Canada Gazette, Part I, Volume 148, Number 7: Regulations Amending Certain Regulations Made Under the Customs Act

February 15, 2014

Statutory authority

Customs Act

Sponsoring agency

Canada Border Services Agency

REGULATORY IMPACT ANALYSIS STATEMENT

(This statement is not part of the Regulations.)

Executive summary

Issues: It is an ongoing challenge for the Canada Border Services Agency (CBSA) to deliver consistently on both the security and facilitation aspects of its mandate while facing an increase in volume of commercial goods coming into Canada. The CBSA must ensure that costs and delays associated with clearance processes on legitimate shipments are minimized while also identifying and mitigating threats to national health, safety, security and prosperity.

To meet this challenge, the CBSA relies on a risk-based, intelligence-driven approach, concentrating its efforts on commercial goods of high or unknown risk while facilitating the entry into Canada of goods deemed to be low risk. The key to this risk-based approach is information: getting the right information to the right people at the right time ensures that border processing is both efficient and effective.

Receiving electronic information about commercial goods in advance of their arrival in Canada allows the CBSA to assess risks associated with goods and make informed decisions about those goods, thereby increasing predictability for stakeholders and minimizing delays at the border.

Description: eManifest (electronic manifest) is an initiative designed to establish advance electronic information requirements in the highway and rail modes of transportation, and to build upon existing advance commercial information requirements for goods in the marine and air modes. eManifest would ensure a paperless process, which starts before any goods reach the Canadian border, for commercial importations in all modes of transportation.

This regulatory proposal represents the first of two packages of regulatory amendments designed to support the full implementation of eManifest. “Package 1” includes requirements for electronic pre-arrival information in the highway and rail modes, enhancements to existing processes in the marine and air modes, and provisions that would allow the CBSA to develop administrative monetary penalties for non-compliance with eManifest requirements. The second package is expected to be introduced in 2015/2016 and would mainly include provisions relating to advance information requirements for importers.

This package of proposed regulatory amendments would introduce changes to five regulations made under the Customs Act:

- the Reporting of Imported Goods Regulations;

- the Customs Sufferance Warehouses Regulations;

- the Designated Provisions (Customs) Regulations;

- the Transportation of Goods Regulations; and

- the Presentation of Persons (2003) Regulations (consequential amendments).

Cost-benefit statement: It is estimated that the implementation of Package 1 would result in a net benefit for businesses of $391 million over a 12-year period from reduced delays at the border and from efficiencies achieved by replacing paper processes with electronic ones. In addition to the anticipated cost savings, the proposed regulatory amendments are expected to enhance and improve border security, which would assist the Government in ensuring the continued health, safety, security and prosperity of Canada and Canadians. It is therefore expected that this regulatory proposal represents an overall net benefit to businesses, the Government of Canada and Canadians.

“One-for-One” Rule and small business lens: The “One-for-One” Rule will apply to this proposal. The proposed regulatory amendments would, over time, decrease the administrative burden on stakeholders by $4.6 million annualized and, therefore, constitute an “OUT” under the Rule. The proposed amendments are expected to lead to a total annualized decrease in administrative costs as paper processes would be replaced by more efficient electronic processes.

Many small businesses would experience compliance costs in transitioning to electronic processes and would therefore be impacted by these regulatory amendments. To assist small businesses with upfront capital costs for IT and ongoing maintenance costs, a flexible option has been developed by the CBSA. Businesses have the option of using the eManifest Internet portal to transmit required information to the CBSA. It is estimated that the administrative and compliance costs to small businesses of the regulatory requirements in support of eManifest would amount to $55 million over a 12-year period, or an average of less than $340 per small business ($42 annualized). Therefore, the impacts of these proposed regulatory amendments on small businesses are expected to be minimal in comparison to the overall benefits of eManifest.

Background

Imports are essential to Canada's economic prosperity. According to the World Bank, the total value of Canadian imports increased from 34% to 45% of Canada's gross domestic product between 2008 and 2011.

Given the importance of imports to the Canadian economy, it is essential for the CBSA to have the appropriate tools to allow the Agency to deliver border services in an open and transparent manner, providing increased predictability and consistency to the commercial import process and the transborder trade environment.

Trade chain partners

The following trade chain partners involved in the importation of commercial goods into Canada would be affected by the proposed Regulations: carriers, freight forwarders and customs sufferance warehouse operators.

A carrier is the person or company that transports commercial goods into Canada. The carrier is responsible for providing goods (cargo) and conveyance information to the CBSA.

A freight forwarder arranges for the transportation of commercial goods to Canada with a carrier and may separate a shipment of goods at a customs sufferance warehouse in Canada on behalf of an importer or the person receiving the goods. The freight forwarder is considered a secondary party in the international transportation chain. The freight forwarder is responsible for providing secondary information to the CBSA, which builds upon the information supplied by the carrier, such as the name of the person receiving the goods and the delivery address.

A customs sufferance warehouse is a privately owned and operated facility licensed by the CBSA for the control, short-term storage and examination of imported goods until they are released by the CBSA or exported from Canada.

Advance Commercial Information (ACI)

The ACI program is about providing CBSA officers with electronic pre-arrival information so that they are equipped with the right information at the right time to identify health, safety and security threats related to commercial goods before the goods arrive in Canada. The ACI program supports three of the CBSA's strategic priorities: targeting high risks as early as possible in the supply chain continuum, offering expedited border processing for commercial goods determined to be low risk, and improving the consistency and predictability of service delivery to stakeholders.

The first phase of ACI was implemented in 2004 and established advance electronic information requirements for commercial goods in the marine mode by requiring marine carriers to transmit prescribed information electronically to the CBSA 24 hours before the goods are loaded onto the vessel at the foreign port or 24 hours prior to the vessel's arrival at a port in Canada, depending on the type and origin of the goods.

The second phase of ACI was implemented in the air mode in 2006 and required commercial air carriers, where applicable, to transmit prescribed information to the CBSA electronically four hours prior to arrival in Canada. This phase also expanded information requirements in the marine mode for goods loaded in the United States.

Although advance electronic reporting requirements were implemented in the marine and air modes of transportation in Phases I and II of ACI, they did not extend to the highway and rail modes of transportation.

The third phase of ACI, called eManifest, (see footnote 1) would introduce amendments that

- (i) establish advance electronic information requirements in the highway and rail modes, and

- (ii) support and enhance ACI processes in the marine and air modes.

The eManifest initiative represents a move towards a comprehensive electronic commercial reporting environment. It would ensure that all goods coming into Canada are assessed for risk consistently, electronically, and in advance of arrival.

Identification of security risks and gaps

Since its creation in 2003, the CBSA has initiated various reviews of its commercial programs and policies with a view to developing stronger tools and processes to streamline the movement of low-risk goods and focus efforts on commercial goods of high or unknown risk. One such initiative was the Commercial Direction Initiative (CDI), which was an internal review undertaken by the CBSA in 2005–2006.

The CDI Report identified the CBSA's continued reliance on paper-based reporting as one of the main barriers to streamlining the commercial importation process. Industry feedback from consultations completed for the CDI supported the implementation of ACI in the highway mode as soon as possible.

In addition to the CDI Report, reviews undertaken by the Auditor General of Canada (AGC) in 2007 and 2010 identified numerous gaps and inefficiencies with the CBSA's collection and risk assessment of commercial information.

According to the 2007 Report of the Auditor General, (see footnote 2) the most significant threats facing border security today are

- Terrorism (both terrorists and terrorism-related material);

- Firearms, drugs, child pornography and other contraband;

- Food and product safety;

- The health of persons entering Canada (e.g. freedom from pandemic disease);

- The proliferation of dual-use goods (equipment, technology or any type of good that may be used in connection with programs of weapons of mass destruction); and

- Illegal migrants (e.g. criminals, including war criminals, and economically driven migrants).

Chapter 8 of the Auditor General's 2010 (see footnote 3) report recommended that “the Canada Border Services Agency should improve its systems and practices for monitoring the quality of electronic information that it receives during the commercial importing process—to obtain reasonable assurance that this information is accurate, complete, and timely. The Agency should then use the results of its monitoring process for continuous improvement.”

The CBSA agreed that improvements were required to address the shortcomings found in the Auditor General Report and decided that systems need to be in place to ensure that commercial information provided by all trade chain partners would be reviewed and evaluated consistently and effectively through every stage of the import process, from pre-arrival through to release.

The CBSA examined the international commercial environment to ensure that any new processes developed would be consistent with its major trading partners — especially its main trading partner, the United States.

Issues

The CBSA is responsible for providing integrated border services that support national security and public safety priorities and that facilitate the free flow of persons and goods that meet all program requirements. It is challenging to deliver consistently on both the security and facilitation aspects of this mandate when faced with an ever-increasing volume of travellers and commercial goods coming into Canada. The CBSA must ensure that costs and delays associated with clearance processes on legitimate people and goods are minimized while at the same time identifying and mitigating diverse and constantly evolving threats to national health, safety, security and prosperity.

To meet these challenges, the CBSA relies on a risk-based, intelligence-driven approach, concentrating its efforts on people and goods of high or unknown risk while facilitating the entry into Canada of people and goods deemed low risk. The key to this risk-based approach is information: getting the right information to the right people at the right time ensures that border processing is both efficient and effective. Receiving electronic information about commercial goods in advance of their arrival in Canada allows the CBSA to assess any risks associated with goods and make informed decisions about those goods, thereby increasing predictability for stakeholders and minimizing delays at the border.

The need to amend the existing regulations stems from a variety of factors:

- Pre-arrival information is not systematically collected and screened consistently in all modes of transportation;

- Specific roles, responsibilities and accountabilities for each stakeholder in the trade chain continuum are not clearly defined; and

- CBSA commercial processes are not aligned with international standards.

Pre-arrival information is not systematically collected and screened consistently in all modes of transportation

Internal program reviews undertaken by the CBSA and reports of the Auditor General of Canada have identified issues with the CBSA's ability to detect and address risks associated with commercial goods consistently and effectively. In addition, questions have been raised about the accuracy and reliability of the information provided to the CBSA about commercial goods.

The establishment of ACI requirements has enabled the CBSA to conduct automated pre-arrival risk assessments for commercial goods imported to Canada by the air and marine modes. Therefore, all goods that come to Canada by sea or by air are subjected to a consistent level of security screening. Conversely, goods that come to Canada overland (i.e. via the highway and rail modes), for which there are no formal advance electronic requirements, are not necessarily subject to the same level of security screening. This is significant as about 64% of goods that enter Canada are imported overland.

Specific roles, responsibilities and accountabilities for each stakeholder in the trade chain continuum are not clearly defined

Currently, the CBSA does not have reasonable assurance that the commercial information provided by stakeholders at various stages of the import process is accurate, complete and timely. For example, freight forwarders are not held accountable for transmitting specific advance commercial information on goods destined for Canada. Likewise, customs sufferance warehouse operators/licensees are not required to acknowledge the arrival of commercial goods at their warehouses with an electronic message.

To ensure that advance commercial information is reliable, accurate and complete, it is essential that all stakeholders involved in the transportation of goods to Canada provide and be accountable for specific information relating to the movement of goods. The CBSA seeks to improve the quality of commercial information provided to it by prescribing roles, responsibilities and accountabilities for each stakeholder in the supply chain continuum. Each stakeholder would be responsible for providing specific information, which could be compared to information provided by other trade chain partners to ensure the integrity, accuracy and completeness of the information the CBSA receives. For example, eManifest would require electronic information from freight forwarders. This information would then be compared to information received from carriers to identify any anomalies or inconsistencies.

CBSA commercial processes are not aligned with international standards

The United States already requires the electronic submission of advance cargo and conveyance data by carriers. The Advance Electronic Information Regulations, (see footnote 4) introduced in 2003, require the advance transmission of electronic cargo information and other specific data requirements from carriers for import shipments in all modes of transportation. The Automated Commercial Environment (ACE) is the United States Customs and Border Protection's (USCBP) commercial trade processing system for transmitting required advance highway, rail and marine cargo information.

In designing eManifest, the need to align with U.S. processes for the sake of a common client, i.e. highway carriers that transport goods across our shared border, was an early priority. Ensuring commonalities between eManifest and ACE would allow highway carriers that have already implemented systems for ACE participation to simply modify those systems for eManifest purposes. The carriers would thereby avoid the cost of implementing an entirely new system. Feedback from stakeholders confirms that the implementation costs for eManifest would be lower for those already using ACE. Once eManifest is implemented, information requirements in the two countries would be closely aligned, which would allow stakeholders to develop common reporting processes and, thereby, reduce complexity and duplication of effort.

In addition, the Beyond the Border Action Plan, (see footnote 5) announced by Prime Minister Stephen Harper and U.S. President Barack Obama on December 7, 2011, committed both nations to the pursuit of a shared approach to strengthening perimeter security and accelerating the legitimate flow of people, goods and service between the two countries. The implementation of eManifest would support these objectives by aligning commercial import processes in the two countries.

Finally, the implementation of eManifest would ensure that commercial reporting requirements in Canada remain consistent with international standards. Since September 11, 2001, international customs administrations, organizations, conventions, and agreements have focused on ensuring better trade security and facilitation. Some of the modern principles of trade security and facilitation include

- establishing harmonized international customs standards;

- using risk management principles (identifying high risk shipments based on analysis and intelligence) to screen the import and export of goods;

- requiring the submission of advance customs information;

- requiring the submission of electronic customs information; and

- facilitating legitimate trade while maintaining effective control.

Notably, these are all standards promoted by the World Customs Organization (WCO). The WCO is an intergovernmental organization that focuses extensively on customs issues with the goal of enhancing the effectiveness and efficiency of international customs processes. It is recognized for its work to facilitate and secure international trade. For example, the WCO's SAFE Framework of Standards to Secure and Facilitate Global Trade, published in 2005, sets out a range of standards to guide customs administrations in providing predictable and consistent supply chain security. Canada has been a member of the WCO since 1971.

Given these issues, the CBSA recognizes the need to enhance how it screens and processes commercial goods coming into Canada. Without the proposed regulations, the CBSA would be unable to identify potential risks associated with the import of goods in the highway and rail modes. Without pre-arrival information, the CBSA would be limited in its ability to streamline import processes. In addition, Canada would not be in line with its biggest trading partner, the United States, and would not meet the standards set out by the WCO, which could result in a loss of economic prosperity.

Objectives

The eManifest initiative would introduce amendments that would expand pre-arrival information requirements to include carriers in the highway and rail modes of transportation. In addition to the required data, advance information will be required from other trade chain partners involved in the importation of goods into Canada in all modes of transportation. Each member of the trade chain would have a separate obligation for various pieces of information relating to commercial goods before they are loaded onto the vessel (in marine mode only) and in advance of the estimated arrival of goods at a port of arrival in Canada. In addition, customs sufferance warehouse operators would be required to acknowledge receipt of goods through an electronic arrival message transmitted to the CBSA once the goods have arrived at their warehouse.

By mandating that all trade chain partners provide advance commercial information to the CBSA, security is enhanced through a risk assessment of all the pertinent information relating to goods in advance of their arrival in Canada. At the same time, trade facilitation is improved, as those commercial goods deemed low risk would benefit from a more efficient border clearance process.

The improved risk assessment process made possible by the pre-arrival electronic transmission of commercial information under the eManifest initiative would lead to shorter and more predictable clearance times for low-risk commercial goods. Also, the automation of customs processes would improve the CBSA's ability to monitor data quality and integrity, to monitor and enforce compliance, and to establish service standards for many of its key services to trade chain partners, such as processing times and wait times at land border crossings.

Description

The regulatory amendments herein are being proposed pursuant to subsection 8.1(8), sections 12 and 12.1, subsection 14(2), sections 22, 30 and 109.1 and subsection 164(1) of the Customs Act. These amendments would enact changes required to implement eManifest and enhance ACI.

Package 1 includes amendments to the following regulations:

- 1. Reporting of Imported Goods Regulations (see footnote 6)

- 2. Customs Sufferance Warehouses Regulations (see footnote 7)

- 3. Transportation of Goods Regulations (see footnote 8)

- 4. Designated Provisions (Customs) Regulations (see footnote 9)

- 5. Presentation of Persons (2003) Regulations (see footnote 10) (consequential amendments)

1. Reporting of Imported Goods Regulations

Interpretation

The terms “airport of arrival,” “commercial driver,” “courier,” “emergency conveyance,” “fishing vessel,” “freight forwarder,” “NAV CANADA,” and “port of arrival” would be added to the Regulations. The terms “commercial goods” and “specified goods” would be amended to detail the goods included in new sections of the Regulations as well as the goods that would not be covered by the new sections of the Regulations.

Highway cargo and conveyance information

Baseline scenario: Currently, commercial highway carriers may provide paper documentation to the CBSA regarding imported goods upon arrival at the border. Since November 2010, highway carriers have had the option to provide this information to the CBSA electronically.

Regulated scenario: The proposed amendment would require highway carriers to provide cargo and conveyance information (e.g. cargo description, licence plate information) electronically to the CBSA at least one hour before the conveyance arrives at the border. This requirement would give the CBSA time to assess risks and make informed determinations without creating significant delays to the travel time of the carrier.

The required information would be provided to the CBSA by either the carrier or on its behalf by a third-party service provider and through either a direct connection or the CBSA's free Internet portal. Both the direct connection and the Internet portal are considered acceptable means of transmission to meet the information requirements.

Virtually all commercial carriers transporting commercial goods to Canada also transport goods to the United States, where they are currently required to transmit information electronically to the USCBP in advance of arrival at the U.S. border. Since it is more economically feasible to transport goods both coming and leaving Canada (rather than making one leg of the journey empty and therefore without revenue), it is assumed that the majority of carriers entering or returning to Canada are already electronically capable in order to comply with U.S. requirements.

Note: The proposed amendments would not apply to goods imported under the courier Low Value Shipment (LVS) program (e.g. casual goods or goods that have an estimated value of less than $2,500) that are transported by or on behalf of a courier that has been authorized to account for those goods in accordance with subsection 32(4) of the Customs Act. The courier LVS program streamlines processing of low-value goods through an alternative method of risk assessment while providing the courier industry with expedited release. Couriers must post security and receive written authorization before participating in the program.

Rail cargo, conveyance and arrival message information

Baseline scenario: Currently, all rail carriers transporting commercial goods to Canada provide cargo and conveyance information to the CBSA either electronically or in paper form. Although the majority of rail carriers provide this information electronically, they are not currently required to notify the CBSA when the train physically crosses the border into Canada.

Regulated scenario: The proposed amendments would require rail carriers to provide cargo and conveyance information electronically to the CBSA at least two hours before the train is expected to cross the border into Canada. In addition, rail carriers would be required to provide an electronic arrival message to the CBSA without delay after the train crosses the border into Canada. This requirement would give the CBSA time to assess risks and make informed determinations without creating significant delays to the travel time of the rail carriers. The electronic arrival message would identify the date, time and the CBSA office of arrival.

Between 2007 and 2012, 99.6% of cargo and conveyance information provided by rail carriers was submitted electronically. Therefore, this change is expected to have a minimal impact on rail carriers.

Note: The proposed amendments would not apply to goods imported under the courier Low Value Shipment (LVS) program (e.g. casual goods or goods that have an estimated value of less than $2,500) that are transported by or on behalf of a courier that has been authorized to account for those goods in accordance with subsection 32(4) of the Customs Act. The courier LVS program streamlines processing of low-value goods through an alternative method of risk assessment while providing the courier industry with expedited release. Couriers must post security and receive written authorization before participating in the program.

Electronic arrival messages in the air and marine modes

Baseline scenario: Currently, carriers in the air and marine modes are not required to notify the CBSA when the conveyance arrives in Canada. Instead, the CBSA automatically generates an arrival time based on the estimated time of arrival provided by the carrier.

Regulated scenario: The proposed amendments would require air and marine carriers to provide an electronic arrival message to the CBSA without delay upon arrival in Canada. Specifically, air carriers would be required to provide this message without delay after the aircraft is cleared by NAV CANADA to land at an airport following arrival in Canada. Marine carriers would be required to provide this message without delay after the vessel lands at a marine port of entry.

Note: The proposed amendments would not apply to goods imported under the courier Low Value Shipment (LVS) program (e.g. casual goods or goods that have an estimated value of less than $2,500) that are transported by or on behalf of a courier that has been authorized to account for those goods in accordance with subsection 32(4) of the Customs Act. The courier LVS program streamlines processing of low-value goods through an alternative method of risk assessment while providing the courier industry with expedited release. Couriers must post security and receive written authorization before participating in the program.

Removal of break-bulk exemption

“Break-bulk goods” are commercial goods that are neither transported within a cargo container nor in bulk (e.g. grain stowed loosely in the vessel's hold) and include goods such as oil and gas equipment, construction equipment, and automobiles.

Baseline scenario: Currently, marine carriers that transport break-bulk goods to Canada are required to provide cargo and conveyance information to the CBSA at least 24 hours before the goods are loaded onto the vessel at the foreign port. However, carriers may request an exemption from this requirement and permission to provide this information to the CBSA 24 hours before a vessel's arrival at a port in Canada.

Regulated scenario: The proposed amendments would extend the beneficial time frame (24 hours before the estimated arrival at a port of arrival in Canada versus 24 hours before the goods are loaded onto the vessel at the foreign port) for approved marine break-bulk carriers to all marine carriers transporting break bulk, eliminating the need for carriers to complete an application and maintain an authorization with the CBSA. Because of the elimination of the need to apply for and maintain exemption status, marine carriers with break-bulk goods that have difficulty meeting the pre-load time frame requirement would no longer incur costs related to the application and maintenance of the exemption status in order to gain flexibility in transmitting cargo and conveyance data.

In addition to section 13.8, other sections that relate to the exemption (sections 13.81, 13.82, 13.83, 13.84, 13.85 and 13.86) would be repealed as consequential amendments to the removal of the exemption.

Carrier code requirements

A carrier code is a four-digit unique identifier that is assigned by the CBSA to a commercial carrier or a freight forwarder free of charge. The carrier code lets the CBSA know with whom it is doing business, and is similar to a passport for a traveller entering Canada.

Baseline scenario: Currently, all commercial carriers transporting commercial goods to Canada require a carrier code. However, this is an administrative and not a legal requirement (i.e. without a carrier code, a carrier would be unable to provide information). Therefore, there are no formal terms and conditions that apply to the issuance and use of carrier codes. Likewise, the CBSA has no legal recourse for addressing carrier code problems and abuses.

The Jobs and Growth Act, 2012, which was passed on December 14, 2012, provides for amendments to section 12.1 of the Customs Act. The new section 12.1, once it comes into effect, will codify requirements for obtaining a valid carrier code.

Regulated scenario: Once section 12.1 comes into force, commercial carriers and freight forwarders would be required to hold a valid carrier code. A carrier may hold one carrier code for each mode of transportation in which it is engaged; a freight forwarder may only hold one carrier code. The proposed regulatory amendments would specify the terms and conditions for obtaining a carrier code and the grounds for suspending or cancelling a carrier code. As well, carriers and freight forwarders would be required to keep the information regarding their carrier codes up to date and to inform the CBSA of certain changes.

The carrier code requirements would ensure that carriers and freight forwarders are accountable for the advance commercial information they provide to the CBSA. In addition, the proposed regulations would allow the CBSA to suspend or cancel a carrier code if a person contravenes a provision of a federal act or regulation (e.g. smuggling), if a person fails to pay an amount under the Act (e.g. failing to pay duties and taxes), or if a person provides false or misleading information in the application for a carrier code.

Freight forwarder cargo information

Baseline scenario: Currently, freight forwarders in the air and marine modes provide secondary information on commercial goods to the CBSA in paper form, and only after the goods have arrived in Canada. Secondary information consists of additional details about the goods, such as the name of the person receiving the goods and the delivery address. Although freight forwarders provide this information in practice, they are not required to do so under the Regulations.

| Marine | Air | Rail | Highway |

|---|---|---|---|

| At least 24 hours before loading the goods or at least 24 hours before the estimated time of arrival at a port of arrival in Canada, depending on type and origin of goods | At least four hours before the estimated time of arrival or at the time of departure, depending on the duration of the flight | Two hours before the conveyance arrives in Canada | One hour before the conveyance arrives in Canada |

Marine bay plan (vessel stow plan)

The marine bay plan is a standard marine transportation document that assigns a numbered position to all cargo bays on the vessel and details the exact location of each container being transported on board the vessel. It is used by persons in the marine transportation industry to identify all the containers and their location on a vessel. Information about each container and its specific location is electronically logged as the vessel is loaded and unloaded at a port, ultimately resulting in a “blueprint” of the cargo and other stowage locations. This data can be represented visually as a virtual x-ray revealing the location of each container.

Baseline scenario: Currently, marine carriers are not required to provide the CBSA with the vessel bay or stow plan. However, most marine carriers provide it to other carriers and marine terminal operators as part of their business operations. Also, since 2009, U.S.-bound marine carriers have been required to provide vessel stow plans to the USCBP.

Regulated scenario: Under the proposed amendments, marine carriers would be required to provide the vessel bay or stow plan to the CBSA electronically within 48 hours after the vessel leaves the last foreign port before its estimated arrival at a port of arrival in Canada. This information would enable the CBSA to identify unreported containers and pinpoint containers which may pose risk. Cargo information provided by the carrier for goods expected to be transported to Canada before the goods are loaded onto the vessel would be compared to bay plan data provided after the containers are loaded aboard the vessel.

2. Customs Sufferance Warehouses Regulations

Electronic arrival messages for in-land customs sufferance warehouses

Baseline scenario: Currently, sufferance warehouse operators are not required to electronically notify the CBSA of the arrival of goods at their warehouses. However, sufferance warehouse operators acknowledge the receipt of goods in a warehouse either by endorsing a customs document or transportation document presented by the carrier, or by issuing a transfer document to the carrier. This proof of receipt shows that goods have been physically transferred from the carrier to the warehouse operator.

Regulated scenario: Under the proposed amendments, sufferance warehouse operators would be required to acknowledge the receipt of goods in their warehouse through an electronic arrival message. As most warehouse operators (634 of 1 017) already receive electronic messages from the CBSA, they would be able to transmit an electronic arrival message to the CBSA through their existing systems at a negligible cost.

Note: The electronic arrival message does not apply to goods imported under the courier Low Value Shipment (LVS) program (e.g. casual goods or goods that have an estimated value of less than $2,500) that are transported by or on behalf of a courier that has been authorized to account for those goods in accordance with subsection 32(4) of the Customs Act. The courier LVS program streamlines processing of low-value goods through an alternative method of risk assessment while providing the courier industry with expedited release. Couriers must post security and receive written authorization before participating in the program.

3. Transportation of Goods Regulations

Amendments to the record requirements

Baseline scenario: Currently, commercial carriers are required to keep records relating to all commercial goods transported by them to Canada for three years plus the current year. Carriers are required to keep paper records about cargo that has been imported into Canada on previous trips (e.g. who shipped the goods and where the goods were delivered).

Regulated scenario: Under the proposed amendments, these record-keeping requirements would be extended to freight forwarders and would include all information provided to and received from the CBSA electronically for three years plus the current year.

4. Designated Provisions (Customs) Regulations

The Administrative Monetary Penalty System (AMPS) program is a civil penalty regime that ensures compliance with legislation through the application of monetary penalties. Section 109.1 of the Customs Act authorizes the CBSA to issue penalties for noncompliance with requirements that have been designated in the Designated Provisions (Customs) Regulations.

In the commercial stream, AMPS penalties have been issued by the CBSA since October 7, 2002, for non-compliance with program requirements found either at the border or through post-release verification of company records.

Baseline scenario: Currently, monetary penalties are not assessed by the CBSA against air and marine carriers regarding existing advance commercial information requirements.

Regulated scenario: The Designated Provisions (Customs) Regulations would be amended to designate new subsections 12.1(2) and (7) of the Customs Act and new sections of the Reporting of Imported Goods Regulations. Together with existing designated provisions, this would allow the CBSA to assess administrative monetary penalties for non-compliance in the following situations:

- failing to provide pre-arrival cargo and conveyance information;

- failing to provide cargo and conveyance information electronically or within the prescribed time frames;

- failing to notify the CBSA without delay of a change to the advance commercial information provided;

- failing to comply with a notification issued by the CBSA regarding commercial goods destined for Canada; and

- failing to hold a valid carrier code.

The new administrative monetary penalties would conform to the existing standards of the CBSA's AMPS program, which is based on uniform systematic criteria reflecting the risk and impact of each contravention.

5. Presentation of Persons (2003) Regulations

Consequential amendments to the Presentation of Persons (2003) Regulations would standardize certain provisions with the new section 12.1 of the Customs Act as well as the new provisions proposed for the Reporting of Imported Goods Regulations.

Consequential amendments

The order and numbering of most of the existing sections and other minimal wording changes in some of the existing sections in the Reporting of Imported Goods Regulations would be amended to ensure that requirements are laid out as clearly and logically as possible. Schedules to the Regulations would be added or amended to detail the advance commercial information required to be provided by carriers and freight forwarders.

Regulatory and non-regulatory options considered

Section 12.1 of the Customs Act provides the Governor in Council with the authority to make regulations regarding advance commercial information in all modes of transportation. The proposed amendments are necessary to complete the implementation of the ACI program and to ensure that the deficiencies identified by the CDI and AGC reports are addressed. In addition, these amendments would ensure that the CBSA has the proper tools to effectively screen and process all commercial goods coming into Canada.

Implementing eManifest as an administrative policy, as opposed to codifying it in regulation as proposed, would mean keeping both a paper-based process and an electronic-based process since both would be legally permissible. This redundancy would limit the benefits which would be realized by the current plan to mandate exclusively electronic processes due to the challenges associated with data management and the costs of maintaining parallel systems.

Benefits and costs

As per the Treasury Board Secretariat requirement to conduct a cost-benefit analysis (CBA) covering at least 10 years for each medium- to high-impact regulatory proposal, a CBA for the full implementation of the eManifest initiative (Packages 1 and 2) was done covering a 12-year period from 2014 (the year the proposed regulations in Package 1 are planned to come into force) to 2025 (the tenth year of the full implementation).

Based on a preliminary analysis, the eManifest initiative was assessed to have a medium level of cost impact (between $10 and $100 million in present value). As a result, the cost-benefit analysis followed Treasury Board Secretariat guidelines on a CBA for medium-impact initiatives, which require that

- all costs and those benefits where data are easily available be monetized and present; and

- all non-measurable benefits be analyzed qualitatively.

Identification and description of costs and benefits for businesses

The eManifest requirements for electronic transmission of data pre-arrival would involve an evolution from paper documents to electronic data. The incremental costs associated with these requirements would include

- 1. IT system updates/changes: Computer hardware and software costs to equip businesses with the technology to transmit data electronically to the CBSA. These could range from the most expensive option of building a system directly connected to the CBSA for transmission, to a less expensive option of subscribing to a third-party service provider that has direct link to the CBSA for transmission, to the least expensive option of entering data via the eManifest Portal (free of charge).

- 2. Electronic data preparation: Labour time to collect data from source documents such as invoices and bills of lading and to enter data into the system.

- 3. Electronic data transmission: Per transaction cost required if a business transmits the data through a third-party service provider.

- 4. Learning/training: Labour time to learn the new eManifest requirements and to attend training on using the new hardware/system.

- 5. Delays due to one-hour minimum pre-notification requirements (in the highway mode): Waiting time that might be required before trucks can head to the border for shipments originating within one hour's driving time from the border.

- 6. Cost of carrier code application: Labour time to prepare and follow up on specific applications.

All the above costs are monetized (i.e. estimated in terms of dollar value) in the cost-benefit analysis.

The implementation of the eManifest initiative is expected to have the following incremental benefits:

- 1. Elimination of paper preparation: Labour time saved by not requiring the collection of data from source documents and filling in the paper forms. This would offset the cost of preparing electronic data (cost 2 above).

- 2. Reduction in the use of paper and ink: Paper and ink saved by not requiring the printing of related customs documents and copies. This would offset the cost of transmitting data (cost 3 above).

- 3. Shipments clearing customs in a timely manner: Waiting time saved at the border due to shorter processing time because of the following:

- • Border Services Officers would no longer need to enter data from paper forms;

- • As data would be validated pre-arrival, any problems of omissions or errors in the data submitted could be rectified beforehand instead of being dealt with at the border, which causes delays and line-ups. Examples of omissions and errors include missing descriptions of goods or descriptions that are too general (e.g. “electronics” is too general; the description needs to be more specific, such as “computers”);

- • For carriers in the air, marine and rail modes, there would be no need to send someone to a CBSA office to present the paper documents. All would be done electronically;

- • There would be shorter line-ups for all carriers at the border due to shorter processing times of shipments from other carriers; and

- • Low-risk shipments would be identified and would have facilitated entry into Canada (e.g. reduced likelihood of being referred to a secondary examination).

- 4. More certainty of shipments clearing customs: Reduced uncertainty in border crossing times due to reduced incidences of delays arising from omissions and errors in the data submitted. Businesses would therefore have greater certainty on the status of their shipments and of their unimpeded flow through a border crossing. This could result in significant savings for the businesses as it would be possible for them to reduce planned slack time in their schedule and reduce employee wage costs.

- 5. Added operational efficiency due to close alignment with U.S. electronic manifest process (in the highway mode): Having similar electronic manifest processes for both northbound and southbound movements would allow carriers to leverage the investment they would be making for systems, procedures and training to comply with eManifest requirements and would give them added operational efficiency.

Benefits 1, 2 and part of 3 (related to cargo and conveyance requirements in the highway mode only) are monetized in the cost-benefits analysis. All other benefits are presented qualitatively due to the lack of reliable data for quantification and monetization of the impacts.

Identification and description of costs and benefits for the CBSA and the Government of Canada

The eManifest initiative would require the CBSA to switch from a paper-based system to an electronic system with the extensive use of information technology. As a result, the CBSA is expected to incur the following incremental costs:

- 1. Operation and maintenance of computer systems: New computer systems have been developed for eManifest. Resources would need to be allocated for the ongoing operation and maintenance of these systems.

- 2. Training of staff: eManifest would necessitate the re- allocation of manpower from paper processing to other policy support, such as policy/program monitoring, and risk assessment activities. Extensive training would have to be offered to the staff for them to learn the new regulations, procedures and computer systems.

The implementation of eManifest is expected to increase the CBSA's ability to identify high-risk and unknown-risk shipments and to facilitate the movement of low-risk shipments across all modes of transportation by bringing the following benefits to the operations of the CBSA:

- 1. Consistency of application across modes of transportation: As the proposed regulations would expand the existing requirements for marine and air carriers to those in the highway and rail environment, there would be a consistent application of risk assessment across all modes of transportation relative to CBSA requirements.

- 2. Better tracking of in-bond movement: With inland electronic arrival messages, the CBSA would be able to identify more accurately the location of in-bond goods once they pass the first point of arrival.

- 3. Greater transparency and delineation of liability for the clients: A unique carrier code for each applicable party would ensure that each client would be held accountable for their requirements and not for those of other businesses.

- 4. Enhanced ability to identify unreported and high-risk containers: A marine bay plan (which provides the location of all cargo and cargo containers on board a vessel) would give the CBSA the enhanced ability to identify unreported containers and containers which might pose significant risks.

- 5. Right information from the right party for accurate risk assessments: Since the freight forwarders have access to detailed information not available to carriers, which they can supply directly to the CBSA, the new regulations that require freight forwarders to submit pre-arrival information would allow the CBSA to receive the right information from the right party to perform accurate risk assessments and to more clearly assign liability and enforce compliance.

- 6. Centralization of targeting activities: Electronic reporting of pre-arrival information would make centralizing risk and targeting activities possible, thereby reducing the duplication of effort found in the current targeting program.

- 7. Shorter processing time at the border: Border service officers would no longer need to enter cargo and conveyance information into the CBSA computer system at the border. Instead, necessary information, as well as release and admissibility recommendations would be available at the touch of a button for the border service officer to make a decision.

A successful risk assessment program should allow the CBSA to better utilize its resources and result in more efficient border management. It is therefore expected that the cost incurred by the proposed regulations would be offset by the reduction of staff and resources for operating and maintaining the previous paper-based system and by the savings from shorter processing time at the border.

The overall net benefit to the CBSA relating to the allocation and utilization of resources, is monetized in the cost-benefit analysis.

Identification and description of costs and benefits for the Canadian public

The implementation of the eManifest initiative is expected to bring the following incremental benefits to the Canadian public:

- 1. Increased protection from security, health and safety risks: Improvements in the CBSA's ability to identify and interdict high-risk shipments would ensure that goods that would potentially pose threats to the security, health and safety of the Canadian public would likely be prevented from entering into the country.

- 2. Increased prosperity from high level of international trade: The facilitation of the movement of low-risk shipments would reduce border-related business costs. These savings would potentially be passed onto the Canadian public in the form of lower prices of imported goods for the consumer and lower prices of imported production inputs for the producer.

These benefits are presented qualitatively in the cost-benefit analysis, as there is no reliable data available to quantify the change in risks and prices due to the new regulations.

General approach to calculation of monetized costs and benefits

Cost and benefit categories

| Cost category | Compliance/ administrative | Upfront/ ongoing | Comment |

|---|---|---|---|

| System upgrades/ changes | Compliance | Upfront/ ongoing |

|

| System upgrades/ changes (maintenance) | Compliance | Ongoing |

|

| Waiting time to satisfy pre-notification requirement | Compliance | Ongoing |

|

| Cost of electronic data transmission | Compliance | Ongoing |

|

| Application | Administrative | Upfront |

|

| Cost of electronic data preparation | Administrative | Ongoing |

|

| Learning/training | Administrative | Upfront |

|

| Benefit category | Compliance/ administrative | Upfront/ ongoing | Comment |

|---|---|---|---|

| Reduction in the use of paper and ink | Compliance | Ongoing |

|

| Elimination of paper preparation | Administrative | Ongoing |

|

| Elimination of application and maintenance of break-bulk exemption status | Administrative | Ongoing |

|

| Waiting time saved at the land border due to shorter processing time | Compliance | Ongoing |

|

General formulas

The total cost for each stakeholder type as presented in the cost-benefit statement in this document is the sum of applicable costs (both compliance and administrative) for the stakeholder type over all applicable proposed regulatory requirements.

Similarly, the total benefit for each applicable stakeholder type as presented in the cost-benefit statement in this document is the sum of applicable benefits (both compliance and administrative savings, as well as indirect savings from shorter waiting time if applicable) for the stakeholder type over all applicable proposed regulatory requirements.

Regarding the costs and benefits to the CBSA, the estimates of benefits are taken from various CBSA internal exercises that have projected net savings in staffing, operations and maintenance in the coming years due to different ongoing CBSA initiatives.

For a detailed description of the formulas used in this analysis, please see Annex 1.

Estimating numbers of affected stakeholders and transactions

| Stakeholder type | Estimated No. | Source |

|---|---|---|

| Carriers | 16 658 | CBSA administrative records — The number of active carrier codes with a Canadian mailing address or a Business Number (issued by the Canada Revenue Agency) on file as of July 26, 2012. |

| Freight forwarders | 450 | CBSA administrative records — The number of active carrier codes with a Canadian mailing address or a Business Number (issued by the Canada Revenue Agency) on file as of July 26, 2012. |

| Sufferance warehouses | 1 017 | CBSA administrative records (as of June 21, 2012). |

| Licensed customs brokers | 255 | CBSA Web site (as of July 29, 2012). |

| Carrier code applicants (2013–2014) | 4 800 | CBSA administrative records — Extrapolated from the 166 new carrier code applications received between January 1 and June 4, 2012. |

| Importers | 150 890 | Statistics Canada (2011): A Profile of Canadian Importers, 2002 to 2009 — The number of importing establishments in 2009. |

The number of affected stakeholders is assumed to be constant over the years, whereas the number of affected transactions is assumed to grow at an annual rate equal to the average annual growth rate between 2007 and 2011.

For costs and benefits that are per transaction, the volumes of transactions during the study period are based on the volumes in 2011. Volume data by carrier code for the year 2011 are retrieved from the CBSA databases.

Estimating unit costs and savings for cost/benefit categories

It is assumed that unit costs and savings for system upgrades, changes, maintenance, data transmission and data preparation depend on the volume of transactions of a business. A business with a high volume of transactions is assumed to process data using a computer system directly connected to the CBSA. A business with a low or medium volume of transactions is assumed to process and transmit data via the free eManifest Portal. Estimates for different levels of transaction volumes are obtained either from industry experts or from existing studies on similar regulations, either in Canada or abroad.

A detailed explanation of how each cost or benefit category is monetized and the assumptions related to all calculations can be found in Annex 1 to this document.

Overall costs and benefits

Based on the costs and benefits that are monetizable, it was estimated that the implementation of the regulatory proposal (Package 1) would result in a net benefit for businesses of $391 million, over a 12-year period from 2014 to 2025, mainly due to savings from reduced delays at the border and efficiency gained from replacing paper with electronic information. The breakdown of costs and benefits from the introduction of Package 1 for each stakeholder is presented in the following table:

| Package 1 | 2014 | 2015 | 2016 | 2025 | Present value (2012) | Annualized average | |

|---|---|---|---|---|---|---|---|

| Benefits | Marine carriers | 696 | 696 | 696 | 696 | 5,165 | 650 |

| Air carriers | 0 | 0 | 0 | 0 | 0 | 0 | |

| Rail carriers | 0 | 0 | 0 | 0 | 0 | 0 | |

| Highway carriers | 51,700,182 | 53,330,165 | 55,011,537 | 72,741,363 | 446,584,644 | 56,225,895 | |

| Freight forwarders | 0 | 0 | 0 | 0 | 0 | 0 | |

| Sufferance warehouses | 0 | 0 | 0 | 0 | 0 | 0 | |

| Importers | 0 | 0 | 0 | 0 | 0 | 0 | |

| Subtotal business benefits | 51,700,878 | 53,330,861 | 55,012,233 | 72,742,059 | 446,589,809 | 56,226,545 | |

| Federal government (CBSA) | 0 | 0 | 11,900,000 | 11,900,000 | 68,226,683 | 8,589,875 | |

| Total benefits | 51,700,878 | 53,330,861 | 66,912,233 | 84,642,059 | 514,816,492 | 64,816,420 | |

| Costs | Marine carriers | 251,123 | 289,354 | 249,689 | 244,749 | 1,874,574 | 236,013 |

| Air carriers | 369,232 | 88,838 | 86,592 | 69,325 | 845,968 | 106,509 | |

| Rail carriers | 254,264 | 25,914 | 25,177 | 19,529 | 372,689 | 46,922 | |

| Highway carriers | 11,749,717 | 6,123,510 | 6,310,619 | 8,363,464 | 56,304,184 | 7,088,809 | |

| Freight forwarders | 0 | −4,613 | −909,906 | −1,050,912 | −5,568,217 | −701,050 | |

| Sufferance warehouses | 388,158 | 288,206 | 288,238 | 288,585 | 2,227,688 | 280,470 | |

| Importers | 0 | 0 | 0 | 0 | 0 | 0 | |

| Subtotal business costs | 13,012,494 | 6,811,209 | 6,050,409 | 7,934,740 | 56,056,886 | 7,057,673 | |

| Federal government (CBSA) | 0 | 0 | 0 | 0 | 0 | 0 | |

| Total costs | 13,012,494 | 6,811,209 | 6,050,409 | 7,934,740 | 56,056,886 | 7,057,673 | |

| Net benefits | (Business) | $390,532,923 | $49,168,872 | ||||

| (All) | $458,759,606 | $57,758,747 | |||||

|

|||||||

The full implementation of the proposed eManifest initiative (i.e. both Packages 1 and 2) would result in a net benefit of $470 million ($377 million to the businesses and $93 million to the federal government), along with non-monetized benefits such as increased business efficiency and reduced security, health and safety risks to the Canadian public, over the 12-year period. The breakdown of costs and benefits from the introduction of both Packages 1 and 2, for each stakeholder, is presented in the following cost-benefit statement:

| Packages 1 and 2 (All) | 2014 | 2015 | 2016 | 2025 | Present value (2012) | Annualized average | |

|---|---|---|---|---|---|---|---|

| Benefits | Marine carriers | 696 | 696 | 696 | 696 | 5,165 | 650 |

| Air carriers | 0 | 0 | 0 | 0 | 0 | 0 | |

| Rail carriers | 0 | 0 | 155,729 | 258,693 | 1,129,906 | 142,257 | |

| Highway carriers | 51,700,182 | 53,330,165 | 55,579,780 | 73,685,313 | 450,707,583 | 56,744,981 | |

| Freight forwarders | 0 | 0 | 0 | 0 | 0 | 0 | |

| Sufferance warehouses | 0 | 0 | 0 | 0 | 0 | 0 | |

| Importers | 0 | 0 | 0 | 0 | 0 | 0 | |

| Subtotal business benefits | 51,700,878 | 53,330,861 | 55,736,205 | 73,944,702 | 451,842,654 | 56,887,888 | |

| Federal government (CBSA) | 0 | 0 | 16,215,000 | 16,215,000 | 92,966,022 | 11,704,607 | |

| Total benefits | 51,700,878 | 53,330,861 | 71,951,205 | 90,159,702 | 544,808,676 | 68,592,495 | |

| Costs | Marine carriers | 251,123 | 289,354 | 1,674,573 | 243,035 | 2,951,808 | 371,638 |

| Air carriers | 369,232 | 88,838 | 2,276,530 | 67,798 | 2,507,927 | 315,753 | |

| Rail carriers | 254,264 | 25,914 | 19,871 | –349,257 | –1,089,574 | –137,179 | |

| Highway carriers | 11,749,717 | 6,123,510 | 9,480,479 | 8,324,110 | 58,561,372 | 7,372,993 | |

| Freight forwarders | 0 | –4,613 | –833,537 | –1,279,189 | –6,815,419 | –858,075 | |

| Sufferance warehouses | 388,158 | 288,206 | 288,238 | 288,585 | 2,227,688 | 280,470 | |

| Importers | 0 | 0 | 3,749,022 | 2,116,432 | 16,870,329 | 2,124,008 | |

| Subtotal business costs | 13,012,494 | 6,811,209 | 16,655,176 | 9,411,514 | 75,214,131 | 9,469,608 | |

| Federal government (CBSA) | 0 | 0 | 0 | 0 | 0 | 0 | |

| Total costs | 13,012,494 | 6,811,209 | 16,655,176 | 9,411,514 | 75,214,131 | 9,469,608 | |

| Net benefits | (Business) | $376,628,523 | $47,418,280 | ||||

| (All) | $469,594,545 | $59,122,887 | |||||

| Qualitative impacts | |||||||

| Benefits | Canadian public | Increased health, safety and security of Canadians as they would be better protected from border-related risks due to the CBSA's enhanced ability to assess risk and intercept high/unknown risk commercial cargo prior to arrival in Canada. | |||||

| Businesses considered trade chain partners involved in the importation of goods into Canada | Automation and electronic information would lead to improved business efficiency through

|

||||||

|

|||||||

| Packages 1 and 2 (businesses only) | 2014 | 2015 | 2016 | 2025 | Present value (2012) | Annualized average | |

|---|---|---|---|---|---|---|---|

| Costs | |||||||

| Compliance | IT system (system upgrades / changes and maintenance) | 5,530,777 | 2,790,908 | 6,538,161 | 2,166,158 | 22,863,698 | 2,878,585 |

| Waiting time to satisfy pre-notification requirement | 12,116,935 | 12,594,044 | 13,089,940 | 18,530,607 | 108,798,758 | 13,697,980 | |

| Cost of electronic data transmissions | 992,876 | 1,091,258 | 1,193,508 | 1,640,931 | 9,655,265 | 1,215,617 | |

| Offset by reduction in the use of paper and ink | −1,467,082 | −1,623,419 | −1,768,060 | −2,466,222 | –14,393,960 | −1,812,228 | |

| Subtotal (Compliance) | 126,923,761 | 15,979,954 | |||||

| Administration | Application | 2,485 | 2,485 | 2,485 | 2,485 | 18,446 | 2,322 |

| Cost of electronic data preparation | 17,177,810 | 19,777,533 | 24,784,788 | 31,312,220 | 188,100,177 | 23,682,186 | |

| Offset by elimination of paper preparation | −24,139,189 | −28,029,054 | −30,295,004 | −41,774,664 | −244,813,491 | −30,822,505 | |

| Learning/training | 2,797,882 | 207,454 | 3,109,359 | 0 | 4,985,238 | 627,651 | |

| Subtotal (Administrative) | −51,709,630 | −6,510,345 | |||||

| Subtotal (Costs) | 75,214,132 | 9,469,609 | |||||

| Benefits | |||||||

| Administration | Elimination of application and maintenance of break-bulk exemption status | 696 | 696 | 696 | 696 | 5,165 | 650 |

| Indirect | Waiting time saved at the land border due to shorter processing time | 51,700,182 | 53,330,165 | 55,735,509 | 73,944,006 | 451,837,490 | 56,887,238 |

| Subtotal (Benefits) | 451,842,655 | 56,887,889 | |||||

| Net benefits | $376,628,523 | $47,418,280 | |||||

For detailed calculations for each proposed regulatory requirement, please refer to the Cost-Benefit Analysis Report, which is available at the CBSA Web site: http://cbsa-asfc.gc.ca.

“One-for-One” Rule

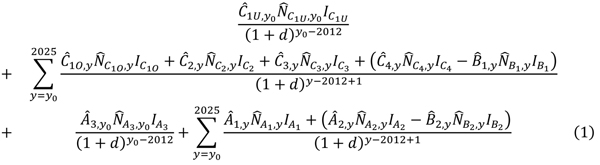

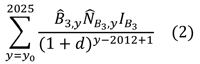

The proposed amendments are subject to the “One-for-One” Rule, as they pertain to statutory instruments pursuant to the Statutory Instruments Act. This rule is used to control new administrative burden on businesses resulting from the introduction of regulations. To estimate the administrative burden for each stakeholder type and each proposed regulatory requirement, the third row of formula (1) as presented in Annex 1 is used. To estimate the administrative relief from the elimination of break-bulk exemption in the marine mode, formula (2) is used. The total administrative burden is then the sum of all administrative costs over all stakeholder types and all proposed regulatory requirements less the administrative relief from the elimination of break-bulk exemption.

The general approach to cost calculations for the “One-for-One” Rule is essentially the same as that for the cost-benefit analysis described in the “Benefits and costs” section above, with essentially the same assumptions used. However, to conform to the requirements of the Treasury Board Secretariat, some alternative assumptions were used. The differences in the assumptions used are explained in the attached Annex 2. Because of these differences, the estimates of administrative costs based on the cost-benefit analysis methodology will be different from the estimates based on the “One-for-One” Rule methodology.

Based on the “One-for-One” Rule methodology, it is estimated that the total administrative savings per year with the introduction of the proposed regulations in Packages 1 and 2 would be about $4.6 million per year (with 2012 constant dollars and a present value base year of 2012), resulting in an administrative saving per business of $26 per year (using simple averaging with an estimated 173 270 businesses affected). The expected decrease in administrative costs would stem mainly from paper processes being replaced by their electronic equivalents. The savings would mainly come from more efficient document (information) preparation and reduced errors and omissions due to the increasing use of information technology and the streamlining of business processes to handle electronic transmission of information, as described in the “Benefits and costs” section above. Therefore, the proposal is considered an “OUT” under the rule. An “OUT” is a monetized decrease in administrative burden costs from the revision of existing regulations.

Small business lens

The CBSA recognizes that small businesses would be impacted by the new reporting requirements. A small business is defined as any business, whether incorporated or not, with under 100 employees or between $30,000 and $5 million in annual revenues. Since revenue data is not readily available, the definition used in the cost-benefit analysis relates to businesses with fewer than 100 employees; the same definition was applied for the small business lens.

To estimate the direct costs (both compliance and administrative) carried by small businesses, for each stakeholder type and each proposed regulatory requirement, formula (1) as presented in Annex 1 is used. To estimate the administrative relief from the elimination of the break-bulk exemption in the marine mode, formula (2) is used. The total direct cost impact is then the sum of all direct costs over all stakeholder types and all proposed regulatory requirements less the administrative relief from the elimination of break-bulk exemption. Since the focus of the small business lens is on direct cost impacts, indirect benefits, such as cost savings due to the time saved at the border, are not included in the calculations.

The general approach to cost calculations for the small business lens is essentially the same as that in the “Benefits and costs” section above, with essentially the same assumptions used. However, to conform to the requirements of the Treasury Board Secretariat, some alternative assumptions are used. The differences in the assumptions used are explained in Annex 2.

Initial option

The initial option would have all businesses, including small businesses, paying to upgrade their systems in order to comply with the electronic reporting requirements of the CBSA. In the initial option, all businesses face the same reporting requirements and IT capability requirements to transmit pre-arrival information electronically to the CBSA. This would likely result in upfront capital and ongoing maintenance costs of IT upgrades.

Flexibility analysis

As small carriers and importers with infrequent shipments tend to be deemed higher risk, and given that the CBSA has much less information about them for risk assessment purposes, it would be counterproductive from a risk management perspective to provide regulatory flexibility for these businesses in terms of fewer data elements required or laxer time frames. Instead, the CBSA proposes to offer the free eManifest Portal for data transmission to help small businesses to alleviate the increased compliance costs.

Flexible option

The flexible option would allow businesses to access a free Internet portal to submit the required information electronically. In the flexible option, all businesses still face the same reporting requirements. However, the CBSA would provide the free eManifest Portal for highway carriers, freight forwarders and importers to transmit eManifest information to mitigate the upfront capital costs and ongoing maintenance costs of IT upgrades. With access to a computer and an Internet connection, smaller businesses would have a different option to send their advance data electronically free of charge, through the eManifest Portal.

The small business costs to be carried as a result of the full implementation of the proposed eManifest initiative (i.e. Packages 1 and 2) for each option are presented in the table below.

| All packages | Initial Option | Flexible Option | ||

|---|---|---|---|---|

| Short description | No Free eManifest Portal | Free eManifest Portal | ||

| Number of small businesses impacted | 165 405 | 165 405 | ||

| Annualized Average ($ 2012) | Present Value ($ 2012) | Annualized Average ($ 2012) | Present Value ($ 2012) | |

| Compliance costs | $22,717,871 | $180,440,927 | $6,042,383 | $47,992,751 |

| Administrative costs | −$2,576,709 | −$20,465,988 | $884,982 | $7,029,136 |

| Total costs | $20,141,163 | $159,974,938 | $6,927,365 | $55,021,887 |

| Total costs per small business | $122 | $967 | $42 | $333 |

| Risk considerations | Small carriers and importers with infrequent shipments might have to carry substantial upfront capital costs and ongoing maintenance costs to upgrade their IT system for the electronic submission of required information. This increase in compliance costs might not be fully offset by the efficiency gained (and the decrease in administrative costs) as a result of increased IT use. This might discourage some of them from conducting cross-border business, especially in the highway mode where the majority of the carriers are small and owner-operated. |

The CBSA bears the cost of developing the eManifest Portal for trade chain partners to transmit information free of charge. Also, since a common eManifest Portal would be developed for businesses with a diverse array of practices, the opportunity of customization to streamline business processes and hence gain efficiency might be minimal for these businesses. |

||

The initial option shows negative administrative costs, reflecting in large part more significant efficiency in data preparation time gained from investing more in the upgrades and changes of the IT system for electronic preparation and transmission of data. The flexible option shows positive administrative costs, reflecting the assumptions that (1) there are no savings in data preparation time by switching from paper to electronic processing; and (2) most small businesses would opt for the eManifest Portal due to the fact that their low volumes of transactions would not justify large investments in IT system upgrades or changes. However, the total costs under the initial option would still be greater than those under the flexible option. Given the difference in costs between the initial option and the flexible option, the flexible option is the recommended option.

Consultation

Private sector consultations

The CBSA established the eManifest Stakeholder Partnership Network (eSPN), made up of nearly two dozen industry associations and CBSA representatives, to provide a forum for dialogue and to help the CBSA reach out to all commercial trade chain partners. Regular consultations among eSPN subcommittees and working groups have been ongoing since 2007. Consultations covered defining requirements and identifying stakeholder needs, establishing processes and procedures, reviewing and resolving policy issues, mapping the technical design and implementation of eManifest, and sharing information and communication products.

The following stakeholders involved in the importation of goods into Canada would be affected by the proposed regulations, due to the requirement of having to provide pre-arrival information to the CBSA electronically: carriers, freight forwarders and sufferance warehouse operators.

Specific industry associations that have been extensively consulted as part of this proposal include the following:

- Canadian International Freight Forwarders Association

- Canadian Courier & Logistics Association

- Canadian Produce Marketing Association

- Canadian Society of Customs Brokers

- Association of International Customs and Border Agencies

- Canadian Association of Importers and Exporters

- Canadian Manufacturers & Exporters

- Canadian Sufferance Warehouse Association

- Canadian Vehicle Manufacturers' Association

- Private Motor Truck Council of Canada

- Shipping Federation of Canada

- Chamber of Shipping of British Columbia

The eManifest initiative has also been discussed regularly at Border Commercial Consultative Committee meetings (BCCC) (see footnote 11) since 2006. The BCCC provides the CBSA and industry stakeholders with a forum for dialogue on border issues. The eManifest subcommittee of the BCCC includes representatives from the CBSA and members of 10 key trade associations. The Committee's mandate is to work collaboratively to promote modernization and improvements to the Commercial Program under eManifest, validate strategic directions related to eManifest and other major projects intended to simultaneously enhance facilitation and security, and provide governance to the existing eManifest Stakeholder Partnership Network (eSPN) working groups.

Inputs from these consultations have also been taken into consideration to identify areas of business burdens and savings in the preparation of the cost-benefit statement for this document.

Private sector support

In general, stakeholders participating in the BCCC and the eSPN meetings have been very supportive of the goals of the eManifest initiative to secure the border and facilitate trade. For example, at the BCCC meeting on February 26 and 27, 2008, the industry representatives agreed unanimously that security and health issues must be addressed at the border. However, they also expressed their concern that traffic could be delayed for issues not related to security or health. At other meetings, some industry representatives expressed their eagerness for the eManifest initiative. For example, a representative from the rail industry stated that “the rail industry is keen to work on developing the eManifest initiative because it already communicates extensively with the CBSA via electronic means.”

Stakeholder feedback was also positive with respect to offsetting costs of new regulatory requirements with enhanced border efficiency (reduced wait times), reduced reliance on paper-based records and increased alignment with the requirements of other countries (chiefly the United States).

Major concerns and CBSA responses

Regarding the development of the system and the manner in which critical policy issues are addressed, throughout the consultation process, industry has been stressing the importance of stakeholder involvement and inclusiveness of and communication with the broader trade community. In response, from 2006 to 2012, the CBSA has held 21 meetings of the eSPN and 15 meetings of the BCCC at which the eManifest initiative was discussed.

A major concern of the industry that was frequently discussed was the burden of collecting the data and transmitting within the prescribed time frames. The various eSPN working groups provided the CBSA with platforms to discuss all proposed data elements and processes for each mode with the various participants. These discussions allowed the CBSA to better understand the business flow in the different modes and design the system and policy to better fit the logistics of the industry.

Another major concern raised by stakeholders was the cost impacts on small and medium-sized businesses. The discussions at consultation meetings led to the development of the eManifest Portal, which would be most beneficial to small and medium-sized businesses. In particular, stakeholder consultations related to the implementation and design of the eManifest Portal were held across Canada in 2008 and 2009, aiming to gauge the views of small and medium-sized businesses on the Portal option. These consultations revealed a need for and a positive reaction to the proposed Portal solution.

Many policy and system development issues of a more technical nature were raised at the meetings, and the CBSA has created a trade issue log, which is shared with the industry, to prioritize the issues in order to deal with them in a transparent and timely manner. It also provides the industry with the necessary information to move forward with its planning and preparation for eManifest.

Government consultations

The proposed regulatory amendments for eManifest would have no direct impact on other government departments (OGDs) such as the Canadian Food Inspection Agency (CFIA) and Foreign Affairs and International Trade Canada (DFAIT), as there are no planned changes under eManifest to the existing electronic or paper-based OGD processes. The proposed amendments deal primarily with the provision of pre-arrival information, which would be used by the CBSA to perform a risk assessment, related to the import of goods into Canada. OGD requirements related to the import of goods into Canada, e.g. the submission of permits and licenses, are part of a different process and would not be impacted by the proposed regulatory amendments. As a result, no formal consultations were conducted with OGD partners and no significant feedback was provided.

Although the proposed amendments do not directly impact OGDs, it should be noted that the eManifest initiative would support the broader Government of Canada objectives of reducing paper processes and paper burden (see footnote 12) and streamlining its processes to ensure consistency and transparency.

U.S. consultations

Extensive consultations have been conducted with the USCBP on the proposed amendments to ensure that pre-arrival information requirements and processes are aligned between Canada and the United States to the greatest extent possible. Goods which are destined for North America and which transit either through Canada or the United States prior to arrival at their ultimate destination are subject to each country's information requirements.