and Part-time Members | Immigration and Refugee Board | June 29, 2018 |

| Members — All regional divisions | Parole Board of Canada |

Upcoming opportunities

| Position | Organization |

|---|---|

| Sergeant-at-Arms | House of Commons |

| Commissioners | International Joint Commission |

BANK OF CANADA

| ASSETS | Amount | Total |

|---|---|---|

| Cash and foreign deposits | 15.3 | |

| Loans and receivables | ||

| Securities purchased under resale agreements | 7,905.2 | |

| Advances | — | |

| Other receivables | 9.1 | |

| 7,914.3 | ||

| Investments | ||

| Treasury bills of Canada | 19,269.9 | |

| Government of Canada bonds | 80,664.8 | |

| Other investments | 423.1 | |

| 100,357.8 | ||

| Property and equipment | 565.9 | |

| Intangible assets | 40.5 | |

| Other assets | 159.0 | |

| Total assets | 109,052.8 | |

| LIABILITIES AND EQUITY | Amount | Total |

|---|---|---|

| Bank notes in circulation | 82,961.2 | |

| Deposits | ||

| Government of Canada | 21,832.0 | |

| Members of Payments Canada | 250.3 | |

| Other deposits | 2,913.8 | |

| 24,996.1 | ||

| Securities sold under repurchase agreements | — | |

| Other liabilities | 580.4 | |

| 108,537.7 | ||

| Equity | ||

| Share capital | 5.0 | |

| Statutory and special reserves | 125.0 | |

| Investment revaluation reservefootnote12 | 385.1 | |

| 515.1 | ||

| Total Liabilities and Equity | 109,052.8 | |

I declare that the foregoing statement is correct according to the books of the Bank.

Ottawa, April 16, 2018

Carmen Vierula

Chief Financial Officer and Chief Accountant

I declare that the foregoing statement is to the best of my knowledge and belief correct, and shows truly and clearly the financial position of the Bank, as required by section 29 of the Bank of Canada Act.

Ottawa, April 16, 2018

Stephen S. Poloz

Governor